Economic Indicators (as on March 28, 2025)

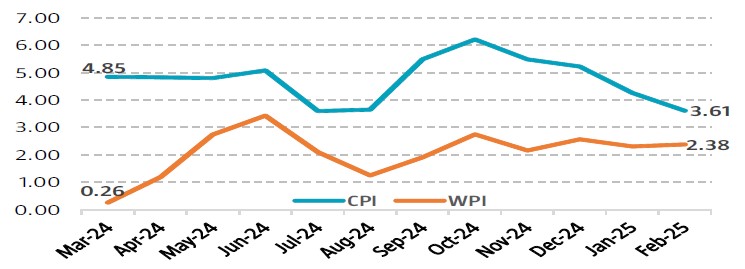

Inflation in India (%)

Consumer Price Index eases to 7-month low to 3.61% in Feb’25 from 4.26% in Jan’25 primarily due to a slowdown in food and beverage inflation. Wholesale Price Index (WPI) increased to 2.38% in Feb’25 from 2.31% in Jan’25 due to the rise in prices of fuel and power.

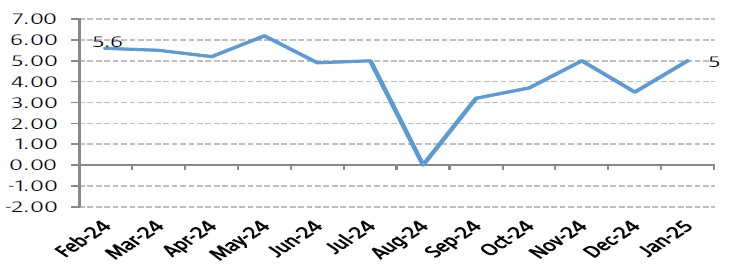

Index of Industrial Production (%)

Index of Industrial Production (IIP) grew by 5% in Jan’25 from 3.5% in Dec’24 as manufacturing and mining supported growth. The manufacturing sector, which accounts for major part of the IIP, grew by 5.5%, while the mining and electricity sectors recorded growth rates of 4.4% and 2.4%, respectively.