Economic Indicators (as on January 31, 2025)

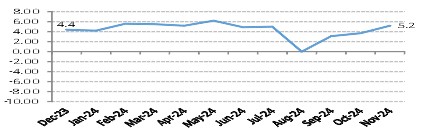

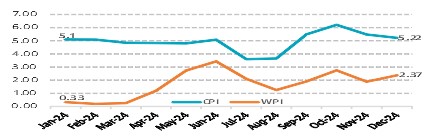

Inflation in India (%)

Consumer Price Index eases to 4-month low to 5.22% in Dec'24 from 5.48% in Nov'24 primarily due to a decline in food and beverage inflation. Wholesale Price Index (WPI) increased to 2.37% in Dec'24 from 1.89% in Nov'24 due to the rise in prices of manufactured items and a low base effect.

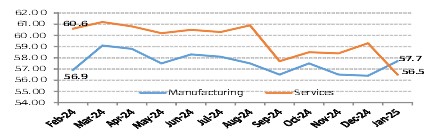

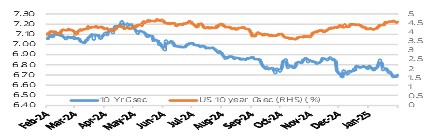

Index of Industrial Production (%)

Index of Industrial Production (IIP) accelerated to 6-months high of 5.2% in Nov’24 from 3.5% in Oct’24. Broad-based improvement in the manufacturing, electricity and mining output supported the overall IIP growth. The recovery was primarily supported by an improvement in the manufacturing sector output, which grew by 5.8% compared to 4.4% in Oct'24. Additionally, mining and electricity output grew by 1.9% and 4.4% respectively, further supporting the IIP rebound. Year-on-year increase was seen in 18 out of 23 subcategories.