Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

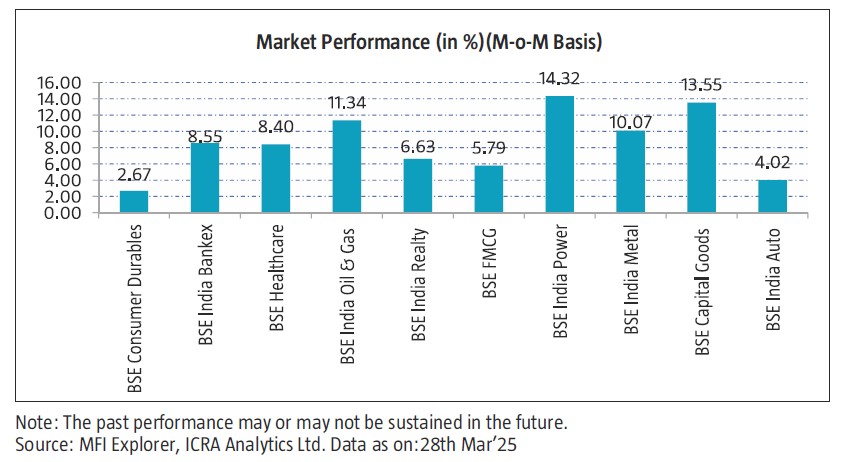

- In the month of Mar’25, Nifty 50 rose sharply by 6.30% amid broad-based buying across sectors and rupee’s rebound from its recent record lows. Gains were extended after the U.S. Federal Reserve, in its Mar’25 monetary policy meeting, maintained the interest rate and signalled the possibility of two rate cuts by the end of the year.

- Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹-3972.62 crore.

- Gross Goods and Services Tax (GST) collections in Mar’25 stood at 11-month high of Rs. 1.96 trillion, representing a 9.9% rise on a yearly basis and this points towards the growing trajectory of the Indian economy.

- The combined Index of Eight Core Industries (Refinery Products Industry, Electricity, Industry, Steel Industry, Coal Industry, Crude Oil Industry, Natural Gas Industry, Cement Industry, Fertilizers Industry) increased by 2.9% YoY in Feb 2025 as compared to 7.1% growth in Feb 2024. All the components of the Eight Core Industries witnessed growth in Feb 2025 over the corresponding month of last year except crude oil & natural gas, with cement production witnessed the highest rate of growth with 10.5% followed by fertilizers with 10.2%, while refinery products rose the least by 0.8% followed by coal by 1.7%.

- Globally, U.S. equity markets decreased following ongoing tariff concerns and indications that the U.S. Federal Reserve is likely to keep interest rates on hold for some time. European equity markets fell as increasing economic uncertainty and concerns regarding tariffs contributed to negative sentiment. Asian equity markets closed on a mixed note, Chinese market rose following Beijing’s commitment to provide policy support for the technology and consumer sectors. However, the Japanese market fell as the Japanese yen continued to strengthen, driven by increased uncertainty regarding U.S. trade policies and hawkish indications from the Bank of Japan.

Equity Market Outlook

The decision of the US Government to enforce reciprocal tariff on most countries points towards its intent to aggressively pursue and resolve the wrong that it believes it is suffering since the globalisation era. It is estimated that these tariffs are likely to affect trade worth roughly US$1tn, thereby impacting Global GDP in FY26/27 by 0.5%. India too is likely to suffer a 0.5% impact on its GDP.

While the theory of US getting short-changed by its trading partners is debatable, there is little doubt that the country was amongst the biggest beneficiaries of globalisation. As the US dominance in the global economy increased, it benefited from global savings moving back the US to fund its large fiscal and trade deficit at an interest rate of under 3% on an average for the past 15 years.

On the other hand, the benefits of increased local manufacturing that is being perceived as one of the end goals of these tariffs may not be easy to materialise. Global manufacturing supply chains have been established over the past 50 years and are almost impossible to move to the US easily. This is due to various limiting factors that US suffers from like lack of labour skillset and ecosystem to produce these products at competitive costs. Thus, in the near term, the strategy of stepping back from globalisation is likely to hurt US consumers as the cascading effect of these tariffs trickle down in the form of higher inflation and lower economic growth.

