Economic Indicators (as on December 29, 2023)

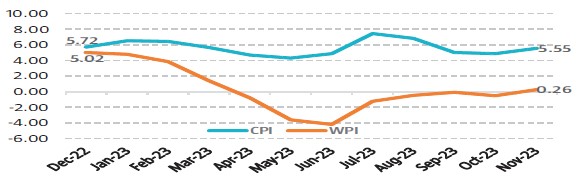

Inflation in India (%)

Consumer Price Index eased to 5.55% in Nov’23, first increase in 4-months, from 4.87% in Oct’23, thanks to increase in prices of some food items. Though, Retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) is 0.26% in Nov’23 from -0.52% in Oct’23, at an 8-months high, mainly due to faster rises in prices of food and primary articles. It stepped out of the deflationary zone for the first time since Mar'23.

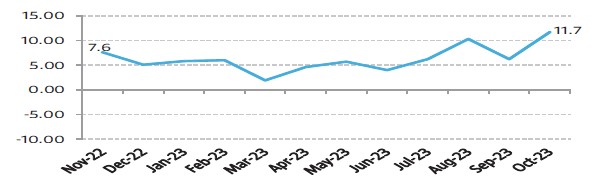

Index of Industrial Production (%)

Index of Industrial Production (IIP) falls to 3 months low of 11.7% in Oct’23 from 5.8% in Sep’23, highest since June last year, due to a significant deceleration in key sectors namely manufacturing sector growing by 10.4%, mining sector growing by 13.1% and electricity growing by 20.4%.