CANARA ROBECO MULTI CAP FUND (CRMUCF)

Multi Cap Fund - An open-endedequity scheme investing across large cap, mid cap, small cap stocks

(as on November 29, 2024)

| SCHEME OBJECTIVE | The fund aims to generate long-term capital appreciation through diversified investments in equity & equity related instruments across large cap, mid cap, and small cap stocks. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. |

| DATE OF ALLOTMENT | 28th July 2023 |

| BENCHMARK | NIFTY 500 Multicap 50:25:25 Index TRI |

| FUND MANAGER | 1) Mr. Shridatta Bhandwaldar 2) Mr. Vishal Mishra |

| TOTAL EXPERIENCE | 1) 16 Years 2) 18 Years |

| MANAGING THIS FUND | 1) Since 28- July-2023 2) Since 28- July-2023 |

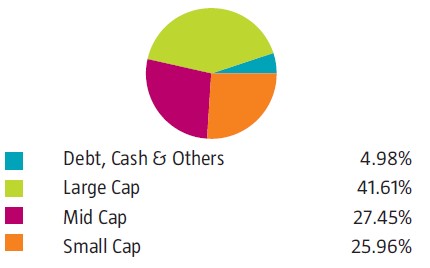

| ASSET ALLOCATION | Equity and Equity-related Instruments of which*: 75% to 100% ( Very High) Large Cap Companies 25% to 50% ( Very High) Midcap Companies 25% to 50% ( Very High) Small Cap Companies 25% to 50% ( Very High) Debt and Money Market Instruments 0% to 25% ( Low to Medium) Units issued by REITs and InvITs 0% to 10% ( Very High) *As defined by SEBI Circular No. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated October 06, 2017, Large Cap Companies are those which are ranked from 1st to 100th, Mid Cap Companies are those which are ranked from 101st to 250th and Small cap companies are those which are ranked 251st company onward, based on their full market capitalization. |

| MINIMUM INVESTMENT | Lumpsum Purchase: ₹ 5,000.00 and multiples of ₹ 1.00

thereafter.

Additional Purchase:₹ 1000.00 and multiples of ₹ 1.00 thereafter. SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 1.86% Direct Plan : 0.43% |

