Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

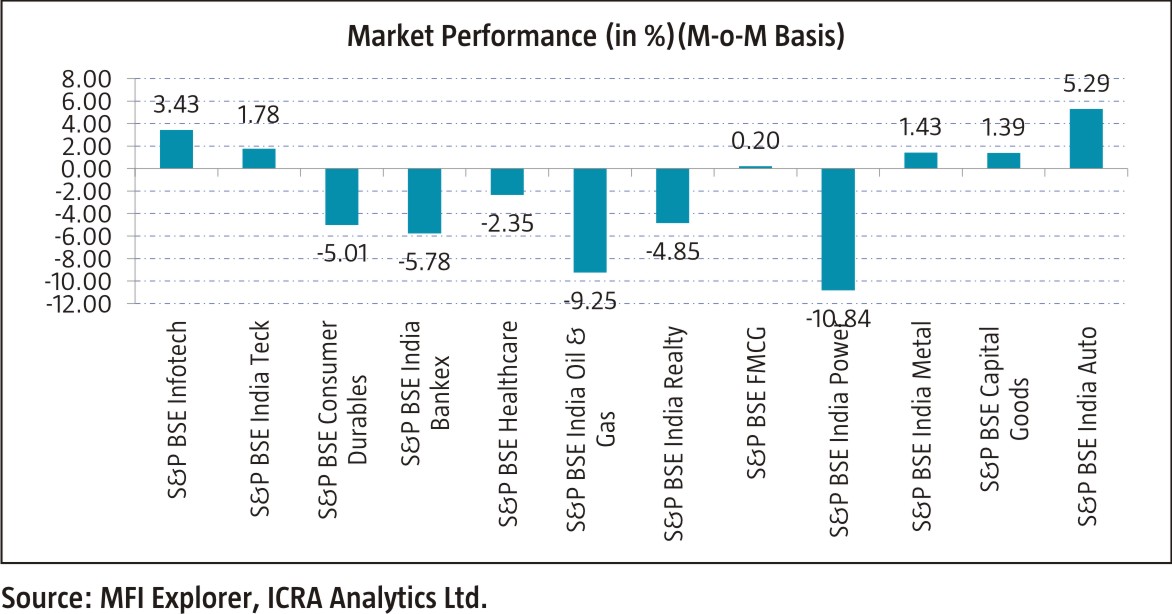

- In the month of Feb'23, equity markets went south with Nifty 50 dropping by 2.03% m-o-m basis majorly led by weak global cues and huge sell off in some of the index heavyweights. Market participants worried about higher borrowing by the Indian government in the next fiscal. Persistent selling by foreign institutional investors and global crude oil prices rising also added negative sentiments in the markets.

- Foreign Institutional Investors (FIIs)were net sellers in Indian equities to the tune of ₹5294.25 crores

- Goods and Services Tax (GST) collection shows that ₹1.50 lakh crore were collected for Feb'23, which is 12%more than the corresponding period of last year. With this, the monthly GST revenues remained over Rs 1.4 lakh crore for 12 straight months in a row.

- Further, uncertainty over aggressive rate hike by the central bank and constant foreign fund outflows also added to the losses. Sentiments were further dampened after the United Nation downgraded its GDP growth forecast for India for the CY'23 and warned that higher interest rates contributed to the decline as well.

- Though during the month, markets improved a bit as rupee strengthened against the greenback, falling yields on U.S. Treasuries and the weakening of the dollar index also acted as tailwinds for the markets. Upbeat domestic earning numbers for the quarter ended Dec'22 and drop in inflation improved overall market sentiments. Government Data showed that the India's Eight Core Industries growth increased by 7.8 per cent in Jan'23 as against a growth of 4 percent recorded in the year-ago period.

- Globally, US equity markets remained worrisome as U.S. Federal Reservemayraise interest rates higher than currently anticipated and keep interest rates at an elevated level for an extended period of time. Asian and European Equity Markets too remained under pressure on continued interest rate hikes from the U.S. Federal Reserve and worries of a slowdown in global growth. European markets looked sluggish after Germany's economy shrank more than estimated in the fourth quarter of 2022.

Equity Market Outlook

The global environment remains adverse, though inflation might have peaked, based on the latest inflation data in US. The latest comments from Fed about possible slowing pace of increase in the interest rates is comforting (but indication on longer period of inflated rates is discomforting). The short term interest rates are likely to remain at elevated level of ~5.5%, till inflation shows serious moderation. Terminal interest rates in US have clearly moved up by 50bps tp 5.25-5.75%. Combination of slowing growth but yet sticky inflation is an outcome of elevated energy prices and challenged supply chains in China/Energy, which are taking time to correct itself. Geopolitical tensions are taking time to abate and are only getting complex. Given these tensions, supply chains and global trade has become vulnerable tonewdimension in 2023, missing till 2022.

In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in 2020 in that order and they will reverse in the same order during CY22/23. We are already witnessing liquidity reversal since last few quarters; growth has started receding lately (Europe is already in recession, US is slowing) and inflation will be the last one to moderate. We have seen an initial downtick in inflation. Inflation is taking more time than usual to recede given healthy household savings, elevated energy prices, tight labor markets and challenged supply chains in China. In-turn, further interest rate increases become imperative - expect additional 25-50bps increase through next 6months to 5.25%-5.75% inUS– and remain there forsome time.

Equity market domestically were focused on the earnings (season) growth and cost of capital (interest rate outlook globally). We think, both these factors are neutral to negative for India from near term perspective and thus market will continue to consolidate till we get visibility on earnings upgrades or substantial decline in interest rates (Inflation globally/locally) to change multiples. The result didn't throw any surprises, the earnings growth in tracking FY23 expected numbers well although helped predominantly by financials during 3QFY23. The internals of the earnings are not very healthy expect in financials, auto and industrials. India trades at premium to other EMs and thankfully that is correcting with the consolidation over last 1.5 year. Indian equity market trades at 18.5xFY24 earnings – with earnings CAGR of 13-14% over FY23-25E – in a fair valuation zone from near term perspective.We will watch out for one year forward (Earnings yield – Gsec yield) gap to compress to ~150bps for getting more constructive in near term.

Having said this on near term earnings /market context, we believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place viz. 1) Corporate and bank balance sheets are in best possible shape to drive capex and credit respectively, 2) Consumer spending remains resilient through cycle given our demographics, 3) Govt is focused on growth through direct investments in budget as well as through reforms like GST(increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), PLIs( private capital through incentives for import substitution or export ecosystem creation) and 4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics. This makes us very constructive on India equities

with 3-5 years view.

Source: ICRA MFI Explorer