Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

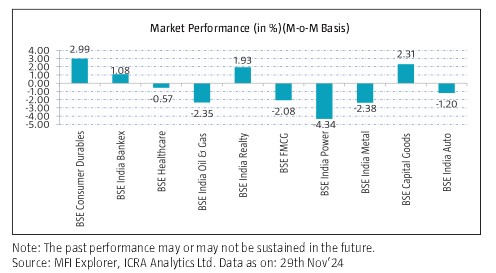

- In the month of Nov'24, Nifty 50 marginally dropped by -0.31% amid rise in dollar index and softening second quarter earnings, continuous foreign fund outflows and uncertainty amid escalating tensions in the Middle East due to the conflict also added to fall.

- Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹ -21,611.93 crore.

- Gross Goods and Services Tax (GST) collections in Nov'24 stood at Rs. 1.82 trillion, mostly driven by festive demand, representing an 8.5% rise on a yearly basis and this points towards the growing trajectory of the Indian economy.

- The combined Index of Eight Core Industries (Refinery Products Industry, Electricity, Industry, Steel Industry, Coal Industry, Crude Oil Industry, Natural Gas Industry, Cement Industry, Fertilizers Industry) increased by 3.1% YoY in Oct 2024 as compared to 12.7% growth in Oct 2023. The production of the Eight Core Industries remained mixed in Oct 2024 over the corresponding month of last year, with coal witnessed the highest rate of growth with 7.8% followed by Refinery Products with 5.2% growth, while Crude Oil fell the most by 4.8% followed by Natural Gas by 1.2%.

- However, during the month, sentiment was boosted after the present coalition administration in Maharashtra state, headed by the ruling party at the Centre, won a significant victory in the state assembly election, raising hopes for more government spending and policy continuity with a focus on capital expenditures and infrastructure.

- Globally, U.S. Equities markets increased after fresh hope for global economic growth during the second term of U.S. President. European equity markets mostly rose tracking the rally in Wall Street and amid anticipations of additional rate reductions by central banks. Asian equity markets closed on a mixed note. The market fell as the Japanese markets are experiencing pressure due to expectations of a Bank of Japan interest rate increase, which has resulted in a stronger Japanese yen.

Equity Market Outlook

The global macro environment remains complex with the latest US unemployment and growth data being more resilient than estimated. Inflation and other data points indicate that inflation, while cooling on headline, the core Personal Consumption Expenditures (PCE) is not receding incrementally – pushing back aggressive rate cut hopes. This led to US 10-year rallying from 3.7% to 4.4% over last 2 months. The dollar index continued to strengthen because of Republican Party’s victory in the upcoming election, a negative for all Emerging Market (EM) capital flows in the near term. All EM’s witnessed capital outflow during October/November. Geopolitics in the middle east, Ukraine-Russia (and now even N-S Korea) is clearly on an escalator path, adverse for growth and energy prices both. However, Trump return might mean de-escalation in wars over next few months – energy/growth positive. The US growth is stabilizing at lower levels (but resilient) as the fiscal and monetary impulse is receding, employment data moderating and inflation is moderating gradually – although not as much as was expected. The latest PCE in the US is running at 2.3% now. This is leading to a possible goldilocks scenario where you might get lower inflation without hurting growth too much. We expect another 25bps cut before Feb’25 and another 75-100bps in CY25. Europe is gradually stabilizing at lower levels (but manufacturing continues to suffer), as inflation and interest rates peak in most economies in the Euro area. China continues to have challenges on growth revival due to ageing population and leverage in households/Real estate, which are structural in our view. Commodities in general may remain muted for extended period, given >30-40% of every commodity is consumed by China and the recent stimulus doesn’t change structural challenges of China in our assessment.

Geopolitical tensions are taking time to abate and are only getting complex. Given these tensions, supply chains and global trade have become vulnerable to new dimensions now, missing till pre-covid. India remains one of the differentiated markets in terms of growth and earnings. In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in CY20-21 in that order and they will reverse in the same order during CY23-24. We have seen an initial downtick in inflation, which will accelerate in our view over the next few quarters. We expect 75-100bps of interest rate cuts over the next 12 months now.

Indian macro remains best among large markets except for growth part, where the last Gross Domestic Product (GDP) print came in at 5.4% - leading to downgrade in FY25 GDP growth to 6.6% by RBI. Current Account Deficit has improved significantly and is expected to be ~1% for FY25. Most domestic macro and micro indicators remain steady. Given these aspects, the domestic equity market remains focused on earnings. Earnings growth remains relatively far better than most Emerging Markets/ Developed Markets. Having said this, FY25 earnings growth for nifty is likely to be high single digit, a downgrade of 3-5% from the start of the financial year. Financials, Pharma, Auto, industrials, Telecom, Hospital and Real Estate are witnessing a healthy earnings cycle whereas FMCG, chemicals and IT continue to face headwinds. Indian equity market trades at 20FY26 earnings – in a fair valuation zone from medium term perspective – given longevity of earnings cycle in India. The broader market has moved up >30% in last 1 year -capturing near term earnings valuation positives for FY25/26E. Expect a rollover returns, as the earnings rollover to FY27E. Given the upfronting of returns in mid and small caps (aided by very strong flows also), valuations are at 20-30% premium to past; we are more constructive on large cap from FY25/26 perspective. Domestic cyclicals continue to have earnings edge over global cyclical and consumption. Select financials, select auto, Real Estate, Cement, Industrials, Power, Hotels/Hospitals/Aviation on domestic side continue to display healthy earnings.

Having said this on near term earnings /market context, we believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place viz. 1) Corporate and bank balance sheets are in best possible shape to drive capex and credit respectively, 2) Consumer spending remains resilient through cycle given our demographics, 3) Govt is focused on growth through direct investments in budget as well as through reforms like GST(increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), Production Linked Incentives private capital through incentives for import substitution or export ecosystem creation) and 4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics. This makes us very constructive on India equities with 3-years view. We believe that India is in a business cycle / credit growth / earnings cycle through FY24-27E – indicating a healthy earnings cycle from medium term perspective.

Source: ICRA MFI Explorer