Debt Market Review

Mr. Avnish Jain

Head - Fixed Income

Macro Review & Fixed Income Market Outlook

Global Economy Update:

Macro Backdrop: The year 2023 will most likely be marked by a milder global slowdown than previously anticipated, but the trajectory remains uncertain. The outlook for the global economy turned less gloomy as moderating inflation assuaged fears of further aggressive monetary tightening.

The IMF revised global growth for 2023 upwards by20basis points (bps) to 2.9 percent in its January 2023 update of the World Economic Outlook (WEO).

Positive surprises, such as a stronger boost from pent-up demand, a faster fall in inflation, and the likely easing of financial conditions, are factored into the revision.

Notably, a global recession is no longer the baseline assessment.

Growth in advanced economies (AEs) has been revised up by 10 basis points to 1.2 percent in 2023, while growth in emerging market economies (EMEs) is expected to be30basis points higher at 4.0 percent in 2023. (as compared withWEOOctober 2022 projections).

Indian Economic Growth:

Macro Backdrop: India 3QFY2023 GDP grew at 4.4%. Though manufacturing contracted, agriculture and services continue to show robust growth. Growth rates moderated as compared toQ2FY2023, but economy remains on track to grow at7%in FY2023

In India, domestic consumption, and investment stand to benefit from stronger prospects for agricultural and allied activities, strengthening business and consumer confidence, and strong credit growth.

Even though inflation rose in January, supply responses and cost conditions are expected to improve.

The emphasis on capital expenditure in the Union Budget 2023-24 is expected to attract private investment, strengthen job creation and demand, and raise India’s potential growth.

Supply responses and overall cost conditions in the Indian economy are poised to improve.

Lead indicators point towards sustained momentum in economic activity. E-way bill volumes and toll collections continued to increase, albeit at a moderate pace.

India’s merchandise exports at US$ 32.9 billion in January 2023, recorded a contraction of 6.6 per cent y-o-y and 13.5 per cent on a sequential basis. During April-January 2022-23, cumulative merchandise exports grew by 8.5 per cent to reach US$ 369.3 billion.

India’s services exports at US$ 31.3 billion expanded robustly at 20.4 per cent in December 2022 (US$ 26.0 billion in December 2021) on the back of earnings from software and travel services.

Merchandise imports at US$ 50.7 billion contracted by 3.6 per cent (y-o-y) in January 2023, partly reflecting the fall in prices of crude oil, certain fertilisers, and vegetable oils.

Service imports at US$ 15.8 billion moderated on account of high base and a decline in transport services. Accordingly, net services earnings are estimated at US$ 15.5 billion for December 2022.

The GST collections (Centre plus States) grew by 10.6 per cent (y-o-y) in January 2023 to ‘1.55 lakh crore, highest since April 2022.

Inflation:

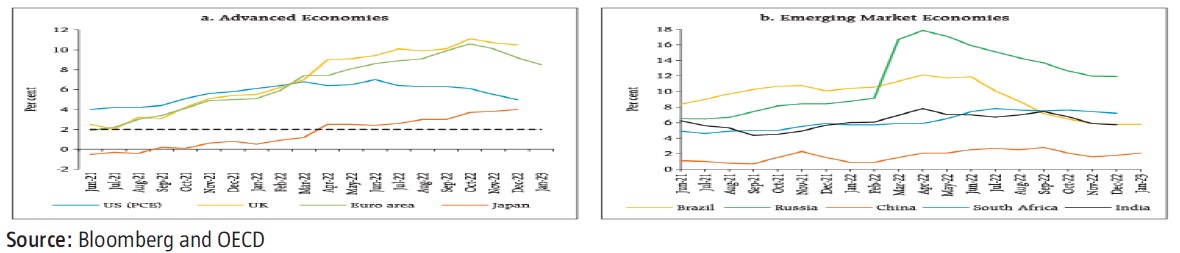

Global: Headline inflation eased across most AEs (Advanced Economies) and EMEs (Emerging Market Economies). However, the momentumof drop is slowing, raising concerns that global central banks may have more work to do.

