Debt Market Review

Mr. Avnish Jain

Head - Fixed Income

Macro Review & Fixed Income Market Outlook

Global Economy Update:

Macro Backdrop:

• The global economy continues to experience moderate growth, though geopolitical tensions and protectionist policies remain key risks.

• Inflation remains sticky across major economies, slowing the pace of expected monetary easing.

• Emerging market Economies (EMEs) face currency depreciation pressures due to a strong U.S. dollar and global risk aversion.

Purchasing Managers’ Index (PMI):

• United States: The S&P Global US Manufacturing PMI fell to 49.8 in March 2025 from 52.7 in February, indicating a contraction in manufacturing activity, a preliminary estimate showed.

• Eurozone: The HCOB Eurozone Manufacturing PMI climbed to 48.7 in March 2025, the highest in 26 months, up from 47.6 in February and exceeding forecasts of 48.2, preliminary data showed.

• China: China’s manufacturing activity reached its highest level in a year in March, with the PMI increasing to 50.5 from 50.2 in February.

Trade and Export-Import Dynamics:

• United States: United States escalated trade tensions by extending tariffs on European and Asian imports.

• Canada & Mexico: Canada and Mexico imposed retaliatory measures against U.S. tariffs, raising global trade uncertainty.

Monetary Policy:

• European Central Bank (ECB): The ECB decided to maintain deposit rates at 2.50% in March but hinted at a possible cut in June.

• U.S. Federal Reserve: The Federal Reserve held rates steady in March, emphasizing the need for more data before any easing.

Inflation Trends:

Global:

• Headline inflation continues to exhibit stickiness in major economies’ last mile of disinflation.

• In the US, CPI inflation moderated to 2.8 per cent (y-o-y) in February from 3.0 per cent in January.

• Headline inflation in the Euro area moderated to 2.4 per cent in February from 2.5 per cent in January.

• Inflation in Japan (CPI excluding fresh food) increased to 3.2 per cent in January, while in the UK, it accelerated by 50 bps.

• Among EMEs, CPI inflation in China returned to deflationary zone at (-)0.7 per cent in February, marking its lowest level in over a year driven by weak domestic demand.

• CPI inflation recorded an increase in Russia and Brazil in February, and in South Africa in January.

• Core and services inflation remains above headline in most AEs (Advanced Economies).

Indian Economy Update:

Macro Backdrop:

• The Indian economy continues to demonstrate resilience in this turbulent global environment, as the growth momentum is supported by robust sectoral performance and improving consumption trends.

• The Union Budget 2025-26 continues to focus on fiscal consolidation and growth.

Purchasing Managers’ Index (PMI):

• The HSBC India Manufacturing PMI accelerated to 57.6 in March 2025 from 56.3 in the previous month, according to preliminary estimates.

• Growth in services PMI remained robust, driven by IT, banking, and hospitality.

Trade and Export-Import Dynamics:

• Trade Balance: Trade deficit narrowed in March, supported by strong exports of software services and pharmaceuticals.

• Production Linked Incentive (PLI) Schemes: The government’s PLI schemes continue to boost domestic manufacturing.

Employment Trends:

• Urban: Urban employment remains strong, led by expansion in IT and financial services.

• Rural: Rural employment benefited from higher agricultural output and government employment programs.

Inflation Trends:

Domestic:

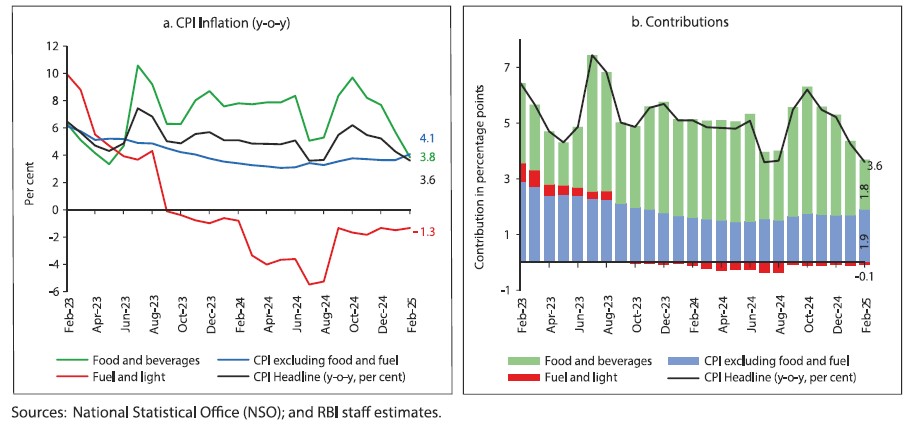

• Headline CPI in India declined to a seven-month low of 3.6 per cent in February 2025 from 4.3 per cent in January.

• Food inflation declined to 3.8 per cent (y-o-y) in February from 5.7 per cent in January.

• Fuel and light deflation narrowed to (-)1.3 per cent in February from (-) 1.5 per cent in January, on account of a lower rate of deflation in kerosene prices, and a higher rate of inflation in electricity prices.

• Core inflation increased to 4.1 per cent in February from 3.6 per cent in January.

• In terms of regional distribution, rural and urban inflation eased to 3.8 per cent and 3.3 per cent, respectively, in February 2025.

Trends and Drivers of Inflation:

Bond Yields & Spreads:

• Indian yields dropped lower in March on US FED status quo as well as aggressive OMO (Open market operations) purchases by the RBI.

• RBI conducted around 2.45 Lac crore of OMO purchase in Feb/Mar 2025 to counter large systemic liquidity deficit apart from taking other liquidity measures like USD / INR buy swaps and longer duration variable rate repo (VRR) auctions.

• Liquidity conditions remained normal on RBI measures in March, despite advance tax outflows.

• US 10Y yield remained rangebound, as ongoing tariff war is expected to lead to slower global growth but may also lead to higher inflation in the US.

• The Indian 10Y yield closed at 6.58% in March 2025.

• Debt FII flows turned positive in CY2025, as Union Budget remained focus on fiscal consolidation and RBI cut rates. RBI Open market operations (OMO) purchase may have further added to positive sentiment.

• US FED policy remained status quo with the FED maintaining a wait and watch attitude on likely US tariff impact on inflation.

• Corporate bonds moved in tandem with sovereign with overall yields falling across the curve.

Outlook:

• US FED rate cut expectations have gone up on recession fears in wake of tariff wars.

• US yield are likely to benefit from tariff war, as growth may get impacted in US, though risks to higher inflation remain.

• Liquidity has eased, however RBI has announced further Rs. 80,000 cr of OMO purchases to be conducted to ensure liquidity conditions remain conducive for growth.

• FII flows remained positive in March on positive bond market conditions in India.

• Looking ahead to the medium and long term, the effect on bonds is expected to be positive due to inclusion in JP Morgan Bond Index and other indices, as the demand for Government Securities (G-Sec) is likely to drive yields downward.

• We expect RBI to reduce rates again in April policy as well as turn stance to accommodative, as growth is moderating, and inflation is likely trending towards 4%. Further, the ongoing tariff disruptions may lead to slower global growth in near term.

• We are structurally long on India as growth inflation dynamics are still favorable for yields to tick down as RBI may have to resort to few more rate cut as growth slows.

Source: RBI, MOSPI, PIB, CMIE, NSDL, S&P Global, Ministry of Commerce and Industry, Reuters, Bloomberg, Internal Research.

Note: Data updated as available in the beginning of the month.