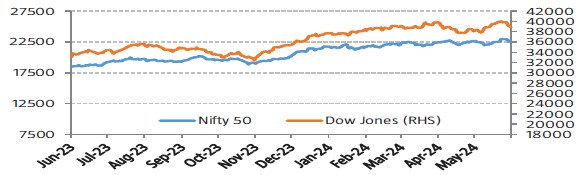

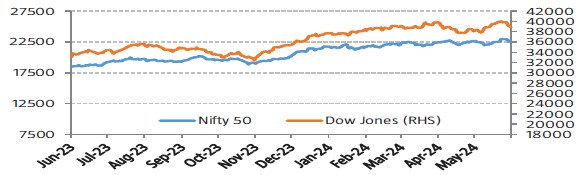

Equity Markets - India & US

Bellwether indices, Nifty 50 and S&P BSE Sensex decreased marginally during the month by -0.70% and 0.33% respectively on m-o-m basis. Upbeat corporate earnings in the final quarter of FY’24 kept the investors optimistic. Equity markets rose during the week after the RBI approved a massive, all-time high surplus transfer of around Rs. 2.11 lakh crore for FY24, boosting government revenues and supporting the fiscal deficit target. Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹ 25586.30 crores this month. Domestic retail inflation is within the Reserve Bank of India’s upper tolerance level of 6%. Goods and Services Tax (GST) shows collection of ₹ 1.73 lakh crore for May’24, 10% more than the corresponding period of last year and this points towards the growing trajectory of the Indian economy. Dow Jones decreased by 2.30% from previous month.

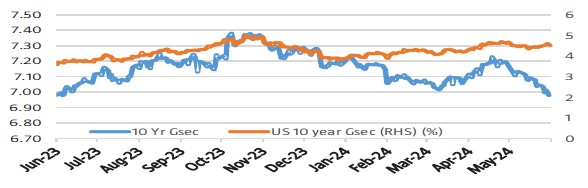

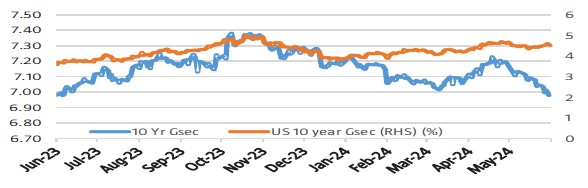

Interest Rate Movement (%) - India & US

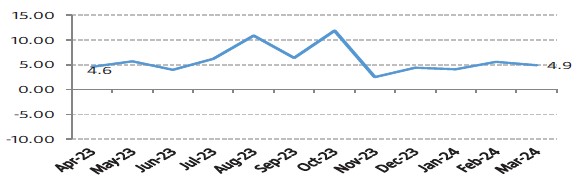

Yield on the 10-Year benchmark paper remained range-bound, closing at 6.944% on May'24 vs 7.186% on Apr'24 as the Indian government decided to continue pumping money into the banking system in the upcoming weeks after reducing the supply of Treasury bills. Gains were extended after the RBI approved a record surplus transfer of Rs. 2.11 lakh crore to the government for the fiscal year ended on Mar'24. Treasury bond closed lower at 4.4985% on May’24 vs 4.6798% on Apr’24.

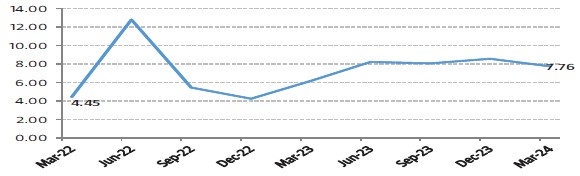

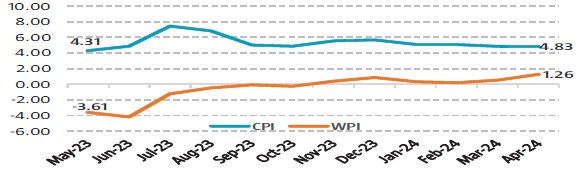

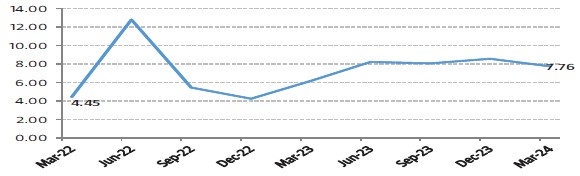

Inflation in India (%)

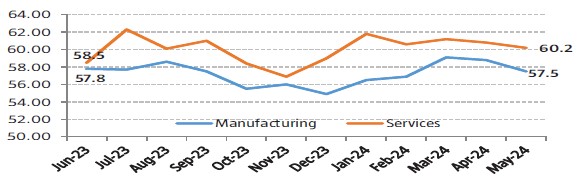

India’s GDP growth hit it out of the park with 7.76% for Q4 FY24 vs 8.4% for Q3 FY24, and 8.2% in FY24, majorly because of construction and manufacturing sector.India remains fastest growing economy in the world, strong GDP was supported by various factors like robust corporate profits, a strong fiscal impulse, with government spending being front-loaded in a pre-election year. This GDP growth came in much higher than expected as robust momentum in domestic demand conditions continues to reflect in the GDP numbers, which have surprised on the upside for four consecutive quarters, citing firm GST collections, credit growth and Purchasing Managing Index.