CANARA ROBECO CONSERVATIVE HYBRID FUND (CRCHF)

Conservative Hybrid Fund - An open-ended hybrid scheme investing predominantly in debt instruments

(as on October 31, 2022)

| SCHEME OBJECTIVE | To generate income by investing in a wide range of Debt Securities and Money Market instruments of various maturities and small portion in equities and Equity Related Instruments. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | April 24, 1988 |

| BENCHMARK | CRISIL Hybrid 85+15-Conservative Index |

| FUND MANAGER | 1) Mr. Avnish Jain (For Debt Portfolio) 2) Mr. Shridatta Bhandwaldar ( For Equity Portfolio) |

| TOTAL EXPERIENCE | 1) 27 Years 2) 15 Years |

| MANAGING THIS FUND | 1) Since 7-Oct-13 2) Since 02-Dec-21 |

| ASSET ALLOCATION | Equity and equity related instruments- 10% - 25% (Risk- High) Debt securities (including Securitized debt) with Money Market Instruments - 75% - 90% (Risk- Medium) |

| MINIMUM INVESTMENT | ₹ 5000 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Monthly Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Monthly Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Quarterly Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Quarterly Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Monthly Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Monthly Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Quarterly Payout of Income Distribution cum Capital Withdrawal Option Direct Plan- Quarterly Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | For any redemption / switch out upto 10% of units within 1 Year from the date of allotment - Nil For any redemption / switch out more than 10% of units within 1 Year from the date of allotment - 1% For any redemption / switch out after 1 Year from the date of allotment - Nil |

