CANARA ROBECO MANUFACTURING FUND (CRMTF)

Thematic - Manufacturing - An open ended equity scheme following Manufacturing theme.

(as on January 31, 2025)

| SCHEME OBJECTIVE | The scheme aims to generate long-term capital appreciation by investing predominantly in equities and equity related instruments of companies engaged in the Manufacturing theme. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | 11th March 2024 |

| BENCHMARK | Nifty India Manufacturing TRI |

| FUND MANAGER | 1) Mr. Pranav Gokhale 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 23 Years 2) 19 Years |

| MANAGING THIS FUND | 1)Since 11- March-2024 |

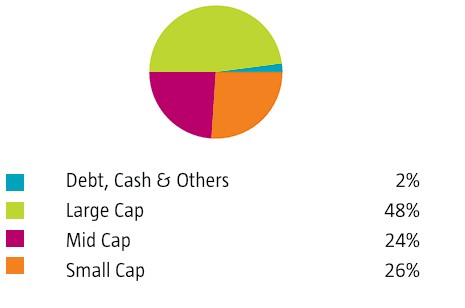

| ASSET ALLOCATION | Equity and Equity-related Instruments of companies engaged in Manufacturing theme |

| MINIMUM INVESTMENT | Lump sum Investment: Purchase: ₹ 5,000 and multiples of ₹ 1 thereafter. Additional Purchase: 1000 and multiples of₹1 thereafter Systematic Investment Plan (SIP):For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – 2000 and in multiples of₹1 thereafter Systematic Transfer Plan (STP): For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – 2000 and in multiples of₹ 1 thereafter Systematic Withdrawal Plan (SWP):For Monthly frequency – 1000 and in multiples of₹1 thereafter For quarterly frequency – 2000 and in multiples of₹1 thereafter For Annual Frequency–2,000and inmultiples of 1 thereafter Auto Switch facility:During the NFO period, the investors can avail the Auto Switch Facility to switch units from the debt schemes of Canara Robeco Mutual Fund at the specified date in the Scheme which will be processed on the last date of the NFO. The provisions of minimum investment amount, applicable NAV and cut-off timing shall also be applicable to the Auto Switch facility. However, CRAMC reserves the right to extend or limit the said facility on such terms and conditions as may be decided from time to time. Minimum redemption Amount: ₹ 1,000/- and in multiples of ₹ 1/- thereafter or the account balance, whichever is lower. |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 2.08% Direct Plan : 0.67% |

| Monthend AUM# | ₹ 1,593.33 Crores |

| Monthly AVG AUM | ₹ 1,627.80 Crores |

| (as on January 31, 2025) | (₹) |

| Direct Plan - Growth Option | 11.6300 |

| Regular Plan - Growth Option | 11.4600 |

| Regular Plan - IDCW (payout/reinvestment | 11.4500 |

| Direct Plan - IDCW (payout/reinvestment) | 11.6300 |

| Name of the Instruments | % to NAV |

Equities |

98.13 |

Listed |

98.13 |

Automobiles |

12.67 |

Mahindra & Mahindra Ltd |

5.48 |

Maruti Suzuki India Ltd |

4.35 |

Bajaj Auto Ltd |

2.84 |

Electrical Equipment |

11.56 |

Suzlon Energy Ltd |

2.54 |

Ge Vernova T&D India Ltd |

2.28 |

Siemens Ltd |

2.07 |

Apar Industries Ltd |

1.23 |

CG Power and Industrial Solutions Ltd |

1.19 |

Triveni Turbine Ltd |

1.18 |

Hitachi Energy India Ltd |

1.07 |

Consumer Durables |

9.50 |

Dixon Technologies (India) Ltd |

2.49 |

Voltas Ltd |

1.45 |

TTK Prestige Ltd |

1.14 |

Safari Industries (India) Ltd |

1.13 |

Greenlam Industries Ltd |

0.86 |

Kansai Nerolac Paints Ltd |

0.83 |

V-Guard Industries Ltd |

0.83 |

Havells India Ltd |

0.77 |

Industrial Products |

7.84 |

Cummins India Ltd |

1.73 |

Polycab India Ltd |

1.60 |

Carborundum Universal Ltd |

1.07 |

KEI Industries Ltd |

1.06 |

Timken India Ltd |

0.92 |

Supreme Industries Ltd |

0.88 |

KSB Ltd |

0.58 |

Auto Components |

6.36 |

Exide Industries Ltd |

1.80 |

Samvardhana Motherson International Ltd |

1.56 |

Sundram Fasteners Ltd |

0.94 |

Craftsman Automation Ltd |

0.76 |

Sona Blw Precision Forgings Ltd |

0.75 |

Schaeffler India Ltd |

0.55 |

Chemicals & Petrochemicals |

5.80 |

Solar Industries India Ltd |

2.04 |

NOCIL Ltd |

1.39 |

Pidilite Industries Ltd |

1.19 |

Deepak Nitrite Ltd |

1.18 |

Cement & Cement Products |

5.46 |

J.K. Cement Ltd |

1.46 |

Ultratech Cement Ltd |

1.38 |

The Ramco Cements Ltd |

1.31 |

Grasim Industries Ltd |

1.31 |

Industrial Manufacturing |

4.96 |

Kaynes Technology India Ltd |

1.83 |

Mazagon Dock Shipbuilders Ltd |

1.10 |

Titagarh Rail Systems Ltd |

1.08 |

Praj Industries Ltd |

0.95 |

Pharmaceuticals & Biotechnology |

4.93 |

Innova Captab Ltd |

1.72 |

J.B. Chemicals & Pharmaceuticals Ltd |

1.37 |

Cipla Ltd |

0.95 |

Concord Biotech Ltd |

0.89 |

Aerospace & Defense |

4.83 |

Bharat Electronics Ltd |

3.83 |

Hindustan Aeronautics Ltd |

1.00 |

Petroleum Products |

4.35 |

Reliance Industries Ltd |

3.90 |

Hindustan Petroleum Corporation Ltd |

0.45 |

Construction |

2.83 |

Larsen & Toubro Ltd |

2.06 |

Engineers India Ltd |

0.77 |

Paper, Forest & Jute Products |

2.20 |

Aditya Birla Real Estate Ltd |

2.20 |

Power |

2.14 |

NTPC Ltd |

1.70 |

NTPC Green Energy Ltd |

0.44 |

Ferrous Metals |

2.14 |

Tata Steel Ltd |

2.14 |

Beverages |

2.09 |

Varun Beverages Ltd |

2.09 |

Oil |

1.93 |

Oil & Natural Gas Corporation Ltd |

1.93 |

Food Products |

1.79 |

Bikaji Foods International Ltd |

1.05 |

Mrs Bectors Food Specialities Ltd |

0.74 |

Non - Ferrous Metals |

1.40 |

Hindalco Industries Ltd |

1.40 |

Consumable Fuels |

1.34 |

Coal India Ltd |

1.34 |

Textiles & Apparels |

1.03 |

K.P.R. Mill Ltd |

1.03 |

Agricultural Food & Other Products |

0.98 |

Balrampur Chini Mills Ltd |

0.98 |

Money Market Instruments |

1.07 |

TREPS |

1.07 |

Net Current Assets |

0.80 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (Nifty India Manufacturing TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer # Monthend AUM as on 31.01.2025 ^The expense ratios mentioned for the schemes includes GST on investment management fees Please click here for disclaimers.

.