CANARA ROBECO VALUE FUND (CRVF)

Value Fund - An open-ended equity scheme following a value investment strategy

(as on July 29, 2022)

| SCHEME OBJECTIVE | The fund aims to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instrument, with higher focus on value stocks. There is no assurance or guarantee that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | September 03, 2021 |

| BENCHMARK | S&P BSE 500 Index TRI |

| FUND MANAGER | 1) Mr. Vishal Mishra (Fund Manager) 2) Ms. Silky Jain (Assistant Fund Manager) |

| TOTAL EXPERIENCE | 1) 18 Years 2) 11 Years |

| MANAGING THIS FUND | 1) Since 03-September -21 2) Since 01-October -21 |

| ASSET ALLOCATION | Equity and Equity – related Instruments 65% to 100% (Risk Medium to High) Debt and Money Market Instruments 0% to 35% (Risk Low to Medium) Units issued by REITs and InviTs 0% to 10% (Risk Medium to High) Units of MF schemes 0% to 5% ((Risk Medium to High) Equity Exchange Traded Funds 0% to 10% (Risk Medium to High) |

| MINIMUM INVESTMENT | Lumpsum Purchase: ₹ 5,000.00 and multiples of ₹ 1.00 thereafter. Subsequent Purchase: ₹ 1000.00 and multiples of ₹ 1.00 thereafter. SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 2.35% Direct Plan : 0.68% |

| Monthend AUM# | ₹ 711.29 Crores |

| Monthly AVG AUM | ₹ 676.92 Crores |

| (as on July 29, 2022) | |

| Direct Plan - Growth Option | ₹ 10.8000 |

| Regular Plan - Growth Option | ₹ 10.6300 |

| Regular Plan - IDCW (payout/reinvestment | ₹ 10.6300 |

| Direct Plan - IDCW (payout/reinvestment) | ₹ 10.7900 |

Name of the Instruments |

% to NAV |

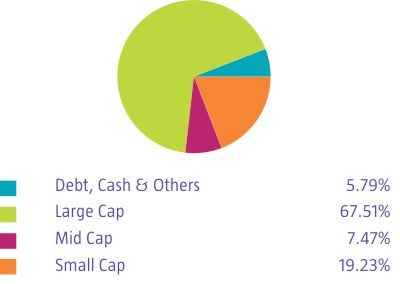

Equities |

94.21 |

Listed |

94.21 |

Banks |

23.46 |

ICICI Bank Ltd |

8.06 |

HDFC Bank Ltd |

5.32 |

Axis Bank Ltd |

4.15 |

State Bank of India |

3.74 |

Federal Bank Ltd |

2.19 |

IT - Software |

8.17 |

Infosys Ltd |

7.31 |

HCL Technologies Ltd |

0.86 |

Finance |

7.53 |

Creditaccess Grameen Ltd |

2.90 |

Housing Development Finance Corporation Ltd |

2.60 |

Can Fin Homes Ltd |

1.30 |

Equitas Holdings Ltd |

0.73 |

Automobiles |

7.26 |

Maruti Suzuki India Ltd |

3.45 |

Tata Motors Ltd |

2.49 |

Bajaj Auto Ltd |

1.32 |

Pharmaceuticals & Biotechnology |

7.24 |

Sun Pharmaceutical Industries Ltd |

3.60 |

J.B. Chemicals & Pharmaceuticals Ltd |

2.65 |

Cipla Ltd |

0.99 |

Petroleum Products |

4.75 |

Reliance Industries Ltd |

4.07 |

Hindustan Petroleum Corporation Ltd |

0.68 |

Diversified Fmcg |

3.71 |

ITC Ltd |

3.71 |

Power |

3.36 |

NTPC Ltd |

3.36 |

Construction |

3.29 |

Larsen & Toubro Ltd |

2.36 |

Ahluwalia Contracts (India) Ltd |

0.93 |

Telecom - Services |

3.02 |

Bharti Airtel Ltd |

2.98 |

Bharti Airtel Ltd |

0.04 |

Aerospace & Defense |

2.73 |

Bharat Electronics Ltd |

2.73 |

Beverages |

2.51 |

Varun Beverages Ltd |

2.51 |

Industrial Products |

2.41 |

KEI Industries Ltd |

2.41 |

Transport Services |

2.31 |

Container Corporation Of India Ltd |

1.36 |

Great Eastern Shipping Co Ltd |

0.95 |

Realty |

2.21 |

Brigade Enterprises Ltd |

2.21 |

Cement & Cement Products |

2.21 |

Ambuja Cements Ltd |

1.45 |

JK Lakshmi Cement Ltd |

0.65 |

Grasim Industries Ltd |

0.11 |

Insurance |

2.09 |

SBI Life Insurance Co Ltd |

2.09 |

Chemicals & Petrochemicals |

1.94 |

NOCIL Ltd |

1.94 |

Consumer Durables |

1.54 |

Cera Sanitaryware Ltd |

1.33 |

Greenpanel Industries Ltd |

0.21 |

Agricultural Food & Other Products |

1.02 |

EID Parry India Ltd |

1.02 |

Textiles & Apparels |

0.73 |

K.P.R. Mill Ltd |

0.73 |

Gas |

0.72 |

GAIL (India) Ltd |

0.72 |

Money Market Instruments |

5.94 |

Tri - party repo |

5.94 |

Net Current Assets |

-0.15 |

Grand Total (Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | Monthend AUM as on 29.07.2022 | ^The expense ratios mentioned for the schemes includes GST on investment management fees.