Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

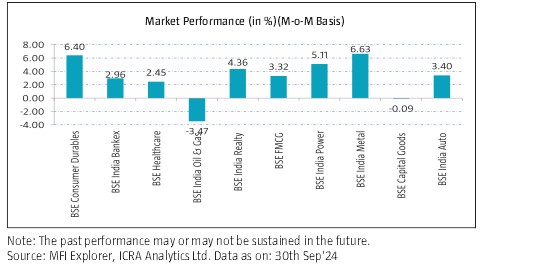

- In the month of Sep’24, equity markets reached a fresh high as Nifty 50 increased by 2.28% following continuous foreign fund inflows and prospects of solid domestic economic growth amid a healthy monsoon. Investors reacted positively to the U.S. Federal Reserve’s decision to cut interest rate by 50 bps, signalling further easing in coming months to keep the labor market from slowing too much. The market has surged due to the infusion of retail investors, the strength of India’s economic growth, and growing hope about the potential start of a rate-cutting cycle.

- Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹57723.80 crore.

- Gross goods and services tax (GST) collections in Sep’24 stood at Rs. 1,73,240 crore, representing a 6.5% rise on a yearly basis and this points towards the growing trajectory of the Indian economy.

- The combined Index of Eight Core Industries decreased by 1.8% YoY basis in Aug’24. Except for Steel and Fertilizers, all other six core sectors showed negative YoY growth for Aug’24. Fertilizer and Steel production rose by 4.5% and 3.2% respectively YoY basis in Aug’24

- However, markets witnessed some profit booking at higher levels amid signs of escalating tensions in the Middle East and weak global cues as sentiments were dampened following weak U.S. manufacturing data of Aug’24, which reignited concerns over an economic slowdown in the world’s largest economy.

- Globally, U.S. equities markets increased as investors continued cheering the U.S. Federal Reserve’s decision to lower interest rates, IT sector gained strength after a U.S. chipmaker announced good sales driven by demand for artificial intelligence and Labor Department released the most recent data, which shows that new claims for unemployment benefits unexpectedly fell helping. European and Asian markets also rose amid expectations that the U.S. Fed will further reduce interest rates in the upcoming months. China’s central bank announcement of its most significant stimulus package since the pandemic to support the economy and address the ongoing challenges in the property sector. Additionally, the Japanese market experienced a positive trend amid indications that the Bank of Japan is not in a rush to implement further interest rate increases.

Equity Market Outlook

Global macro environment just turned more complex in last few weeks with US employment data turning weak, Japan Increased interest rates (when US is cutting rates) reversing Yen trade and Israel killing top Hezbollah leader in Lebanon. Geopolitics in the middle east is clearly on a escalator path, adverse for growth and energy prices both. These are all significant events and pose a risk to a low volatility market that has existed for several months now. On the other hand, the US growth is stabilizing at lower levels as the fiscal and monetary impulse is receding, employment data moderating and inflation is moderating gradually – and seems like it is in last leg now. The latest PCE in the US is running at 2.5% now. This is leading to a possible goldilocks scenario where you might get lower inflation without hurting growth too much. Given the way growth inflation dynamics is in US – we expect faster interest rate cuts than anticipated earlier. We expect another 50bps cut before Dec 2024 and another 100-125bps in CY25. Europe is gradually stabilizing at lower levels (but manufacturing continues to suffer), as inflation and interest rates peak in most economies in the Euro area. China continues to have challenges on growth revival due to ageing population and leverage in households/Real estate, which are structural in our view. China reacted to this vicious cycle by giving sizable monetary stimulus last week, leading to market moving up significantly (>20%). While this create possibilities of commodities going up in near term, commodities in general will remain muted for extended period, given >30-40% of every commodity is consumed by China and this stimulus doesn’t change structural challenges of China in our assessment.

Geopolitical tensions are taking time to abate and are only getting complex. Given these tensions, supply chains and global trade has become vulnerable to new dimension now, missing till pre-covid. India remains one of the differentiated markets in terms of growth and earnings. In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in CY20-21 in that order and they will reverse in the same order during CY23-24. We have seen an initial downtick in inflation, which will accelerate in our view over the next few quarters. We expect 100-150bps of interest rate cuts over the next 12 months now.

Indian macro remains best among large markets. Political stability looks almost given. CAD has improved significantly and is expected to be ~1% for FY25. Most domestic macro and micro indicators remain steady. Given these aspects, the domestic equity market remains focused on earnings. Earnings growth (13-15% earnings CAGR FY24-26E) remains relatively better than most EM/DM markets. While the earnings are not getting upgraded significantly yet; they are resilient and seems to be bottoming. Financials, Auto, industrials, Telecom, Hospital and Real Estate are witnessing a healthy earnings cycle whereas FMCG, chemicals and IT continue to face headwinds. Indian equity market trades at 21FY26 earnings – with earnings CAGR of ~15% over FY24-26E – in a fair valuation zone from medium term perspective – given longevity of earnings cycle in India. The broader market has moved up >50% in last 1 year -capturing near term earnings valuation positives for FY25/26E. Expect a rollover return as the earnings rollover to FY27. Given the upfronting of returns in mid and small caps (aided by very strong flows also), valuations are at 20-30% premium to past; we are more constructive on large cap from FY25/26 perspective. Domestic cyclicals continue to have earnings edge over global cyclical and consumption. Select financials, select auto, RE, Cement, Industrials, Power, Hotels/Hospitals/Aviation on domestic side continue to display healthy earnings.

Having said this on near term earnings /market context, we believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place viz. 1) Corporate and bank balance sheets are in best possible shape to drive capex and credit respectively, 2) Consumer spending remains resilient through cycle given our demographics, 3) Govt is focused on growth through direct investments in budget as well as through reforms like GST(increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), PLIs( private capital through incentives for import substitution or export ecosystem creation) and 4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics. This makes us constructive on India equities with 3-years view. We believe that India is in a business cycle / credit growth / earnings cycle through FY24-27E – indicating a healthy earnings cycle from medium term perspective.

Source: ICRA MFI Explorer