CANARA ROBECO EMERGING EQUITIES (CREE)

Large & Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks

(as on March 28, 2025)

| SCHEME OBJECTIVE | To generate capital appreciation by investing in a diversified portfolio of large and mid-cap stocks. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | March 11, 2005 |

| BENCHMARK | NIFTY Large Midcap 250 TRI |

| FUND MANAGER | Mr. Amit Nadekar |

| TOTAL EXPERIENCE | 21 Years 19 Years |

| MANAGING THIS FUND | Since 28-Aug-23 Since 01-Oct-19 |

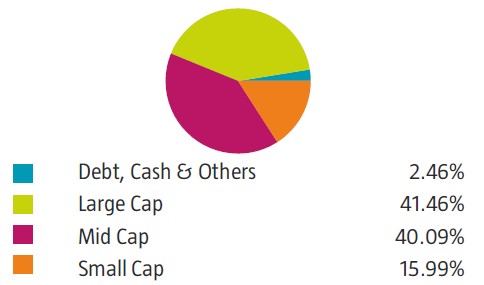

| ASSET ALLOCATION | Large Cap equity and equity related instruments* - 35% to 65%. (Risk- Very High) Mid Cap equity and equity related instruments* - 35% to 65% (Risk- Very High) Other equity and equity related instruments, debt and money market instruments - 0% to 30% (Risk- Very High) Reits/Invits- 0% to 10%.(Risk- Very High) *As defined by SEBI Circular No. SEBI / HO / IMD / DF3 / CIR / P / 2017 / 114 dated October 06, 2017 and SEBI/HO/IMD/DF3/CIR/P/2017/126 dated December 04, 2017 as amended from time to time. (Currently it defines Large Cap Companies as those which are ranked from 1 to 100 and Mid Cap Companies as those which are ranked from 101 to 250 based on their full market capitalization.) |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter For Annual Frequency–2,000and inmultiples of 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 1 year from the date of allotment Nil - if redeemed/switched out after 1 year from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 1.62% Direct Plan : 0.57% |

