CANARA ROBECO GILT FUND (CRGILT)

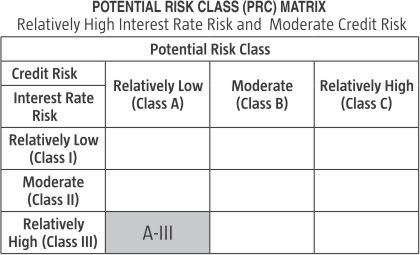

Gilt Fund - An open-ended debt scheme investing in government securities across maturity. A relatively high interest rate risk and relatively low credit risk.

(as on April 30, 2024)

| SCHEME OBJECTIVE | To provide risk free return (except interest rate risk) while maintaining stability of capital and liquidity. Being a dedicated Gilt Scheme, the funds will be invested in securities as defined under Sec. 2 (2) of Public Debt Act, 1944. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| DATE OF ALLOTMENT | December 29, 1999 |

| BENCHMARK | CRISIL Dynamic Gilt Index |

| FUND MANAGER | 1) Mr. Kunal Jain 2) Mr. Avnish Jain |

| TOTAL EXPERIENCE | 1) 14 Years 2) 27 Years |

| MANAGING THIS FUND | 1) Since 18-July-22 2) Since 01-April-22 |

| ASSET ALLOCATION | Govt. Securities - 80% to 100% (Risk- Low) Money Market Instruments - 0% to 20% (Risk- Low to Medium) |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | Nil |

| EXPENSE RATIO^: |

Regular Plan : 1.25% Direct Plan : 0.53% |

| Monthend AUM# | ₹ 107.92 Crores |

| Monthly AVG AUM | ₹ 106.97 Crores |

| (as on April 30, 2024) | (₹) |

| Direct Plan - Growth Option | 73.2701 |

| Regular Plan - Growth Option | 68.6086 |

| Regular Plan - IDCW (payout/reinvestment) | 14.9590 |

| Direct Plan - IDCW (payout/reinvestment) | 16.1662 |

| Annualised Portfolio YTM | 7.19% |

| Modified Duration | 5.78 Years |

| Residual Maturity | 9.11 Years |

| Macaulay Duration | 6.01 Years |

Name of the Instruments |

Rating |

% to NAV |

Government Securities |

|

80.48 |

7.18% GOI 2037 (24-JUL-2037) |

Sovereign |

31.35 |

7.18% GOI 2033 (14-AUG-2033) |

Sovereign |

19.44 |

7.32% GOI 2030 (13-NOV-2030) |

Sovereign |

9.32 |

7.10% GOI 2034 (08-APR-2034) |

Sovereign |

6.88 |

7.10% GOI 2029 (18-APR-2029) |

Sovereign |

4.61 |

7.17% GOI 2030 (17-APR-2030) |

Sovereign |

2.39 |

7.38% GOI 2027 (20-JUN-2027) |

Sovereign |

2.33 |

7.30% GOI 2053 (19-JUN-2053) |

Sovereign |

2.04 |

7.25% GOI 2063 (12-JUN-2063) |

Sovereign |

2.02 |

8.13% GOI 2045 (22-JUN-2045) |

Sovereign |

0.10 |

Money Market Instruments |

|

17.67 |

TREPS |

|

17.67 |

Other Current Assets |

|

1.85 |

Grand Total ( Net Asset) |

|

100.00 |

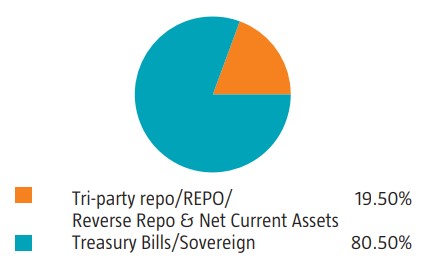

% Allocation |

|

Net Current Assets/CDMDF |

1.83% |

| 0 to 3 Months | 17.67% |

| Greater than 2 Years | 80.50% |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (CRISIL Dynamic Gilt Index) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 30.4.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.