Economic Indicators (as on April 30, 2024)

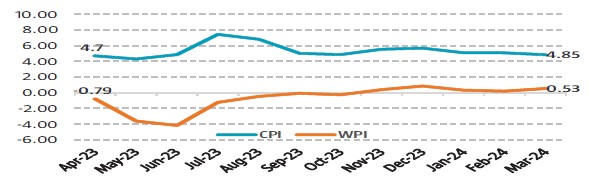

Inflation in India (%)

Consumer Price Index decelerated to 10-month low to 4.85% in Mar’24 from 5.09% in Feb’24 due to easing food prices. Though, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) rises to 3-month high to 0.53% in Mar’24 from 0.2% in Feb’24. Positive rate of inflation in Mar'24 is primarily due to increase in prices of food articles, crude petroleum & natural gas, electricity, machinery & equipment and motor vehicles, trailers & semi-trailers etc. It stepped out of the deflationary zone for the fourth time in row.

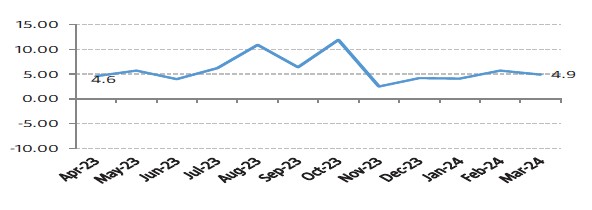

Index of Industrial Production (%)

Index of Industrial Production (IIP) rises to 4.9% in Mar’24 from 5.7% in Feb’24, indicating a growth in the manufacturing sector of the Indian economy. Manufacturing output, which accounts for a considerable majority of industrial production, expanded by 5.2%. Mining sector growing by 1.2% and electricity growing by 8.6%.