Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

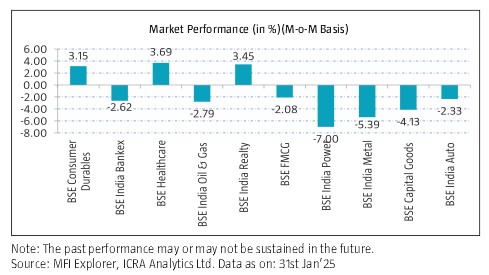

- In the month of Jan’25, Nifty 50 dropped slightly by -0.58% amid rupee’s record fall against the U.S. dollar, broad-based sell-off across the sectors on concerns over weak corporate earnings in Q3 FY’25 and continued foreign fund outflows.

- Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹ -78027.13 crore.

- Gross Goods and Services Tax (GST) collections in Jan’25 stood at Rs. 1.96 trillion, second highest collection in the FY’25, mostly driven by festive demand, representing an 12.3% rise on a yearly basis and this points towards the growing trajectory of the Indian economy.

- The combined Index of Eight Core Industries (Refinery Products Industry, Electricity, Industry, Steel Industry, Coal Industry, Crude Oil Industry, Natural Gas Industry, Cement Industry, Fertilizers Industry) increased by 4.0% YoY in Dec 2024 as compared to 5.1% growth in Dec 2023. All the components of the Eight Core Industries witnessed growth in Dec 2024 over the corresponding month of last year except natural gas, with coal production witnessed the highest rate of growth with 5.3% followed by steel and electricity with 5.1% each, while crude oil rose the least by 0.6% followed by fertilizers by 1.7%

- However, at the end of the month, sentiment was boosted after RBI announced several measures to inject over Rs. 1 lakh crore liquidity into the banking system, which also raised the expectations of policy easing by the RBI in its Feb’25 monetary policy meeting. Additionally, there was a decline in global crude oil prices which boosted the sentiments.

- Globally, U.S. equity markets increased as investors reacted favorably to a number of positive announcements and earnings reports, as well as ongoing optimism about possible interest rate cuts by the U.S. Federal Reserve. News that the U.S. President will announce private sector financing for the construction of artificial intelligence infrastructure bolstered gains. European equity markets rose after the European Central Bank delivered a widely expected 25-basis point interest-rate cut on 30th Jan’25 and guided for a further reduction in Mar’25 due to concerns about economic growth. However, concerns regarding the U.S. President’s tariff threats and policies weighed on market sentiment. The closing of the Asian equity markets was uneventful. As concerns about a recently released Chinese artificial intelligence model negatively impacted technology shares, the Japanese markets plummeted. The market’s attitude was further impacted by worries about the US tariff proposals.

Equity Market Outlook

The FY26 Union Budget was set in the context of a) need to stick to the fiscal prudence and b) need to support demand given the economic slowdown. Amid this pull and push, the budget has tried to play a balancing act, with continued fiscal consolidation while lowering tax rates for the middle class to support consumption. The Gross Fiscal Deficit (GFD) for FY26 is targeted at 4.4% of GDP against 4.8% of GDP in FY25. Budget laid out the fiscal roadmap for next 5 years in terms of lowering India’s debt to GDP by 6-7% by FY31. Overall, this Budget reinforces government’s commitment to fiscal prudence, though the revenue targets look little optimistic for FY26E. The budget has achieved balance beautifully. While there is a consumption boost, the capex allocation has continued to grow at > 10%. While the road and railways have slowed; the defense spending and rural areas has remained healthy. Rural and consumption has clearly returned as focus area after long time.

Beyond fiscal math, the deregulation/ease of doing business has been the key theme of the Budget. Budget has emphasized there is a need to ease permissions, documentation, certifications and licenses specifically for Micro, Small and Medium Enterprises (MSMEs), which would work to increase employment as well. From equity markets standpoint, consumption segments are likely to benefit. As regards portfolio, we maintain our quality/defensive bias and prefer barbel strategy with a mix of consumption and domestic cyclicals including capex plays.

Markets have corrected by 10-15% over last 6 months. The froth in the market to a great degree has been taken out. Nifty now trades at 18XFY27; though the mid and small caps still remain expensive as compared to historical valuation multiples. We expect (like consensus) that the earnings to gradually start normalizing; as both capex and consumption pick up from FY25 lows. We are gradually turning constructive given the expected earnings over FY25-27E (Consensus) and valuations correction which is underway as a combination of time and price correction over last 6 months.

Source: ICRA MFI Explorer