The global macro environment remains complex as:

1) US growth inflation dynamics indicating increased possibility of stagflation.

2) Tariff news flow increases business uncertainty and keeps inflation high in an environment where the incremental data points continue to indicate consumer slowdown.

If this scenario of global uncertainty elongates, then US might be in for a negative growth surprise, when high headline inflation leaves limited room for the Fed to cut beyond current expectations of 50-75bps in CY25.

U.S President’s policies so far are indicating their inward focus with a multi-polar world and disregard for global trade and defence agreements of previous US establishments. We thus expect uncertainty to prevail both on global growth and capital flows for Emerging markets including India. One possibility is that it may quickly lead to a US recession potentially easing monetary policy, Fed providing liquidity and faster interest rate cuts. US dollar would depreciate under such circumstances, which will be positive for Emerging markets over next 4-6 quarters.

Emerging markets witnessed strong capital outflows over last 3 months. After strengthening for 3 months, the dollar index has started depreciating – a good sign – indicating possible flows moving towards Emerging markets and Europe. However, Europe and China’s growth rates remain subdued at best. Euro area might be an eventual beneficiary of this environment as it finally moves towards policies which make it a better economic and geopolitical zone. European leaders have been forced to make serious choices for the first time in last several decades. They may start looking East more and India could be beneficiary of the same along with China and Others. Geopolitics in the Middle East and Ukraine-Russia is clearly on a de-escalation path, which is positive for growth and negative for energy prices. China continues to have challenges on growth revival due to ageing population and leverage in households/Real estate, which are structural in our view.

Commodities in general may remain muted for extended period, given that more than 30-40% of every commodity is consumed by China and the recent stimulus does little to improve the structural challenges that the Chinese economy is going through. Only positive for China is its relatively cheap valuations and good quality listed tech companies. Eurozone would be the area to look out for over next 5 years from growth perspective. India remains one of the differentiated markets (Exports just 15% of GDP) in terms of structural growth and earnings, notwithstanding cyclical slowdown that we are witnessing right now.

Indian macro remains best among large economies; however, its growth too has faltered. The last Gross Domestic Product (GDP) print came in at 5.4% and 6.2% respectively for 2Q/3QFY25 - leading to downgrade in FY25 GDP growth to ~6.5% by consensus. Current Account Deficit has improved significantly and is expected to be 1 - 1.5% for FY25E/FY26E. Most domestic macro and micro indicators remain steady. Given these aspects, despite the global geo-political and economic dark clouds, the domestic equity market remains focused on earnings. While the structural earning growth has been healthy at >15% CAGR for FY20-24, FY25E has moderated to mid-high single digit, which is a cause of concern.

We believe that this cyclical slowdown is driven by:

1) Reduced Govt spending during 1HFY25 (which is catching up now)

2) Significantly above average monsoon in southern part of country; and

3) Stringent liquidity and administrative actions by RBI on retail credit (which is also reversing now).

Consumption and revenue expenditure at State /Central level has started moving up. Financials, Pharma, industrials, Telecom, Hospital, Hotels, Aviation and Real Estate are witnessing a healthy earnings cycle whereas FMCG, Commodities and IT continues to face headwind. Indian equity market trades at 19xFY26/17xFY27 consensus Nifty earnings – in an attractive valuation zone from medium term perspective – given longevity of earnings growth potential in India. Large caps appear quite attractive based on these valuations. The broader market has moved up more than 70% in last 2 year capturing near term earnings positives. While the latest correction has taken out the froth in mid-caps and small caps, they continue to trade at 10-15% premium to their own historical valuations – indicating that the strong earnings revival is must for this part of the market. FY26/27 is expected to be a stock pickers market as against broad themes as experienced in FY24/25.

Having said that, on near term earnings /market context, we believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges/flow challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place

1) Corporate and bank’s financials are in best possible shape to drive capex and credit respectively,

2) Consumer spending likely to normalize given our demographics

3) Government is focused on growth through direct investments in budget as well as through reforms like GST(increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), Production Linked Incentives private capital through incentives for import substitution or export ecosystem creation)

4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics.

This makes us constructive on India equities with 3-5 years view. We believe that India is in a business cycle / credit growth / earnings cycle through FY24-27E – indicating a healthy earnings cycle from medium term perspective.

Source: ICRA MFI Explorer