Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

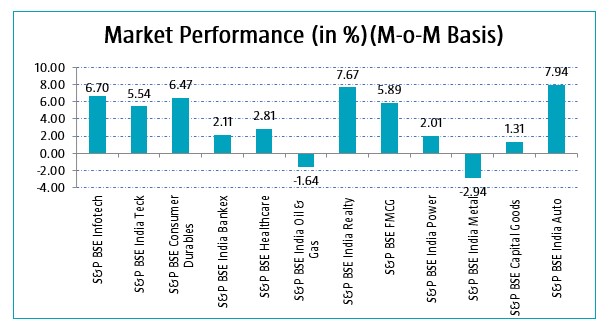

- In the month of May’23, equity markets surged significantly with Nifty 50 rising by 2.60% on m-o-m basis fuelled by upbeat corporate earning numbers for the quarter ended Mar 2023 and favourable domestic macroeconomic data and strong buying by foreign institutional investors for the month ended May’23.

- Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹ 43,838.15 crores

- Goods and Services Tax (GST) shows highest ever collection of ₹1.57 lakh crore for May’23, which is 12% more than the corresponding period of last year and this points towards the growing trajectory of the Indian economy.

- Though during the month, gains were neutralized as market participants preferred to book profits. Government Data showed that the India's Eight Core Industries growth moderated to 6-month low of 3.5% in Apr’23.

- Though at the end of the month, markets were resilient with the help from cooling off global inflationary pressures and buoyancy in domestic macro indicators. Climate expert also suggest the 2023 monsoon may be normal. India's economy sees significant growth and merrier-than-estimates as GDP growth is at 6.1% in Q4FY23 compared to 4.4% growth rate witnessed in Q3FY23. Gains were also boosted by a decline in oil prices on the world markets and a reduction in anxiety about the U.S. debt ceiling.

- Globally, US equity markets went south by 3.49% as there was uncertainty over the interest rate outlook and U.S. consumer sentiment and initial jobless claims rose more than expected. European Equity fell after data showed that Germany’s economy fell into recession in the first quarter of this year and Bank of England's decision to raise its benchmark interest rate by 25 bps. Asian equity markets closed on a mixed note as fears of a resurgence in China-U.S. trade tension weighed on the market sentiment and concerns over weak domestic demand in China.

Equity Market Outlook

Global environment remains complex with persistent inflation at higher level than expected, persistent supply chain challenges and geopolitical re-alignment and its long-term implications for supply chains. Within this complexity, the underlying Inflation seems to be moderating fast (though not visible yet in headline) and energy prices have finally started reacting to global compression in money supply. Expect lower inflation and energy prices in a quarter or two. The Federal Reserve increased its key interest rate by 0.25 percentage points - its 10th hike in 14 months. That pushed its benchmark rate to between 5% and 5.25%, up from near zero in March 2022, although the Fed hinted the rise may be its last one for now. The latest banking crisis could mean Fed might have to pause the interest rates despite near term inflation and see how increases of past year play out on growth and banking system. Combination of slowing growth but yet sticky inflation is an outcome of elevated energy prices and challenged supply chains in China/Energy, which are taking time to correct itself. Geopolitical tensions are taking time to abate and are only getting complex. Given these tensions, supply chains and global trade has become vulnerable to new dimension in 2023, missing till 2022. The banking crisis is being tackled by central bankers through regulatory channels without compromising on inflation fight through interest rate increases. This will mean that the developed world will see growth moderation through FY24, though China might see some improvement due to post covid opening-up of economy.

In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in CY20-21 in that order and they will reverse in the same order during CY22-23. We have already witnessed liquidity reversal in the last few quarters (although was forced to reverse due to the banking crisis); growth has started receding lately (Europe is already in recession, US is slowing) and inflation will be the last one to moderate. We have seen an initial downtick in inflation, which will accelerate in our view. Inflation is taking more time than usual to recede given healthy household savings, elevated energy prices, tight labor markets and challenged supply chains in China.

Indian macro remains resilient. CAD has improved significantly and is expected to be within 2% for FY24, with falling commodities and slowing growth. Most domestic macro and micro indicators remain steady. The only worrying aspects domestically are latest consumption slowdown and sticky core inflation above 6% level. Given these aspects, the domestic equity market remains focused on earnings. Both key factors, earnings growth and cost of capital (interest rate outlook globally) are neutral to negative for India from near term perspective and thus market will continue to consolidate till we get visibility on earnings upgrades or substantial decline in interest rates (Inflation globally/locally) to change multiples. The cost of capital has peaked and has started witnessing correction – US and India 10 years at 3.5% and 7% respectively- likely to aid valuation multiples. While the earnings are not getting upgraded; they are fairly resilient and seems to be bottoming. Financials, auto, industrials, Telecom, Hospital and Hotels are witnessing a healthy earnings cycle whereas Energy/commodities and IT continues to moderate. India trades at premium to other EMs and thankfully that is correcting with the consolidation in market over last 18months. Indian equity market trades at 19xFY24 earnings – with earnings CAGR of 13-14% over FY23-25E – in a fair valuation zone from near term perspective. We will watch out for one year forward (Earnings yield – Gsec yield) gap to compress to ~150bps for getting more constructive in near term. This is falling in place it appears to us. The earnings growth/Valuation expectations context is turning more and more favorable for anyone who has 18-24months view from hereon.

Having said this on near term earnings /market context, we believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place viz. 1) Corporate and bank balance sheets are in best possible shape to drive capex and credit respectively, 2) Consumer spending remains resilient through cycle given our demographics, 3) Govt is focused on growth through direct investments in budget as well as through reforms like GST(increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), PLIs( private capital through incentives for import substitution or export ecosystem creation) and 4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics. This makes us very constructive on India equities with 3-5years view.

Source: ICRA MFI Explorer