CANARA ROBECO SMALL CAP FUND (CRSCF)

Small Cap Fund -An open-ended equity scheme predominantly investing in small cap stocks.

(as on December 29, 2023)

| SCHEME OBJECTIVE | The investment objective of the Scheme is to generate capital appreciation by investing predominantly in Small Cap stocks. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | February 15, 2019 |

| BENCHMARK | Nifty Smallcap 250 Index TRI |

| FUND MANAGER* | 1) Mr. Pranav Gokhale 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 21 Years 2) 15 Years |

| MANAGING THIS FUND | 1)Since 06-Nov-23 2) Since 01-Oct-19 |

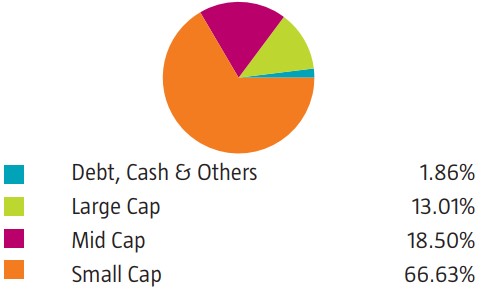

| ASSET ALLOCATION | Equity and Equity-related Instruments of Smallcap companies* 65% to 100% (Risk - Very High) Equity and Equity-related Instruments of companies other than Smallcap companies 0% to 35% (Risk - Very High) Debt and Money Market Instruments 0% to 35% (Low to Medium) Units issued by REITs and InvITs 0% to 10% (Risk - Very High) *Investment universe of "Small Cap": The investment universe of "Small Cap" shall comprise companies as defined by SEBI from time to time. In terms of SEBI circular SEBI/ HO/ IMD/ DF3/ CIR/ P/ 2017/ 114 dated October 6, 2017, the universe of "Small Cap" shall consist of 251st company onwards in terms of full market capitalization |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan- Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | In respect of each purchase / switch-in of units,1% - if Units are redeemed / switched-out within 1 year from the date of allotment. Nil – if redeemed / switched out after 1 year from the date of allotment. |

