Economic Indicators (as on July 29, 2022)

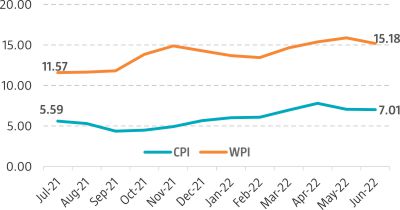

Inflation in India (%)

Consumer Price Index marginally reduced to 7.01% in Jun’22, from 7.04% in May’22 due to moderation in food prices. Also, the low base of last year, when the data was computed with a low response rate contributed to this level of inflation. The current level of inflation continues to remain above 7% mark for the third consecutive month and marking completion of the second quarter. Wholesale Price Index (WPI) decreased to 15.18% in Jun'22 from 15.88% in May'22 as crude prices reduced. The current level of inflation continues to rise above RBI’s limit of 4%-6% in response to rise in prices of mineral oil, natural gas, basic metals, chemicals and chemical products, food articles etc.

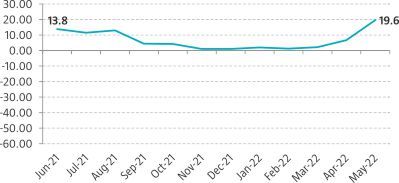

Index of Industrial Production (%)

Index of Industrial Production (IIP) grew drastically to twelve months high of 19.6% in May'22 from 7.1% in Apr'22 powered mainly by higher electricity and manufacturing output. Improving IIP is quite indicative of the ongoing economic recovery. Mining, manufacturing and electricity generation experienced a drastic growth of 10.9%, 20.6% and 23.5% in May'22, respectively.