CANARA ROBECO BANKING AND PSU DEBT FUND (CRBPDF)

Banking and PSU Fund - An open-ended debt scheme predominantly investing in debt instruments of banks, public sector undertakings, public financial institutions and municipal bonds. A relatively high interest rate risk and moderate credit risk.

(as on May 31, 2023)

| SCHEME OBJECTIVE | To generate income and/or capital appreciation through a portfolio of high quality debt and money market instruments issued by entities such as Banks, Public Sector Undertakings (PSUs), Public Financial Institutions (PFIs) and Municipal Bonds. However, there is no assurance that the objective of the fund will be realised. |

| DATE OF ALLOTMENT | August 22, 2022 |

| BENCHMARK | CRISIL Banking and PSU Debt Index |

| FUND MANAGER* | Mr. Avnish Jain |

| TOTAL EXPERIENCE | 27 Years |

| MANAGING THIS FUND | Since 22-August-22 |

| ASSET ALLOCATION | Debt and Money Market Instruments issued by Banks, Public Financial Institutions (PFIs), Public Sector Undertakings (PSUs) and Municipal Bonds - 80% to 100% (Low to Medium) Debt (including securities issued by Central and State Governments) and Money Market Instruments issued by entities other than Banks, PFIs, PSUs and Municipal Bonds -0% to 20%(Low to Medium) Units issued by REITs and InvITs - 0% to 10% (Medium to High) |

| MINIMUM INVESTMENT | Lump sum: ₹ 5,000.00 and multiples of ₹ 1.00 thereafter.

Subsequent purchases: ₹ 1000.00 and multiples of ₹ 1.00 thereafter

SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter

For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | NA |

| EXIT LOAD | Nil |

| EXPENSE RATIO^: |

Regular Plan :0.71% Direct Plan : 0.43% |

| Monthend AUM# | ₹ 452.08 Crores |

| Monthly AVG AUM | ₹ 427.94 Crores |

| (as on May 31, 2023) | (₹) |

| Direct Plan -Growth Option | 10.4816 |

| Regular Plan -GrowthOption | 10.4588 |

| Regular Plan - IDCW(payout/reinvestment) | 10.4589 |

| Direct Plan - IDCW(payout/reinvestment) | 10.4814 |

| Annualised Portfolio YTM | 7.32% |

| Modified Duration | 2.55 Years |

| Residual Maturity | 3.61 Years |

| Macaulay Duration | 2.82 Years |

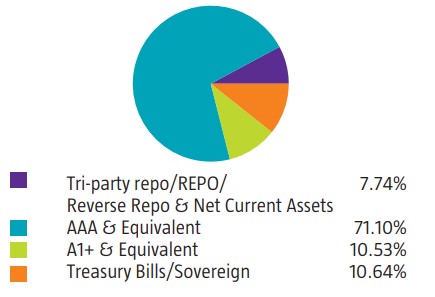

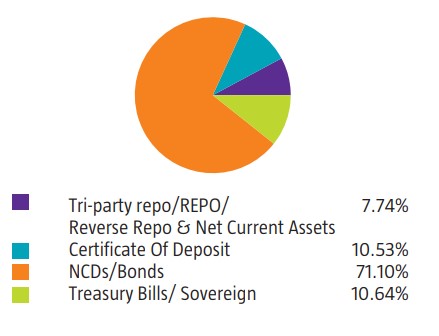

| Name of the Instruments | Rating | % to NAV |

Money Market Instruments |

10.53 |

|

Kotak Mahindra Bank Ltd |

A1+(CRISIL) |

5.30 |

State Bank Of India |

A1+(IND) |

5.23 |

Debt Instruments |

71.07 |

|

HDFC Bank Ltd |

AAA(CRISIL) |

5.75 |

Axis Bank Ltd |

AAA(CRISIL) |

5.62 |

NTPC Ltd |

AAA(CRISIL) |

5.54 |

ICICI Bank Ltd |

AAA(CARE) |

5.52 |

Hindustan Petroleum Corporation Ltd |

AAA(CRISIL) |

5.51 |

Small Industries Development Bank Of India |

AAA(ICRA) |

5.50 |

National Bank For Agriculture & Rural Development |

AAA(CRISIL) |

5.34 |

Housing Development Finance Corporation Ltd |

AAA(CRISIL) |

4.43 |

Indian Railway Finance Corporation Ltd |

AAA(CRISIL) |

3.49 |

Indian Railway Finance Corporation Ltd |

AAA(CRISIL) |

3.38 |

REC Ltd |

AAA(CRISIL) |

3.36 |

Grasim industries Ltd |

AAA(CRISIL) |

3.35 |

REC Ltd |

AAA(CRISIL) |

3.26 |

National Bank For Agriculture & Rural Development |

AAA(ICRA) |

3.24 |

Power Finance Corporation Ltd |

AAA(CRISIL) |

2.26 |

Power Finance Corporation Ltd |

AAA(CRISIL) |

2.25 |

LIC Housing Finance Ltd |

AAA(CRISIL) |

2.16 |

REC Ltd |

AAA(CRISIL) |

1.11 |

Government Securities |

10.11 |

|

7.26% GOI 2033 (06-FEB-2033) |

Sovereign |

5.63 |

7.64% KERALA SDL 04-JAN-34 |

Sovereign |

2.26 |

7.17% GOI 2030 (17-APR-2030) |

Sovereign |

1.12 |

GOI FRB 2033 (22-SEP-2033) |

Sovereign |

1.10 |

TREPS |

3.67 |

|

Treasury Bills |

0.53 |

|

Other Current Assets |

4.06 |

|

Grand Total ( Net Asset) |

100 |

The Fund will endeavour to invest in “High Grade Assets” that are either government –backed entities or systemically important private banks/entities. This potentially provides lower credit risk.

The fund is suitable for investors who have a “Medium-term investment horizon” of 3-4years & having relatively “low to medium risk appetite” looking to invest in high credit quality bonds with good liquidity.

% Allocation |

|

Net Current Assets |

4.06% |

| 0 to 3 Months | 3.67% |

3 to 6 Months |

5.52% |

| 6 to 12 Months | 11.06% |

| 1 -2 years | 23.12% |

| More Than 2 Years | 52.57% |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer # Monthend AUM / Quantitative Information as on 31.5.2023 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. **Please refer notice cum addendum no.07 dated May 03, 2023 for change in riskometer for CRBPDF