Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

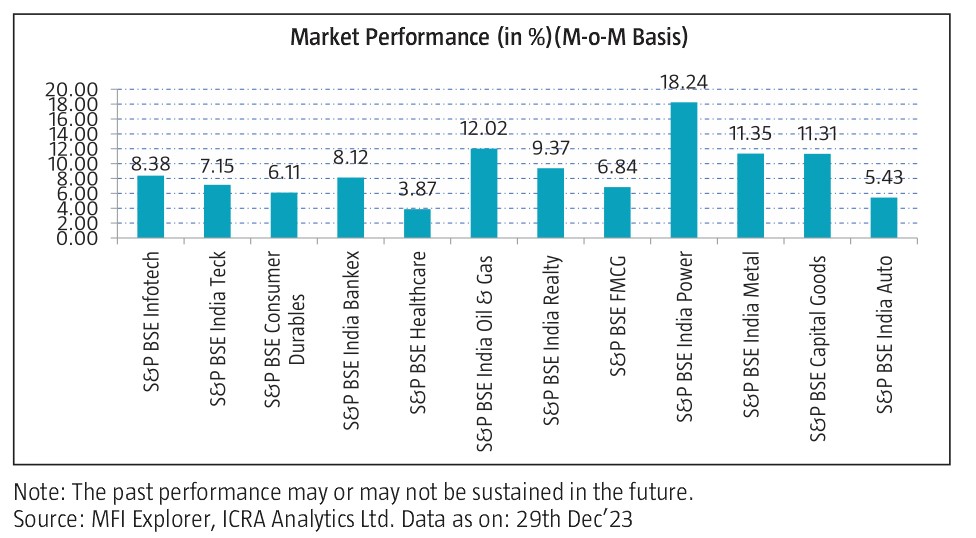

- In the month of Dec’23, equity markets gave returns with Nifty 50 gaining by 7.94% on m-o-m basis following quarter end earning numbers, fall in global crude oil prices improving domestic macroeconomic data and strong FII buying. Market participants in the just finished state assembly elections expressed optimism for continued political stability and policy direction. In the recent Monetary Policy Committee meeting concluded on Dec 8, 2023, the RBI kept the policy repo rate unchanged for the fifth consecutive time and raised the GDP growth forecast for FY24, which also contributed to the surge.

- Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹ 66,134.68 crores.

- Goods and Services Tax (GST) shows collection of ₹ 1.64 lakh crore for Dec’23, 12% more than the corresponding period of last year and this points towards the growing trajectory of the Indian economy. The gross GST collection surpassed the mark of Rs. 1.60 lakh crore for the seventh time in FY’24.

- The combined Index of Eight Core Industries increased by 7.8% in Nov 2023 as compared to 5.7% in Nov 2022. The production of all Eight Core Industries recorded positive growth in Nov 2023 over the corresponding month of last year except crude oil and cement.

- Globally, US Equity Markets also went north amid expectations from investors that the U.S. Federal Reserve will cease raising interest rates. Additionally, there was reduction in fears about violence in the Middle East following Israel and Hamas’s agreement to a ceasefire mediated by Qatar. European equity markets too rose on slightly easing geopolitical tensions and better than expected Eurozone business activity for Nov’23 data. Asian equity markets closed on a mixed note amid continuing concerns about the Chinese economy. The downward revision of Japan’s GDP for the third quarter of 2023 further damaged sentiment.

Equity Market Outlook

The pace of macroeconomic growth remains robust, and economic activities are at pre-pandemic levels. Government spending has resumed, employment is increasing, and supply bottlenecks are gradually easing, providing a counterbalance to the negative impact of higher inflation (although it is moderating faster). In the medium term, the Indian economy is poised to receive support from a stable political scenario, favorable policy environments, the effects of Production-Linked Incentive (PLI) programs, opportunities arising from changes in the global supply chain, and the government’s focus on infrastructure spending.

In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in CY20-21 in that order and they will reverse in the same order during CY23-24. We have already witnessed liquidity reversal in the last few quarters (although it was forced to reverse due to the banking crisis); growth has started receding (Europe is already in recession, US is slowing and China is very weak) and inflation will be the last one to moderate. We have seen an initial downtick in inflation, which will accelerate in our view over next few quarters. Inflation is taking more time than usual to recede given healthy household savings in US, elevated energy prices, tight labour markets and challenged supply chains in China.

GDP growth is expected to normalize in the coming quarters, and the decline in crude oil prices should positively contribute to terms of trade. However, escalating downside risks are stemming from global factors and the lagged impact of monetary tightening. Despite oil prices temporarily dropping below $80 per barrel, uncertainties persist due to challenges in Russian oil supply, OPEC+ supply restrictions, and insufficient U.S. supply growth. As a result, Brent crude is anticipated to once again reach $90 per barrel.

We believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place viz. 1) Corporate and bank balance sheets are in best possible shape to drive capex and credit respectively, 2) Consumer spending remains resilient through cycle given our demographics, 3) Government is focused on growth through direct investments in budget as well as through reforms like GST (increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), Production Linked Incentives (private capital through incentives for import substitution or export ecosystem creation) and 4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics. This makes us constructive on India equities with 3years view. We believe that India is in a business cycle / credit growth cycle through FY23-26E – indicating starting of healthy earnings cycle from medium term perspective.

In the political arena, there is a prevailing consensus that the incumbent ruling party is poised for a third term in the upcoming 2024 general election. The party’s recent success in the December state elections has generated positive momentum as the nation approaches the general election. Notably, even in states where the ruling party is in the opposition, there has been an observed increase in its vote share. While an unexpected victory for the opposition “India Alliance” may temporarily exert downward pressure on the market, it is unlikely to bring about a substantial alteration in the long-term growth trajectory.

A pro-investment stance remains a common theme among both the ruling party and a majority of the opposition parties. Consequently, an improbable opposition win is not perceived as a significant factor capable of fundamentally altering the growth trajectory for the economy.

Source: ICRA MFI Explorer