CANARA ROBECO MID CAP FUND (CRMCF)

Mid Cap Fund - An open-ended equity

scheme predominantly investing in mid cap stocks.

(as on February 28, 2023)

| SCHEME OBJECTIVE | The investment objective of the Scheme is to generate capital appreciation by investing predominantly in equity and equity related instruments of mid cap companies. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | December 02, 2022 |

| BENCHMARK | S&P BSE 150 Mid Cap Index TRI |

| FUND MANAGER | 1) Mr. Ajay Khandelwal 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 17 Years 2) 15 Years |

| MANAGING THIS FUND | 1) Since 02 - December - 22 2) Since 02 - December - 22 |

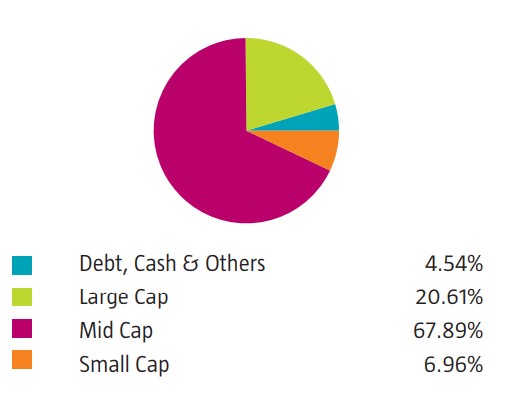

| ASSET ALLOCATION | Equity and Equity-related Instruments of Midcap

companies* 65% to 100% (Risk Very High)

Equity and Equity-related Instruments of companies other than Midcap companies 0% to 35% (Risk Very High) Debt and Money Market Instruments 0% to 35% (Risk Low to Medium) Units issued by REITs and InvITs 0% to 10% ((Risk Medium to High) *As defined by SEBI Circular No. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated October 06, 2017 and as amended from time to time Mid Cap Companies are those companies which are ranked from 101 to 250 based on their full market capitalization. |

| MINIMUM INVESTMENT | Lumpsum Purchase: ₹ 5,000.00 and multiples of ₹ 1.00

thereafter.

Subsequent Purchase: ₹ 1000.00 and multiples of ₹ 1.00 thereafter. SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | N.A |

| EXIT LOAD | In respect of each purchase / switch-in of units 1% - If redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 2.38% Direct Plan : 0.60% |

| Monthend AUM# | ₹ 971.62 Crores |

| Monthly AVG AUM | ₹ 963.06 Crores |

| (as on February 28, 2023) | (₹) |

| Direct Plan - Growth Option | 9.6400 |

| Regular Plan - Growth Option | 9.6000 |

| Regular Plan - IDCW (payout/reinvestment | 9.6000 |

| Direct Plan - IDCW (payout/reinvestment) | 9.6400 |

| Name of the Instruments | % to NAV |

Equities |

95.46 |

Listed |

95.46 |

Industrial Products |

11.30 |

Polycab India Ltd |

3.39 |

AIA Engineering Ltd |

2.81 |

Astral Ltd |

2.67 |

Bharat Forge Ltd |

2.43 |

Banks |

9.47 |

Federal Bank Ltd |

3.47 |

HDFC Bank Ltd |

2.72 |

Indian Bank |

2.22 |

ICICI Bank Ltd |

1.06 |

Auto Components |

8.56 |

Uno Minda Ltd |

3.50 |

Sundram Fasteners Ltd |

2.82 |

Schaeffler India Ltd |

2.24 |

Chemicals & Petrochemicals |

8.07 |

Linde India Ltd |

2.51 |

Navin Fluorine International Ltd |

2.00 |

Deepak Nitrite Ltd |

1.86 |

Atul Ltd |

1.70 |

Pharmaceuticals & Biotechnology |

5.97 |

Abbott India Ltd |

2.78 |

IPCA Laboratories Ltd |

1.97 |

J.B. Chemicals & Pharmaceuticals Ltd |

1.22 |

Retailing |

5.28 |

Trent Ltd |

2.75 |

Avenue Supermarts Ltd |

1.61 |

Go Fashion India Ltd |

0.92 |

Cement & Cement Products |

5.13 |

J.K. Cement Ltd |

2.99 |

JK Lakshmi Cement Ltd |

2.14 |

Healthcare Services |

5.09 |

Global Health Ltd |

2.68 |

Max Healthcare Institute Ltd |

2.41 |

Finance |

4.85 |

Sundaram Finance Ltd |

2.44 |

CRISIL Ltd |

2.41 |

IT - Software |

4.66 |

Persistent Systems Ltd |

3.36 |

Mphasis Ltd |

1.30 |

Consumer Durables |

3.83 |

Kajaria Ceramics Ltd |

2.57 |

Whirlpool Of India Ltd |

1.26 |

Textiles & Apparels |

3.13 |

K.P.R. Mill Ltd |

1.74 |

Page Industries Ltd |

1.39 |

Agricultural, Commercial & Construction Vehicles |

2.74 |

Ashok Leyland Ltd |

2.74 |

Fertilizers & Agrochemicals |

2.74 |

PI Industries Ltd |

2.74 |

Automobiles |

2.46 |

TVS Motor Co Ltd |

2.46 |

Diversified Fmcg |

2.33 |

Hindustan Unilever Ltd |

2.33 |

Telecom - Services |

2.14 |

Bharti Airtel Ltd |

2.14 |

Beverages |

2.08 |

United Breweries Ltd |

2.08 |

Ferrous Metals |

2.01 |

Tata Steel Ltd |

2.01 |

Aerospace & Defense |

1.86 |

Bharat Electronics Ltd |

1.86 |

Leisure Services |

1.76 |

Devyani International Ltd |

1.76 |

Money Market Instruments |

4.81 |

TREPS |

4.81 |

Net Current Assets |

-0.27 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 28.02.2023 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.