| Monthend AUM# | ₹ 23,163.33 Crores |

| Monthly AVG AUM | ₹ 22,567.03 Crores |

| (as on March 28, 2025) | (₹) |

| Direct Plan - Growth Option | 266.9400 |

| Regular Plan - Growth Option | 233.8800 |

| Regular Plan - IDCW (payout/reinvestment | 79.9500 |

| Direct Plan - IDCW (payout/reinvestment) | 121.2500 |

| Standard Deviation | 15.39 |

| Portfolio Beta | 0.94 |

| Portfolio Turnover Ratio | 0.6 times |

| Sharpe Ratio | 0.50 |

| R-Squared | 0.93 |

| Name of the Instruments | % to NAV |

Equities |

97.54 |

Listed |

97.54 |

Banks |

10.98 |

ICICI Bank Ltd |

6.25 |

Federal Bank Ltd |

2.75 |

State Bank of India |

1.51 |

Indian Bank |

0.46 |

HDFC Bank Ltd |

0.01 |

Leisure Services |

7.53 |

Indian Hotels Co Ltd |

5.65 |

EIH Ltd |

1.77 |

Devyani International Ltd |

0.11 |

Auto Components |

6.88 |

Uno Minda Ltd |

3.78 |

Sona Blw Precision Forgings Ltd |

1.06 |

ZF Commercial Vehicle Control Systems India Ltd |

0.70 |

Bharat Forge Ltd |

0.70 |

Schaeffler India Ltd |

0.39 |

Samvardhana Motherson International Ltd |

0.25 |

Retailing |

6.66 |

Trent Ltd |

3.62 |

Zomato Ltd |

2.58 |

Swiggy Ltd |

0.21 |

Vishal Mega Mart Ltd |

0.13 |

Arvind Fashions Ltd |

0.12 |

Consumer Durables |

6.55 |

Dixon Technologies (India) Ltd |

3.39 |

Crompton Greaves Consumer Electricals Ltd |

1.10 |

Bata India Ltd |

1.08 |

Titan Co Ltd |

0.46 |

Cello World Ltd |

0.37 |

Kajaria Ceramics Ltd |

0.15 |

Automobiles |

6.12 |

TVS Motor Co Ltd |

2.98 |

Mahindra & Mahindra Ltd |

1.79 |

Bajaj Auto Ltd |

1.17 |

Hero MotoCorp Ltd |

0.16 |

Maruti Suzuki India Ltd |

0.02 |

IT - Software |

5.89 |

KPIT Technologies Ltd |

3.81 |

Tata Consultancy Services Ltd |

0.99 |

Coforge Ltd |

0.54 |

Tech Mahindra Ltd |

0.25 |

Ltimindtree Ltd |

0.18 |

Persistent Systems Ltd |

0.11 |

Mphasis Ltd |

0.01 |

Finance |

4.89 |

Cholamandalam Investment and Finance Co Ltd |

2.50 |

Bajaj Finance Ltd |

1.35 |

Creditaccess Grameen Ltd |

1.04 |

Pharmaceuticals & Biotechnology |

4.19 |

Abbott India Ltd |

1.94 |

Sun Pharmaceutical Industries Ltd |

0.86 |

Ajanta Pharma Ltd |

0.85 |

Mankind Pharma Ltd |

0.24 |

Cipla Ltd |

0.21 |

Torrent Pharmaceuticals Ltd |

0.08 |

Biocon Ltd |

0.01 |

Aerospace & Defense |

4.05 |

Bharat Electronics Ltd |

4.05 |

Healthcare Services |

3.69 |

Max Healthcare Institute Ltd |

2.20 |

Global Health Ltd |

1.07 |

Dr. Lal Path Labs Ltd |

0.21 |

Syngene International Ltd |

0.21 |

Capital Markets |

3.63 |

HDFC Asset Management Company Ltd |

1.31 |

Central Depository Services (India) Ltd |

0.78 |

Multi Commodity Exchange Of India Ltd |

0.50 |

UTI Asset Management Co Ltd |

0.25 |

Computer Age Management Services Ltd |

0.24 |

Angel One Ltd |

0.20 |

BSE Ltd |

0.18 |

Indian Energy Exchange Ltd |

0.17 |

Power |

3.43 |

Tata Power Co Ltd |

1.60 |

Torrent Power Ltd |

1.52 |

NTPC Ltd |

0.31 |

Electrical Equipment |

3.21 |

ABB India Ltd |

1.16 |

Suzlon Energy Ltd |

0.73 |

CG Power and Industrial Solutions Ltd |

0.45 |

Ge Vernova T&D India Ltd |

0.39 |

Siemens Ltd |

0.32 |

Thermax Ltd |

0.12 |

Waaree Energies Ltd |

0.04 |

Industrial Manufacturing |

2.77 |

Praj Industries Ltd |

1.85 |

Kaynes Technology India Ltd |

0.92 |

Chemicals & Petrochemicals |

2.18 |

Vinati Organics Ltd |

0.87 |

Pidilite Industries Ltd |

0.74 |

Navin Fluorine International Ltd |

0.35 |

Solar Industries India Ltd |

0.20 |

Tata Chemicals Ltd |

0.02 |

Deepak Nitrite Ltd |

0.00 |

Agricultural Food & Other Products |

2.13 |

Tata Consumer Products Ltd |

2.13 |

Beverages |

1.93 |

United Breweries Ltd |

1.13 |

Varun Beverages Ltd |

0.80 |

Telecom - Services |

1.76 |

Bharti Airtel Ltd |

1.69 |

Bharti Hexacom Ltd |

0.07 |

Fertilizers & Agrochemicals |

1.34 |

PI Industries Ltd |

1.34 |

Paper, Forest & Jute Products |

1.33 |

Aditya Birla Real Estate Ltd |

1.33 |

Realty |

1.16 |

Oberoi Realty Ltd |

1.16 |

Cement & Cement Products |

0.92 |

J.K. Cement Ltd |

0.92 |

Diversified |

0.86 |

3M India Ltd |

0.86 |

Transport Services |

0.77 |

Blue Dart Express Ltd |

0.46 |

Container Corporation Of India Ltd |

0.16 |

TCI Express Ltd |

0.15 |

Food Products |

0.64 |

Nestle India Ltd |

0.39 |

Mrs Bectors Food Specialities Ltd |

0.25 |

Financial Technology (Fintech) |

0.55 |

PB Fintech Ltd |

0.55 |

Industrial Products |

0.41 |

Carborundum Universal Ltd |

0.28 |

Cummins India Ltd |

0.13 |

Non - Ferrous Metals |

0.35 |

National Aluminium Co Ltd |

0.26 |

Hindustan Zinc Ltd |

0.09 |

Construction |

0.27 |

KNR Constructions Ltd |

0.27 |

Insurance |

0.17 |

SBI Life Insurance Co Ltd |

0.17 |

Entertainment |

0.17 |

Zee Entertainment Enterprises Ltd |

0.15 |

Tips Music Ltd |

0.02 |

Household Products |

0.13 |

Doms Industries Ltd |

0.13 |

Money Market Instruments |

2.49 |

TREPS |

2.49 |

Net Current Assets |

-0.03 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (NIFTY Large Midcap 250 TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 28.03.2025 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.