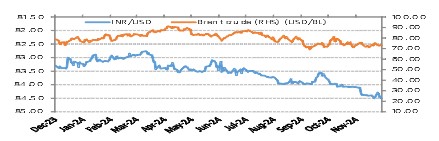

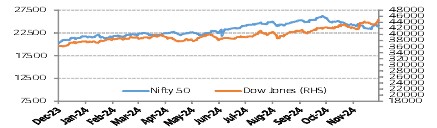

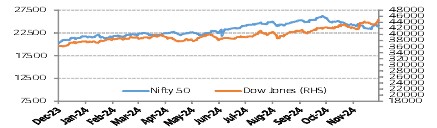

Equity Markets - India & US

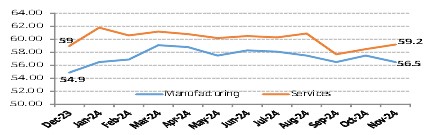

Bellwether indices, Nifty 50 and S&P BSE Sensex moved during the month by -0.31% % and 0.52% respectively amid rise in dollar index and softening second quarter earnings, continuous foreign fund outflows and uncertainty amid escalating tensions in the Middle East due to the conflict also added to fall. Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹21,611.93 crore. Gross Goods and Services Tax (GST) collections in Nov’24 stood at Rs. 1.82 trillion, mostly driven by festive demand, representing a 8.5% rise on a yearly basis and this points towards the growing trajectory of the Indian economy. Dow Jones increased by 7.54% from previous month.

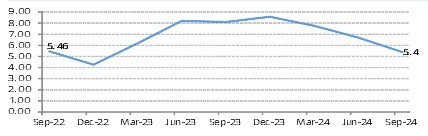

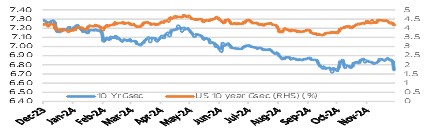

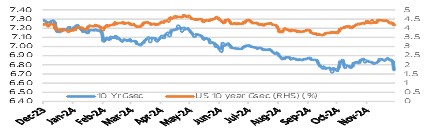

Interest Rate Movement (%) - India & US

Yield on the 10-Year benchmark paper remained range-bound, closing at 6.74% on Nov'24 vs 6.85% on Oct'24 following weaker-than-expected domestic GDP growth data for the second quarter of FY25 and fall in U.S. Treasury yields after the U.S. Federal Reserve reduced interest rate by 25 bps in its Nov'24 policy meeting . US 10 year G-Sec closed lower at 4.1685% on Nov’24 vs 4.2844% on Oct’24.

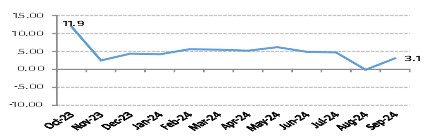

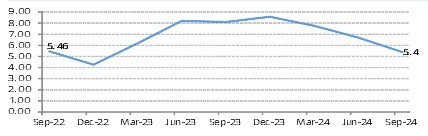

India GDP Growth Rate

India’s GDP hit a 7-quarter low of 5.4% for Q2 FY25 vs 6.7% for Q1 FY25 and much below the market expectations. While the GDP growth was expected to moderate as being indicated by some of the high frequency macroeconomic indicators and weaker corporate performance, domestic consumption and adverse weather impacts on key industries, the quantum of deceleration is much sharper than expected. In terms of the sectors, agriculture growth continued to recover, services sector, too, maintained its broad momentum, however, the industrial sector performed poorly, with all major subheads witnessing a slowdown. A prolonged monsoon this year impacted the mining sector. Additionally, the contraction in public capex further slowed construction activities. The manufacturing growth witnessed a steep slowdown in growth. The RBI has retained its GDP growth forecast at 7.2% for the current fiscal year, down from 8.2% in the previous year, whilst numerous private economists have reduced their estimates.