Economic Indicators (as on September 30, 2024)

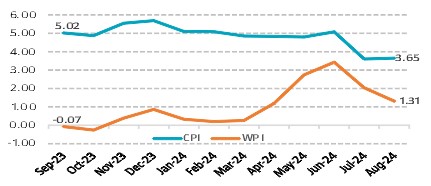

Inflation in India (%)

Consumer Price Index inched up marginally to 3.65% in Aug’24 from 3.6% in JuL’24 largely on account of an uptick in food inflation. Fuel and light segment continued to remain in deflation, continuing the trend observed over the past one year. Core inflation remained largely benign. Though, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) eased to 1.31% in Aug’24 from 2.04% in Jul’24 due to a slower rise in manufacturing and fuel prices. It stepped out of the deflationary zone for the tenth time in row.

Index of Industrial Production (%)

Index of Industrial Production (IIP) accelerated to 4.8% in Jul’24 from 4.7% in Jun’24, mainly due to a good show by the electricity sectors. Growth in manufacturing and electricity output moderated to 4.6% and 7.9% respectively. Mining output accelerated to 3.7%. Year-on-year increase in output was seen in 17 out of 23 subcategories