CANARA ROBECO OVERNIGHT FUND (CROF)

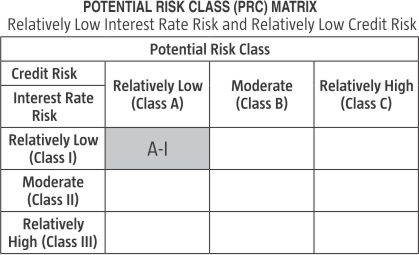

Overnight Fund - An open-ended debt scheme investing in overnight securities. A relatively low interest rate risk and relatively low credit risk.

(as on April 30, 2024)

| SCHEME OBJECTIVE | The investment objective of the Scheme is to generate returns commensurate with low risk and providing high level of liquidity, through investments made primarily in overnight securities. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| DATE OF ALLOTMENT | 24th July, 2019 |

| BENCHMARK | CRISIL Liquid Overnight Index |

| FUND MANAGER | Ms. Suman Prasad |

| TOTAL EXPERIENCE | 24Years |

| MANAGING THIS FUND | Since 24-July-19 |

| ASSET ALLOCATION | Overnight Securities *- 0% - 100% (Risk - Low) *Overnight Securities: Debt and money market instruments with overnight interest rate risk such as debt instruments with one business day residual maturity. Overnight securities include synthetic overnight positions such as reverse repo/tri-party repo & other transactions where the interest rate is reset every business day. |

| MINIMUM INVESTMENT | I. Lump sum Investment: Minimum amount: ₹ 5,000.00 and multiples of ₹ 1.00 thereafter. Additional purchases: Minimum amount of ₹ 1000.00 and multiples of ₹ 1.00 thereafter. II. Systematic Transfer Plan (STP): For Daily/Weekly/Monthly frequency - ₹ 1000/- and in multiples of ₹ 1/- thereafter. For Quarterly frequency - ₹ 2000/- and in multiples of ₹ 1/- thereafter. III. Systematic Withdrawal Plan (SWP): For Monthly frequency - ₹ 1000/- and in multiples of ₹ 1/- thereafter. For Quarterly frequency - ₹ 2000/- and in multiples of ₹ 1/- thereafter. |

| PLANS / OPTIONS | Regular Plan - Daily Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Daily Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | Nil |

| EXPENSE RATIO^: |

Regular Plan : 0.11% Direct Plan : 0.10% |

| Monthend AUM# | ₹ 142.38 Crores |

| Monthly AVG AUM | ₹ 160.74 Crores |

| (as on April 30, 2024) | (₹) |

| Regular Plan - Daily IDCW (reinvestment) | 1,001.0000 |

| Direct Plan - Daily IDCW (reinvestment) | 1,001.0012 |

| Direct Plan - Growth Option | 1,244.7231 |

| Regular Plan - Growth Option | 1,243.6598 |

| Annualised Portfolio YTM | 6.58% |

| Modified Duration | 0.0026 Years |

| Residual Maturity | 0.01 Years |

| Macaulay Duration | 0.0054 Years |

| Name of the Instruments | Rating | % to NAV |

| Money Market Instruments | 99.36 |

|

| TREPS | 99.36 |

|

| Other Current Assets | 0.64 |

|

| Grand Total ( Net Asset) | 100.00 |

Fund predominantly invests in tri-party repos, overnight reverse repos and fixed income securities/instruments with maturity of one (1) business day. Fund has minimal interest rate and credit risk and tends to ensure a high degree of liquidity in the portfolio. Fund offers an alternative to corporate and individual investors who may want to park their idle funds for short period of time and expecting minimal interest rate and credit risk.

% Allocation |

|

Net Current Assets/ CDMDF |

0.64% |

0 to 3 Months |

99.36% |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (CRISIL Liquid Overnight Index) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 30.4.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.