CANARA ROBECO CONSUMER TRENDS FUND (CRCTF)

Thematic - Consumption & Finance Theme - An open ended equity scheme following the consumption and financial theme

(as on May 31, 2024)

| SCHEME OBJECTIVE | To provide long-term capital appreciation by primarily investing in equity and equity related securities of companies which directly or indirectly benefit from the growing consumer demand in India. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | September 14, 2009 |

| BENCHMARK* | BSE 100 TRI |

| FUND MANAGER | 1) Ms. Ennette Fernandes 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 12 Years 2) 15 Years |

| MANAGING THIS FUND | 1) Since 01-Oct-21 2) Since 01-Oct-19 |

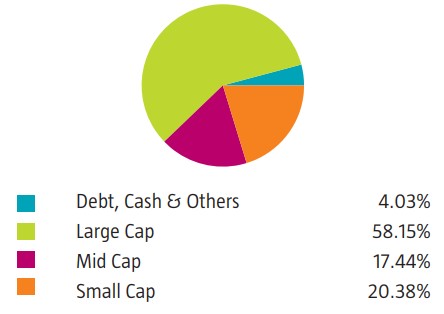

| ASSET ALLOCATION | Equity and equity related instruments of companies which directly or indirectly benefit from the growing consumer demand in India - 80% to 100%. (Risk - Very High) Other Equity and equity related instruments - 0% to 20%. (Risk - Very High) Debt and Money Market instruments - 0% to 20%. (Risk- Medium to Low) Reits/Invits- 0% to 10% (Risk - Very High) |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 1 year from the date of allotment. Nil - if redeemed/switched out after 1 year from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 2.12% Direct Plan : 0.86% |

| Monthend AUM# | ₹ 1,486.28 Crores |

| Monthly AVG AUM | ₹ 1,493.66 Crores |

| (as on May 31, 2024) | (₹) |

| Direct Plan - Growth Option | 110.7700 |

| Direct Plan - IDCW (payout/reinvestment) | 80.3300 |

| Regular Plan - Growth Option | 97.7300 |

| Regular Plan - IDCW (payout/reinvestment) | 44.6100 |

| Standard Deviation | 11.88 |

| Portfolio Beta | 0.83 |

| Portfolio Turnover Ratio | 0.4 times |

| R-Squared | 0.77 |

| Sharpe Ratio | 0.99 |

| Name of the Instruments | % to NAV |

Equities |

95.97 |

Listed |

95.97 |

Consumer Durables |

11.02 |

Titan Co Ltd |

2.46 |

Voltas Ltd |

2.24 |

Crompton Greaves Consumer Electricals Ltd |

2.11 |

Havells India Ltd |

1.99 |

Bata India Ltd |

1.47 |

V.I.P. Industries Ltd |

0.75 |

Banks |

10.78 |

HDFC Bank Ltd |

4.66 |

ICICI Bank Ltd |

2.20 |

IndusInd Bank Ltd |

1.97 |

Federal Bank Ltd |

1.07 |

Indian Bank |

0.88 |

Retailing |

10.34 |

Trent Ltd |

3.37 |

Zomato Ltd |

3.31 |

Arvind Fashions Ltd |

1.48 |

Vedant Fashions Ltd |

1.23 |

Shoppers Stop Ltd |

0.95 |

Beverages |

7.83 |

United Breweries Ltd |

2.90 |

Varun Beverages Ltd |

2.59 |

United Spirits Ltd |

2.34 |

Finance |

7.35 |

Bajaj Finance Ltd |

2.25 |

L&T Finance Ltd |

1.54 |

Power Finance Corporation Ltd |

1.26 |

Cholamandalam Financial Holdings Ltd |

1.20 |

REC Ltd |

1.10 |

Automobiles |

7.07 |

Bajaj Auto Ltd |

3.02 |

Tata Motors Ltd |

2.55 |

Maruti Suzuki India Ltd |

1.50 |

Diversified Fmcg |

6.38 |

ITC Ltd |

6.38 |

Insurance |

5.49 |

ICICI Lombard General Insurance Co Ltd |

1.94 |

Max Financial Services Ltd |

1.46 |

SBI Life Insurance Co Ltd |

1.26 |

Medi Assist Healthcare Services Ltd |

0.83 |

Personal Products |

4.86 |

Godrej Consumer Products Ltd |

2.99 |

Dabur India Ltd |

1.87 |

Telecom - Services |

4.65 |

Bharti Airtel Ltd |

4.65 |

Industrial Products |

4.48 |

KEI Industries Ltd |

2.80 |

Finolex Industries Ltd |

1.68 |

Leisure Services |

3.57 |

EIH Ltd |

2.03 |

Westlife Foodworld Ltd |

1.54 |

Transport Services |

2.49 |

Interglobe Aviation Ltd |

2.49 |

Auto Components |

2.16 |

Samvardhana Motherson International Ltd |

2.16 |

Capital Markets |

1.81 |

BSE Ltd |

1.81 |

Household Products |

1.78 |

Jyothy Labs Ltd |

1.78 |

Pharmaceuticals & Biotechnology |

1.59 |

J.B. Chemicals & Pharmaceuticals Ltd |

1.59 |

Textiles & Apparels |

1.16 |

Page Industries Ltd |

1.16 |

Entertainment |

1.16 |

PVR Inox Ltd |

1.16 |

Money Market Instruments |

3.48 |

TREPS |

3.48 |

Net Current Assets |

0.55 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

Benchmark Riskometer (BSE 100 TRI) |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 31.5.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees.Please click here for disclaimers. *Please refer notice cum addendum no.13 dated June 07, 2024 for Change in Benchmark of certain Schemes with effect from June 01, 2024