Although global headline inflation seems to have peaked in Q3:2022, the IMF warned that core inflation stays well above pre-pandemic levels in most economies.

In the United States, headline CPI inflation fell to 6.4% in January 2023 from 6.5% the previous month.

In January, inflation in the Eurozone and the United Kingdom fell to 8.5% and 10.1%, respectively.

In Japan, CPI inflation (all items excluding fresh food) reached a 41-year high of 4.0 percent in December 2022.

India:CPI inflation increased sharply to 6.5 per cent in January 2023 from 5.7 per cent in December 2022. Price pressures mainly emanated from m-o-m increases in the food and beverages group (45 bps) and in the ‘core’ (CPI excluding food and fuel) group (52 bps). The index for fuel group, however, remained unchanged during the month.

Trends and Drivers of CPI Inflation:

Bond Yields & Spreads:

USFED hiked by 25bps in Feb 23 FOMC (Federal Open Market Committee), going to back to smaller rate hikes post sharp increases in 2022.

RBI MPC slowed as well, raising rates by 25bps in Feb 23 policy meet.

US10Y yield rose sharply in Feb, rising to 3.92% as inflation fears resurfaced.

India rates rose with global cues as well higher uptick in inflation, though extent of rise was limited. 10Y GSEC traded in 7.30-7.45% range.

Short-term rates moved higher on the back of shrinking liquidity as well as increased issuance by Banks, leading to inversion of curve in 1-3 yr segment.

Medium to long term corporate spreads remained on lower side in absence of any material increase in supply.

Outlook:

Global: Global economy is likely to be marked by slow growth, moderating but elevated inflation, peaking policy rates, and continuing geo-political risks.

Inflation seems to have peaked in major countries, though reasons to cheer may still be far away. Recent inflation prints point to pace of fall moderating and pushing global central banks to continue hawkish stance.

The sharp rise in rates by the US FED and other central banks points to extraordinary steps needed to tame decades high inflation.

With inflation mandates of 2% in most AEs (Advanced Economies), the current inflation is still very high. AE Central banks may be reluctant supporters of growth in backdrop of unprecedented high inflation andmayerr on the side of caution, waiting for inflation to trend down meaningfully.

While rate hikes in major countriesmayend soon, rates may have to remain higher for longer to bring down inflation to mandated levels.

India: In India, macro situation is better. Growth while remaining resilient is likely to slow down to below 6% in FY2024.

Inflation surprised in January 23, rising to 6.5% on back of increase in food prices. RBI may have to follow its global counterparts in keeping rates higher for longer.

Government borrowing programme for FY2023 ended in Feb 23. However, to meet requirements, government is resorting to issuing T-Bills, pressuring the short end of yield curve.

Further, corporate bonds as well as SDL supply may continue to move higher, pressuring rates.

RBIMPC hiked rates by 25bps without changing stance, keeping room open for another rate hike.

Considering the global rate scenario, it is more likely now that RBI MPC will hike by 25bps more in April 2023 policy meet

Rate market sentiments are negative both from global and local perspective.

We now expect RBI MPC to pause after rate hike in April 23 taking repo to 6.75%. However, rate scenario remains uncertain in wake of resurfacing of global inflation as well continued strong growth in major markets

India growth remains robust keeping pressure on core inflation as well as on RBI MPCto maintain tight monetary policy.

Near term short rates may be under pressure. Long term rates may adjust upwards when new fiscal year supply hits in April 23. However, as fiscal deficit remains under check as well as continuance of strong GST revenues, market yields may not go up too much.

Weexpect 10Y G-SEC to trade in range of 7.30-7.50%.

Source: RBI, MOSPI, CMIE, FIMMDA, NSDL, Bloomberg.