CANARA ROBECO INFRASTRUCTURE (CRI)

Thematic - Infrastructure - An open-ended equity scheme following infrastructure theme

(as on September 30, 2024)

| SCHEME OBJECTIVE | To generate income / capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | December 2, 2005 |

| BENCHMARK* | BSE India Infrastructure TRI |

| FUND MANAGER | 1) Mr. Vishal Mishra 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 18 Years 2) 15 Years |

| MANAGING THIS FUND | 1) Since 26-June-21 2) Since 29-Sept-18 |

| ASSET ALLOCATION | Equity and equity related instruments of companies in the Infrastructure sector including derivatives of such companies - 80% to 100% (Risk - Very High) Debt and Money Market instruments - 0% to 20% (Risk- Low to Medium) Reits/Invits- 0% to 10% (Risk - Very High) |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - if redeemed/switched out within 1 year from the date of allotment. Nil – if redeemed / switched out after 1 year from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan :2.28% Direct Plan :0.99% |

| Monthend AUM# | ₹ 883.22 Crores |

| Monthly AVG AUM | ₹ 874.89 Crores |

| (as on September 30, 2024) | (₹) |

| Direct Plan - Growth Option | 188.1000 |

| Regular Plan - Growth Option | 169.0300 |

| Regular Plan - IDCW (payout/reinvestment | 68.3500 |

| Direct Plan - IDCW (payout/reinvestment) | 94.6200 |

| Standard Deviation | 15.12 |

| Portfolio Beta | 0.49 |

| Portfolio Turnover Ratio | 0.43 times |

| R-Squared | 0.55 |

| Sharpe Ratio | 1.55 |

| Name of the Instruments | % to NAV |

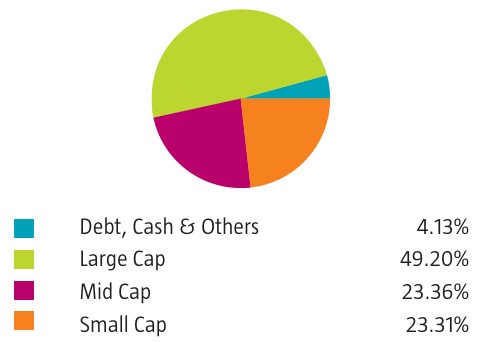

Equities |

95.87 |

Listed |

95.87 |

Electrical Equipment |

17.70 |

Hitachi Energy India Ltd |

3.79 |

Siemens Ltd |

3.16 |

CG Power and Industrial Solutions Ltd |

2.95 |

ABB India Ltd |

2.12 |

Suzlon Energy Ltd |

1.92 |

GE T&D India Ltd |

1.91 |

Thermax Ltd |

1.85 |

Power |

11.28 |

NTPC Ltd |

5.18 |

Power Grid Corporation of India Ltd |

3.91 |

Tata Power Co Ltd |

2.19 |

Construction |

9.43 |

Larsen & Toubro Ltd |

5.97 |

KNR Constructions Ltd |

1.57 |

KEC International Ltd |

1.28 |

PNC Infratech Ltd |

0.61 |

Consumer Durables |

7.78 |

Voltas Ltd |

2.84 |

V-Guard Industries Ltd |

2.53 |

Dixon Technologies (India) Ltd |

2.41 |

Industrial Products |

7.06 |

Cummins India Ltd |

2.26 |

KSB Ltd |

1.33 |

Timken India Ltd |

1.26 |

KEI Industries Ltd |

1.22 |

Grindwell Norton Ltd |

0.99 |

Industrial Manufacturing |

7.02 |

Kaynes Technology India Ltd |

2.33 |

GMM Pfaudler Ltd |

1.43 |

Praj Industries Ltd |

1.23 |

Jyoti CNC Automation Ltd |

1.16 |

Honeywell Automation India Ltd |

0.87 |

Petroleum Products |

5.41 |

Reliance Industries Ltd |

4.09 |

Bharat Petroleum Corporation Ltd |

1.32 |

Transport Services |

4.56 |

Interglobe Aviation Ltd |

2.55 |

Great Eastern Shipping Co Ltd |

1.29 |

VRL Logistics Ltd |

0.37 |

TCI Express Ltd |

0.35 |

Aerospace & Defense |

3.81 |

Bharat Electronics Ltd |

2.71 |

Hindustan Aeronautics Ltd |

1.10 |

Cement & Cement Products |

3.36 |

Ultratech Cement Ltd |

2.12 |

J.K. Cement Ltd |

1.24 |

Telecom - Services |

3.22 |

Bharti Airtel Ltd |

3.22 |

Finance |

3.12 |

Power Finance Corporation Ltd |

3.12 |

Banks |

2.85 |

State Bank of India |

2.85 |

Consumable Fuels |

2.45 |

Coal India Ltd |

2.45 |

Realty |

2.13 |

Brigade Enterprises Ltd |

2.13 |

Auto Components |

1.84 |

Schaeffler India Ltd |

1.84 |

Chemicals & Petrochemicals |

1.15 |

Linde India Ltd |

1.15 |

Non - Ferrous Metals |

1.14 |

Hindalco Industries Ltd |

1.14 |

Diversified |

0.56 |

3M India Ltd |

0.56 |

Money Market Instruments |

4.43 |

TREPS |

4.43 |

Net Current Assets |

-0.30 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (BSE India Infrastructure TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 30.9.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.