| Monthend AUM# | ₹ 3,848.80 Crores |

| Monthly AVG AUM | ₹ 3,724.00 Crores |

| (as on November 29, 2024) | (₹) |

| Direct Plan - Growth Option | 14.4000 |

| Regular Plan - Growth Option | 14.1300 |

| Regular Plan - IDCW (payout/reinvestment | 13.9900 |

| Direct Plan - IDCW (payout/reinvestment) | 14.2500 |

Name of the Instruments |

% to NAV |

Equities |

95.02 |

Listed |

95.02 |

Banks |

14.41 |

HDFC Bank Ltd |

4.65 |

ICICI Bank Ltd |

3.96 |

Indian Bank |

1.64 |

State Bank of India |

1.27 |

Federal Bank Ltd |

1.08 |

Axis Bank Ltd |

0.92 |

Equitas Small Finance Bank Ltd |

0.89 |

IT - Software |

7.68 |

Infosys Ltd |

2.85 |

Mphasis Ltd |

0.99 |

KPIT Technologies Ltd |

0.98 |

HCL Technologies Ltd |

0.96 |

Sonata Software Ltd |

0.96 |

Tech Mahindra Ltd |

0.94 |

Pharmaceuticals & Biotechnology |

6.27 |

Ajanta Pharma Ltd |

1.46 |

J.B. Chemicals & Pharmaceuticals Ltd |

1.00 |

Piramal Pharma Ltd |

0.91 |

Cipla Ltd |

0.84 |

Torrent Pharmaceuticals Ltd |

0.78 |

Mankind Pharma Ltd |

0.67 |

Abbott India Ltd |

0.61 |

Finance |

5.43 |

Cholamandalam Investment and Finance Co Ltd |

1.11 |

Shriram Finance Ltd |

0.94 |

Power Finance Corporation Ltd |

0.86 |

Can Fin Homes Ltd |

0.80 |

Creditaccess Grameen Ltd |

0.79 |

PNB Housing Finance Ltd |

0.72 |

Bajaj Housing Finance Ltd |

0.21 |

Retailing |

4.42 |

Zomato Ltd |

2.38 |

Vedant Fashions Ltd |

0.97 |

FSN E-Commerce Ventures Ltd |

0.69 |

Avenue Supermarts Ltd |

0.38 |

Capital Markets |

4.41 |

Multi Commodity Exchange Of India Ltd |

1.19 |

ICRA Ltd |

0.98 |

HDFC Asset Management Company Ltd |

0.97 |

Computer Age Management Services Ltd |

0.74 |

Central Depository Services (India) Ltd |

0.36 |

UTI Asset Management Co Ltd |

0.17 |

Electrical Equipment |

4.26 |

Ge Vernova T&D India Ltd |

1.30 |

Suzlon Energy Ltd |

0.91 |

Hitachi Energy India Ltd |

0.82 |

CG Power and Industrial Solutions Ltd |

0.66 |

Waaree Energies Ltd |

0.57 |

Auto Components |

4.05 |

Uno Minda Ltd |

1.65 |

Motherson Sumi Wiring India Ltd |

0.71 |

Schaeffler India Ltd |

0.68 |

Sona Blw Precision Forgings Ltd |

0.51 |

ZF Commercial Vehicle Control Systems India Ltd |

0.50 |

Consumer Durables |

4.03 |

Crompton Greaves Consumer Electricals Ltd |

1.37 |

V-Guard Industries Ltd |

1.04 |

Kajaria Ceramics Ltd |

0.90 |

Dixon Technologies (India) Ltd |

0.72 |

Industrial Products |

3.38 |

KEI Industries Ltd |

1.18 |

Cummins India Ltd |

0.98 |

APL Apollo Tubes Ltd |

0.69 |

Supreme Industries Ltd |

0.53 |

Automobiles |

2.80 |

Mahindra & Mahindra Ltd |

1.64 |

TVS Motor Co Ltd |

1.16 |

Power |

2.63 |

NTPC Ltd |

1.61 |

Tata Power Co Ltd |

1.02 |

Telecom - Services |

2.41 |

Bharti Airtel Ltd |

2.41 |

Industrial Manufacturing |

2.40 |

Praj Industries Ltd |

1.10 |

Kaynes Technology India Ltd |

1.04 |

GMM Pfaudler Ltd |

0.26 |

Leisure Services |

2.27 |

EIH Ltd |

1.16 |

Westlife Foodworld Ltd |

0.62 |

TBO Tek Ltd |

0.49 |

Agricultural Food & Other Products |

2.19 |

Tata Consumer Products Ltd |

1.48 |

CCL Products (India) Ltd |

0.71 |

Cement & Cement Products |

2.18 |

J.K. Cement Ltd |

2.18 |

Construction |

2.15 |

Larsen & Toubro Ltd |

1.78 |

Engineers India Ltd |

0.37 |

Aerospace & Defense |

1.98 |

Bharat Electronics Ltd |

1.98 |

Insurance |

1.93 |

Max Financial Services Ltd |

1.03 |

ICICI Lombard General Insurance Co Ltd |

0.90 |

Realty |

1.81 |

Brigade Enterprises Ltd |

1.81 |

Beverages |

1.58 |

Varun Beverages Ltd |

1.28 |

United Breweries Ltd |

0.30 |

Petroleum Products |

1.55 |

Reliance Industries Ltd |

1.55 |

Chemicals & Petrochemicals |

1.45 |

Deepak Nitrite Ltd |

1.23 |

Vinati Organics Ltd |

0.22 |

Healthcare Services |

1.43 |

Max Healthcare Institute Ltd |

1.43 |

Textiles & Apparels |

1.19 |

K.P.R. Mill Ltd |

0.99 |

Arvind Ltd |

0.20 |

Transport Services |

1.11 |

Interglobe Aviation Ltd |

1.11 |

Diversified Fmcg |

0.87 |

ITC Ltd |

0.87 |

Non - Ferrous Metals |

0.85 |

National Aluminium Co Ltd |

0.85 |

Household Products |

0.80 |

Jyothy Labs Ltd |

0.80 |

Paper, Forest & Jute Products |

0.70 |

Aditya Birla Real Estate Ltd |

0.70 |

Food Products |

0.40 |

Bikaji Foods International Ltd |

0.40 |

Money Market Instruments |

5.22 |

TREPS |

5.22 |

Net Current Assets |

-0.24 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (NIFTY 500 Multicap 50:25:25 Index TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.11.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.