| EXPENSE RATIO^: |

Regular Plan : 1.72% Direct Plan : 0.46% |

| Monthend AUM# | ₹ 9,174.79 Crores |

| Monthly AVG AUM | ₹ 8,949.45 Crores |

| (as on December 29, 2023) | (₹) |

| Direct Plan - Growth Option | 35.4000 |

| Regular Plan - Growth Option | 32.6600 |

| Regular Plan - IDCW (payout/reinvestment | 30.3300 |

| Direct Plan - IDCW (payout/reinvestment) | 33.2800 |

| Standard Deviation | 15.43 |

| Portfolio Beta | 0.77 |

| Portfolio Turnover Ratio | 0.12 times |

| R-Squared | 0.89 |

| Sharpe Ratio | 1.57 |

| Name of the Instruments | % to NAV |

Equities |

98.14 |

Listed |

98.14 |

Capital Markets |

9.93 |

Multi Commodity Exchange Of India Ltd |

2.60 |

BSE Ltd |

1.48 |

Angel One Ltd |

1.30 |

Anand Rathi Wealth Ltd |

1.17 |

ICRA Ltd |

1.05 |

Computer Age Management Services Ltd |

1.03 |

Central Depository Services (India) Ltd |

0.58 |

Prudent Corporate Advisory Services Ltd |

0.46 |

Kfin Technologies Ltd |

0.26 |

Industrial Products |

8.27 |

KEI Industries Ltd |

2.81 |

Rhi Magnesita India Ltd |

1.21 |

EPL Ltd |

0.93 |

Grindwell Norton Ltd |

0.90 |

Mold Tek Packaging Ltd |

0.85 |

Ratnamani Metals & Tubes Ltd |

0.79 |

Timken India Ltd |

0.78 |

Banks |

7.44 |

Equitas Small Finance Bank Ltd |

2.40 |

City Union Bank Ltd |

1.48 |

Karur Vysya Bank Ltd |

1.38 |

Indian Bank |

1.32 |

Ujjivan Small Finance Bank Ltd |

0.57 |

DCB Bank Ltd |

0.29 |

Finance |

7.29 |

Creditaccess Grameen Ltd |

1.70 |

Can Fin Homes Ltd |

1.57 |

Bajaj Finance Ltd |

1.19 |

Cholamandalam Financial Holdings Ltd |

1.07 |

Power Finance Corporation Ltd |

0.89 |

Home First Finance Co India Ltd |

0.87 |

Pharmaceuticals & Biotechnology |

6.81 |

J.B. Chemicals & Pharmaceuticals Ltd |

1.40 |

Suven Pharmaceuticals Ltd |

1.32 |

Sun Pharmaceutical Industries Ltd |

1.30 |

Ajanta Pharma Ltd |

1.27 |

Abbott India Ltd |

0.84 |

Innova Captab Ltd |

0.68 |

Consumer Durables |

6.09 |

Cera Sanitaryware Ltd |

1.88 |

V-Guard Industries Ltd |

1.41 |

V.I.P. Industries Ltd |

0.93 |

Greenpanel Industries Ltd |

0.85 |

Greenply Industries Ltd |

0.53 |

Greenlam Industries Ltd |

0.49 |

Industrial Manufacturing |

5.31 |

Kaynes Technology India Ltd |

2.43 |

Titagarh Rail Systems Ltd |

2.08 |

GMM Pfaudler Ltd |

0.80 |

Auto Components |

4.87 |

ZF Commercial Vehicle Control Systems India Ltd |

1.10 |

Schaeffler India Ltd |

1.07 |

Rolex Rings Ltd |

0.99 |

CIE Automotive India Ltd |

0.94 |

Subros Ltd |

0.65 |

Ask Automotive Ltd |

0.12 |

Aerospace & Defense |

3.73 |

Bharat Electronics Ltd |

2.49 |

Bharat Dynamics Ltd |

1.24 |

Healthcare Services |

3.49 |

Global Health Ltd |

1.31 |

Max Healthcare Institute Ltd |

1.16 |

Vijaya Diagnostic Centre Ltd |

0.88 |

Jupiter Life Line Hospitals Ltd |

0.14 |

Chemicals & Petrochemicals |

3.23 |

Deepak Nitrite Ltd |

0.93 |

Rossari Biotech Ltd |

0.93 |

Galaxy Surfactants Ltd |

0.63 |

Fine Organic Industries Ltd |

0.42 |

NOCIL Ltd |

0.32 |

Cement & Cement Products |

3.11 |

Ultratech Cement Ltd |

1.64 |

JK Lakshmi Cement Ltd |

1.47 |

Retailing |

3.09 |

Avenue Supermarts Ltd |

0.99 |

Go Fashion India Ltd |

0.91 |

Vedant Fashions Ltd |

0.61 |

V-Mart Retail Ltd |

0.58 |

Construction |

2.77 |

PNC Infratech Ltd |

1.23 |

KNR Constructions Ltd |

0.83 |

Ahluwalia Contracts (India) Ltd |

0.71 |

IT - Software |

2.75 |

Persistent Systems Ltd |

1.45 |

Ltimindtree Ltd |

1.30 |

Electrical Equipment |

2.71 |

KEC International Ltd |

1.42 |

Triveni Turbine Ltd |

0.79 |

Thermax Ltd |

0.50 |

Transport Services |

2.41 |

Great Eastern Shipping Co Ltd |

1.25 |

VRL Logistics Ltd |

1.16 |

Leisure Services |

2.39 |

Indian Hotels Co Ltd |

1.25 |

Westlife Foodworld Ltd |

1.14 |

Realty |

1.48 |

Sobha Ltd |

0.76 |

Brigade Enterprises Ltd |

0.72 |

Food Products |

1.42 |

Bikaji Foods International Ltd |

1.42 |

Paper, Forest & Jute Products |

1.23 |

Century Textile & Industries Ltd |

1.23 |

Fertilizers & Agrochemicals |

1.16 |

EID Parry India Ltd |

1.16 |

Petroleum Products |

1.13 |

Reliance Industries Ltd |

1.13 |

Diversified Fmcg |

1.08 |

ITC Ltd |

1.08 |

Entertainment |

1.05 |

PVR Inox Ltd |

1.05 |

Power |

1.00 |

NTPC Ltd |

1.00 |

Non - Ferrous Metals |

0.93 |

National Aluminium Co Ltd |

0.93 |

Textiles & Apparels |

0.81 |

K.P.R. Mill Ltd |

0.81 |

Personal Products |

0.75 |

Honasa Consumer Ltd |

0.75 |

Agricultural Food & Other Products |

0.41 |

CCL Products (India) Ltd |

0.41 |

Money Market Instruments |

0.57 |

TREPS |

0.57 |

Net Current Assets |

1.29 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.12.2023 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.*Please refer notice cum addendum no.32 dated November 02, 2023 for change in fund management responsibilities.