CANARA ROBECO INFRASTRUCTURE (CRI)

Thematic - Infrastructure - An open-ended equity scheme following infrastructure theme

(as on July 29, 2022)

| SCHEME OBJECTIVE | To generate income / capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | December 2, 2005 |

| BENCHMARK | S&P BSE India Infrastructure TRI |

| FUND MANAGER | 1) Mr. Vishal Mishra 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 18 Years 2) 15 Years |

| MANAGING THIS FUND | 1) Since 26-June-21 2) Since 29-Sept-18 |

| ASSET ALLOCATION | Equity and equity related instruments of companies in the Infrastructure sector including derivatives of such companies - 80% to 100% (Risk- High) Debt and Money Market instruments - 0% to 20% (Risk- Low to Medium) Reits/Invits- 0% to 10% (Risk- Medium to High) |

| MINIMUM INVESTMENT | 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - if redeemed/switched out within 1 year from the date of allotment. Nil – if redeemed / switched out after 1 year from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan :2.52% Direct Plan :1.33% |

| Monthend AUM# | ₹ 221.54 Crores |

| Monthly AVG AUM | ₹ 208.28 Crores |

| (as on July 29, 2022) | |

| Direct Plan - Growth Option | ₹ 85.1300 |

| Regular Plan - Growth Option | ₹ 78.5900 |

| Regular Plan - IDCW (payout/reinvestment | ₹ 35.4800 |

| Direct Plan - IDCW (payout/reinvestment) | ₹ 47.8500 |

| Standard Deviation | 23.91 |

| Portfolio Beta | 0.68 |

| Portfolio Turnover Ratio | 0.22 times |

| R-Squared | 0.79 |

| Sharpe Ratio | 0.83 |

Name of the Instruments |

% to NAV |

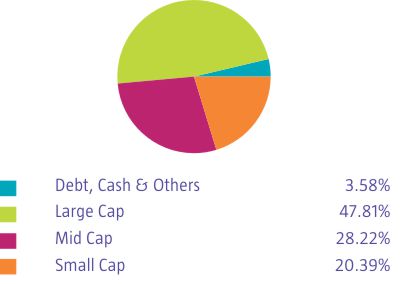

Equities |

96.42 |

Listed |

96.42 |

Construction |

16.27 |

Larsen & Toubro Ltd |

6.88 |

KNR Constructions Ltd |

4.56 |

Ahluwalia Contracts (India) Ltd |

2.80 |

PNC Infratech Ltd |

2.03 |

Electrical Equipment |

16.15 |

Siemens Ltd |

6.45 |

Thermax Ltd |

4.91 |

ABB India Ltd |

4.79 |

Banks |

11.02 |

ICICI Bank Ltd |

6.38 |

State Bank of India |

4.64 |

Auto Components |

8.82 |

Schaeffler India Ltd |

6.77 |

Bosch Ltd |

2.05 |

Industrial Products |

8.38 |

Timken India Ltd |

5.33 |

Grindwell Norton Ltd |

3.05 |

Power |

7.15 |

NTPC Ltd |

3.87 |

Power Grid Corporation of India Ltd |

3.28 |

Aerospace & Defense |

7.00 |

Bharat Electronics Ltd |

7.00 |

Transport Services |

4.78 |

TCI Express Ltd |

2.66 |

Container Corporation Of India Ltd |

2.12 |

Petroleum Products |

3.31 |

Reliance Industries Ltd |

1.90 |

Indian Oil Corporation Ltd |

1.41 |

Realty |

3.01 |

Brigade Enterprises Ltd |

3.01 |

Cement & Cement Products |

2.82 |

J.K. Cement Ltd |

1.07 |

Ambuja Cements Ltd |

0.94 |

Ultratech Cement Ltd |

0.81 |

Gas |

2.64 |

GAIL (India) Ltd |

1.74 |

Gujarat Gas Ltd |

0.90 |

Industrial Manufacturing |

2.56 |

Honeywell Automation India Ltd |

2.56 |

Non - Ferrous Metals |

1.40 |

Hindalco Industries Ltd |

1.40 |

Ferrous Metals |

1.11 |

Tata Steel Ltd |

1.11 |

Money Market Instruments |

4.40 |

Tri - party repo |

4.40 |

Net Current Assets |

-0.82 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | Monthend AUM as on 29.07.2022 | ^The expense ratios mentioned for the schemes includes GST on investment management fees.