CANARA ROBECO SMALL CAP FUND (CRSCF)

Small Cap Fund -An open-ended equity scheme predominantly investing in small cap stocks.

(as on May 31, 2024)

| SCHEME OBJECTIVE | The investment objective of the Scheme is to generate capital appreciation by investing predominantly in Small Cap stocks. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | February 15, 2019 |

| BENCHMARK | Nifty Smallcap 250 Index TRI |

| FUND MANAGER | 1) Mr. Pranav Gokhale 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 21 Years 2) 15 Years |

| MANAGING THIS FUND | 1)Since 06-Nov-23 2) Since 01-Oct-19 |

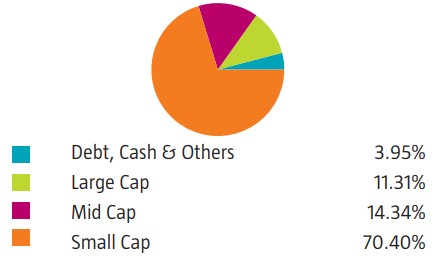

| ASSET ALLOCATION | Equity and Equity-related Instruments of Smallcap companies* 65% to 100% (Risk - Very High) Equity and Equity-related Instruments of companies other than Smallcap companies 0% to 35% (Risk - Very High) Debt and Money Market Instruments 0% to 35% (Low to Medium) Units issued by REITs and InvITs 0% to 10% (Risk - Very High) *Investment universe of "Small Cap": The investment universe of "Small Cap" shall comprise companies as defined by SEBI from time to time. In terms of SEBI circular SEBI/ HO/ IMD/ DF3/ CIR/ P/ 2017/ 114 dated October 6, 2017, the universe of "Small Cap" shall consist of 251st company onwards in terms of full market capitalization |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | In respect of each purchase / switch-in of units,1% - if Units are redeemed / switched-out within 1 year from the date of allotment. Nil – if redeemed / switched out after 1 year from the date of allotment. |