| EXPENSE RATIO^: |

Regular Plan:1.80% Direct Plan: 0.56% |

| Monthend AUM# | ₹ 1,142.92 Crores |

| Monthly AVG AUM | ₹ 1,138.77 Crores |

| (as on October 31, 2022) | (₹) |

| Direct Plan - Growth Option | 85.3133 |

| Regular Plan - Growth Option | 76.7466 |

| Direct Plan - Monthly IDCW (payout/reinvestment) | 15.6312 |

| Regular Plan - Monthly IDCW (payout/reinvestment) | 13.3770 |

| Regular Plan - Quarterly IDCW (payout/reinvestment) | 13.4738 |

| Direct Plan - Quarterly IDCW (payout/reinvestment) | 15.5284 |

| Equity Quants | |

| Standard Deviation | 4.99 |

| Portfolio Beta | 0.97 |

| Portfolio Turnover Ratio | 2.39 times |

| R-Squared | 0.76 |

| Sharpe Ratio | 0.51 |

| Debt Quants | |

| Yield to Maturity | 7.41% |

| Modified Duration | 2.56 Years |

| Average Maturity | 3.36 Years |

| Macaulay Duration | 2.67 Years |

Name of the Instruments |

% to NAV |

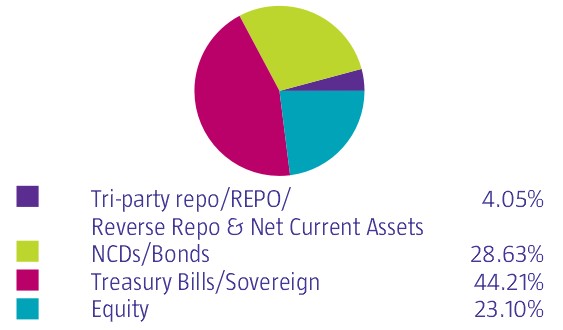

Equities |

23.10 |

Listed |

23.10 |

Banks |

6.98 |

ICICI Bank Ltd |

2.53 |

HDFC Bank Ltd |

1.99 |

State Bank of India |

1.38 |

Axis Bank Ltd |

1.08 |

IT - Software |

1.88 |

Infosys Ltd |

1.57 |

Tata Consultancy Services Ltd |

0.31 |

Finance |

1.25 |

Bajaj Finance Ltd |

1.03 |

SBI Cards and Payment Services Ltd |

0.22 |

Pharmaceuticals & Biotechnology |

1.20 |

J.B. Chemicals & Pharmaceuticals Ltd |

0.57 |

Suven Pharmaceuticals Ltd |

0.44 |

Gland Pharma Ltd |

0.19 |

Petroleum Products |

1.14 |

Reliance Industries Ltd |

1.14 |

Diversified Fmcg |

1.13 |

ITC Ltd |

0.69 |

Hindustan Unilever Ltd |

0.44 |

Auto Components |

1.09 |

Uno Minda Ltd |

0.42 |

Schaeffler India Ltd |

0.40 |

Sona Blw Precision Forgings Ltd |

0.27 |

Automobiles |

0.88 |

Maruti Suzuki India Ltd |

0.88 |

Chemicals & Petrochemicals |

0.84 |

Vinati Organics Ltd |

0.50 |

Atul Ltd |

0.34 |

Power |

0.68 |

NTPC Ltd |

0.68 |

Electrical Equipment |

0.63 |

CG Power and Industrial Solutions Ltd |

0.40 |

Thermax Ltd |

0.23 |

Beverages |

0.62 |

United Spirits Ltd |

0.39 |

Varun Beverages Ltd |

0.23 |

Capital Markets |

0.59 |

Multi Commodity Exchange Of India Ltd |

0.34 |

Prudent Corporate Advisory Services Ltd |

0.25 |

Healthcare Services |

0.57 |

Apollo Hospitals Enterprise Ltd |

0.57 |

Insurance |

0.55 |

SBI Life Insurance Co Ltd |

0.55 |

Construction |

0.44 |

Larsen & Toubro Ltd |

0.44 |

Food Products |

0.40 |

Britannia Industries Ltd |

0.40 |

Leisure Services |

0.38 |

Westlife Development Ltd |

0.38 |

Paper, Forest & Jute Products |

0.37 |

Century Textile & Industries Ltd |

0.37 |

Telecom - Services |

0.36 |

Bharti Airtel Ltd |

0.36 |

Realty |

0.34 |

Brigade Enterprises Ltd |

0.34 |

Retailing |

0.30 |

Avenue Supermarts Ltd |

0.30 |

Transport Services |

0.30 |

TCI Express Ltd |

0.30 |

Industrial Products |

0.18 |

KSB Ltd |

0.18 |

Debt Instruments |

28.62 |

Housing Development Finance Corporation Ltd |

3.07 |

HDB Financial Services Ltd |

3.06 |

National Bank For Agriculture & Rural Development |

2.63 |

Bajaj Finance Ltd |

2.17 |

LIC Housing Finance Ltd |

2.17 |

Housing Development Finance Corporation Ltd |

2.17 |

Housing Development Finance Corporation Ltd |

2.17 |

Bajaj Finance Ltd |

2.15 |

LIC Housing Finance Ltd |

2.13 |

Sundaram Finance Ltd |

2.11 |

LIC Housing Finance Ltd |

1.75 |

LIC Housing Finance Ltd |

1.73 |

LIC Housing Finance Ltd |

0.87 |

LIC Housing Finance Ltd |

0.44 |

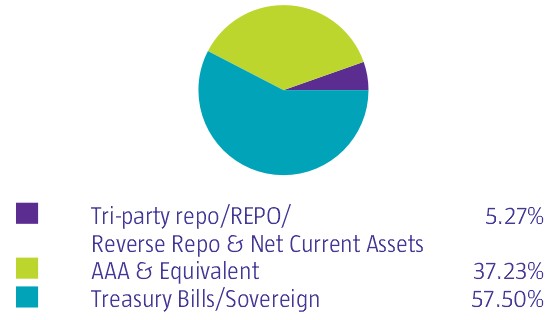

Government Securities |

44.22 |

7.38% GOI 20-JUN-27 |

10.50 |

5.63% GOI 12-APR-26 |

6.23 |

7.26% GOI 22-AUG-32 |

6.05 |

5.74% GOI 15-NOV-26 |

5.38 |

7.59% GOI 11-JAN-26 |

3.53 |

7.35% GOI 22-JUN-24 |

3.51 |

6.79% GOI 15-MAY-27 |

1.71 |

6.69% GOI 27-JUN-24 |

1.31 |

GOI FRB 30-OCT-34 |

1.29 |

7.10% GOI 18-APR-29 |

1.29 |

6.54% GOI 17-JAN-32 |

1.23 |

6.30% GOI 09-APR-23 |

0.87 |

7.27% GOI 08-APR-26 |

0.87 |

9.25% MAHARASHTRA SDL 09-OCT-23 |

0.45 |

7.72% GOI 26-OCT-55 |

0.00 |

Tri - party repo |

2.54 |

Other Current Assets |

1.52 |

Grand Total ( Net Asset) |

100.00 |

% Allocation |

|

0 to 3 Months |

5.60% |

3 to 6 Months |

3.04% |

| 6 to 12 Months | 4.35% |

| 1 -2 years | 20.42% |

| More Than 2 Years | 41.98% |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer |# Monthend AUM as on 31.10.2022 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers. | **Please refer notice cum addendum no.30 dated September 06, 2022 for change in riskometer for CRCHF.