CANARA ROBECO MANUFACTURING FUND (CRMTF)

Thematic - Manufacturing - An open ended equity scheme following Manufacturing theme.

(as on April 30, 2024)

| SCHEME OBJECTIVE | The scheme aims to generate long-term capital appreciation by investing predominantly in equities and equity related instruments of companies engaged in the Manufacturing theme. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | 11th March 2024 |

| BENCHMARK* | Nifty India Manufacturing TRI |

| FUND MANAGER | 1) Mr. Pranav Gokhale 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 21 Years 2) 15 Years |

| MANAGING THIS FUND | 1)Since 11- March-2024 |

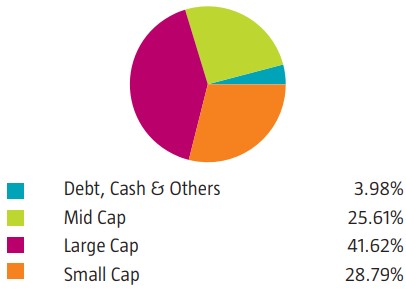

| ASSET ALLOCATION | Equity and Equity-related Instruments of companies engaged in Manufacturing theme |

| MINIMUM INVESTMENT | Lump sum Investment: Purchase: ₹ 5,000 and multiples of ₹ 1 thereafter. Additional Purchase: 1000 and multiples of₹1 thereafter Systematic Investment Plan (SIP):For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – 2000 and in multiples of₹1 thereafter Systematic Transfer Plan (STP): For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – 2000 and in multiples of₹ 1 thereafter Systematic Withdrawal Plan (SWP):For Monthly frequency – 1000 and in multiples of₹1 thereafter For quarterly frequency – 2000 and in multiples of₹1 thereafter Auto Switch facility:During the NFO period, the investors can avail the Auto Switch Facility to switch units from the debt schemes of Canara Robeco Mutual Fund at the specified date in the Scheme which will be processed on the last date of the NFO. The provisions of minimum investment amount, applicable NAV and cut-off timing shall also be applicable to the Auto Switch facility. However, CRAMC reserves the right to extend or limit the said facility on such terms and conditions as may be decided from time to time. Minimum redemption Amount: ₹ 1,000/- and in multiples of ₹ 1/- thereafter or the account balance, whichever is lower. |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 2.10% Direct Plan : 0.40% |

| Monthend AUM# | ₹ 1,241.89 Crores |

| Monthly AVG AUM | ₹ 1,180.47 Crores |

| (as on April 30, 2024) | (₹) |

| Direct Plan - Growth Option | 10.8100 |

| Regular Plan - Growth Option | 10.7800 |

| Regular Plan - IDCW (payout/reinvestment | 10.7800 |

| Direct Plan - IDCW (payout/reinvestment) | 10.8100 |

| Name of the Instruments | % to NAV |

Equities |

96.02 |

Listed |

96.02 |

Automobiles |

13.67 |

Maruti Suzuki India Ltd |

4.80 |

Bajaj Auto Ltd |

3.67 |

Mahindra & Mahindra Ltd |

3.03 |

Eicher Motors Ltd |

2.17 |

Industrial Products |

12.31 |

Supreme Industries Ltd |

2.04 |

Cummins India Ltd |

1.77 |

Carborundum Universal Ltd |

1.64 |

Timken India Ltd |

1.38 |

Rhi Magnesita India Ltd |

1.04 |

APL Apollo Tubes Ltd |

1.00 |

KSB Ltd |

0.95 |

AIA Engineering Ltd |

0.92 |

Mold Tek Packaging Ltd |

0.84 |

Inox India Ltd |

0.73 |

Electrical Equipment |

10.55 |

Suzlon Energy Ltd |

2.00 |

Siemens Ltd |

1.79 |

Hitachi Energy India Ltd |

1.54 |

Triveni Turbine Ltd |

1.46 |

ABB India Ltd |

1.34 |

CG Power and Industrial Solutions Ltd |

1.33 |

Apar Industries Ltd |

1.09 |

Consumer Durables |

8.64 |

Voltas Ltd |

2.18 |

Dixon Technologies (India) Ltd |

1.53 |

TTK Prestige Ltd |

1.43 |

Safari Industries (India) Ltd |

1.28 |

Greenlam Industries Ltd |

1.14 |

Kajaria Ceramics Ltd |

1.08 |

Aerospace & Defense |

6.25 |

Hindustan Aeronautics Ltd |

3.24 |

Bharat Electronics Ltd |

3.01 |

Chemicals & Petrochemicals |

6.20 |

Solar Industries India Ltd |

2.30 |

Pidilite Industries Ltd |

1.62 |

Deepak Nitrite Ltd |

1.30 |

NOCIL Ltd |

0.98 |

Industrial Manufacturing |

6.17 |

Kaynes Technology India Ltd |

1.88 |

Titagarh Rail Systems Ltd |

1.75 |

Mazagon Dock Shipbuilders Ltd |

1.48 |

Praj Industries Ltd |

1.06 |

Auto Components |

4.72 |

Samvardhana Motherson International Ltd |

1.85 |

Sona Blw Precision Forgings Ltd |

1.19 |

Craftsman Automation Ltd |

1.03 |

Balkrishna Industries Ltd |

0.65 |

Cement & Cement Products |

4.69 |

Grasim Industries Ltd |

1.61 |

J.K. Cement Ltd |

1.55 |

Ultratech Cement Ltd |

1.53 |

Petroleum Products |

3.50 |

Reliance Industries Ltd |

3.50 |

Food Products |

2.81 |

Bikaji Foods International Ltd |

1.69 |

Mrs Bectors Food Specialities Ltd |

1.12 |

Construction |

2.67 |

Larsen & Toubro Ltd |

2.67 |

Power |

2.44 |

NTPC Ltd |

2.44 |

Pharmaceuticals & Biotechnology |

2.14 |

Innova Captab Ltd |

1.08 |

Concord Biotech Ltd |

1.06 |

Paper, Forest & Jute Products |

1.99 |

Century Textile & Industries Ltd |

1.99 |

Beverages |

1.64 |

Varun Beverages Ltd |

1.64 |

Ferrous Metals |

1.47 |

Tata Steel Ltd |

1.47 |

Non - Ferrous Metals |

1.24 |

Hindalco Industries Ltd |

1.24 |

Textiles & Apparels |

1.14 |

K.P.R. Mill Ltd |

1.14 |

Minerals & Mining |

0.93 |

MOIL Ltd |

0.93 |

Consumable Fuels |

0.85 |

Coal India Ltd |

0.85 |

Money Market Instruments |

3.70 |

TREPS |

3.70 |

Net Current Assets |

0.28 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (S&P BSE India Manufacturing TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer # Monthend AUM as on 30.4.2024 ^The expense ratios mentioned for the schemes includes GST on investment management fees Please click here for disclaimers. *Please refer notice cum addendum no.03 dated April 09, 2024 for Change in Benchmark of Canara Robeco Manufacturing Fund

.