| EXPENSE RATIO^: |

Regular Plan : 1.69% Direct Plan : 0.42% |

| Monthend AUM# | ₹ 10,429.89 Crores |

| Monthly AVG AUM | ₹ 10,190.42 Crores |

| (as on May 31, 2024) | (₹) |

| Direct Plan - Growth Option | 39.0800 |

| Regular Plan - Growth Option | 35.8600 |

| Regular Plan - IDCW (payout/reinvestment | 33.3100 |

| Direct Plan - IDCW (payout/reinvestment) | 36.7300 |

| Standard Deviation | 13.94 |

| Portfolio Beta | 0.70 |

| Portfolio Turnover Ratio | 0.21 times |

| R-Squared | 0.86 |

| Sharpe Ratio | 1.27 |

| Name of the Instruments | % to NAV |

Equities |

96.05 |

Listed |

96.05 |

Capital Markets |

10.22 |

Multi Commodity Exchange Of India Ltd |

2.59 |

Central Depository Services (India) Ltd |

1.63 |

Anand Rathi Wealth Ltd |

1.53 |

Computer Age Management Services Ltd |

1.19 |

BSE Ltd |

1.17 |

ICRA Ltd |

0.90 |

Prudent Corporate Advisory Services Ltd |

0.86 |

Angel One Ltd |

0.35 |

Industrial Manufacturing |

7.85 |

Kaynes Technology India Ltd |

2.88 |

Titagarh Rail Systems Ltd |

2.49 |

Cochin Shipyard Ltd |

1.20 |

Jyoti CNC Automation Ltd |

0.66 |

GMM Pfaudler Ltd |

0.62 |

Industrial Products |

7.32 |

KEI Industries Ltd |

3.12 |

Rhi Magnesita India Ltd |

0.93 |

Ratnamani Metals & Tubes Ltd |

0.90 |

Timken India Ltd |

0.83 |

Mold Tek Packaging Ltd |

0.80 |

EPL Ltd |

0.74 |

Pharmaceuticals & Biotechnology |

7.06 |

J.B. Chemicals & Pharmaceuticals Ltd |

1.36 |

Sun Pharmaceutical Industries Ltd |

1.33 |

Ajanta Pharma Ltd |

1.22 |

Suven Pharmaceuticals Ltd |

0.99 |

Abbott India Ltd |

0.81 |

Innova Captab Ltd |

0.73 |

Piramal Pharma Ltd |

0.62 |

Finance |

6.15 |

Can Fin Homes Ltd |

1.29 |

Creditaccess Grameen Ltd |

1.23 |

Power Finance Corporation Ltd |

1.01 |

Cholamandalam Financial Holdings Ltd |

0.98 |

Bajaj Finance Ltd |

0.96 |

Home First Finance Co India Ltd |

0.68 |

Banks |

5.69 |

Equitas Small Finance Bank Ltd |

1.86 |

Karur Vysya Bank Ltd |

1.47 |

City Union Bank Ltd |

1.25 |

Indian Bank |

1.11 |

Consumer Durables |

5.40 |

V-Guard Industries Ltd |

1.57 |

Cera Sanitaryware Ltd |

1.48 |

V.I.P. Industries Ltd |

0.67 |

Greenpanel Industries Ltd |

0.51 |

Greenply Industries Ltd |

0.50 |

Greenlam Industries Ltd |

0.46 |

Blue Star Ltd |

0.21 |

Aerospace & Defense |

4.48 |

Bharat Electronics Ltd |

2.94 |

Bharat Dynamics Ltd |

1.54 |

Construction |

4.40 |

PNC Infratech Ltd |

1.42 |

KEC International Ltd |

1.13 |

Ahluwalia Contracts (India) Ltd |

0.95 |

KNR Constructions Ltd |

0.90 |

IT - Software |

4.02 |

Sonata Software Ltd |

1.02 |

Ltimindtree Ltd |

0.94 |

Persistent Systems Ltd |

0.75 |

Latent View Analytics Ltd |

0.69 |

Birlasoft Ltd |

0.62 |

Auto Components |

3.64 |

Schaeffler India Ltd |

1.25 |

CIE Automotive India Ltd |

0.94 |

Rolex Rings Ltd |

0.81 |

Subros Ltd |

0.64 |

Healthcare Services |

2.76 |

Max Healthcare Institute Ltd |

1.04 |

Global Health Ltd |

1.01 |

Metropolis Healthcare Ltd |

0.71 |

Realty |

2.68 |

Sobha Ltd |

1.48 |

Brigade Enterprises Ltd |

1.20 |

Cement & Cement Products |

2.27 |

Ultratech Cement Ltd |

1.14 |

JK Lakshmi Cement Ltd |

1.13 |

Leisure Services |

2.17 |

Indian Hotels Co Ltd |

1.15 |

Westlife Foodworld Ltd |

1.02 |

Transport Services |

2.09 |

Great Eastern Shipping Co Ltd |

1.36 |

VRL Logistics Ltd |

0.73 |

Chemicals & Petrochemicals |

2.03 |

Deepak Nitrite Ltd |

0.73 |

Rossari Biotech Ltd |

0.71 |

Fine Organic Industries Ltd |

0.33 |

NOCIL Ltd |

0.26 |

Paper, Forest & Jute Products |

1.89 |

Century Textile & Industries Ltd |

1.89 |

Power |

1.62 |

NTPC Ltd |

1.01 |

CESC Ltd |

0.61 |

Retailing |

1.59 |

Go Fashion India Ltd |

0.62 |

V-Mart Retail Ltd |

0.53 |

Vedant Fashions Ltd |

0.44 |

Electrical Equipment |

1.41 |

Triveni Turbine Ltd |

1.01 |

Hitachi Energy India Ltd |

0.40 |

Food Products |

1.36 |

Bikaji Foods International Ltd |

1.36 |

Fertilizers & Agrochemicals |

1.22 |

EID Parry India Ltd |

1.22 |

Non - Ferrous Metals |

1.19 |

National Aluminium Co Ltd |

1.19 |

IT - Services |

1.16 |

Cyient Ltd |

1.16 |

Petroleum Products |

1.10 |

Reliance Industries Ltd |

1.10 |

Diversified Fmcg |

0.88 |

ITC Ltd |

0.88 |

Household Products |

0.74 |

Jyothy Labs Ltd |

0.74 |

Entertainment |

0.73 |

PVR Inox Ltd |

0.73 |

Textiles & Apparels |

0.66 |

K.P.R. Mill Ltd |

0.66 |

Agricultural Food & Other Products |

0.27 |

CCL Products (India) Ltd |

0.27 |

Money Market Instruments |

4.08 |

TREPS |

4.08 |

Net Current Assets |

-0.13 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (Nifty Smallcap 250 Index TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 31.5.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.