Economic Indicators (as on October 31, 2022)

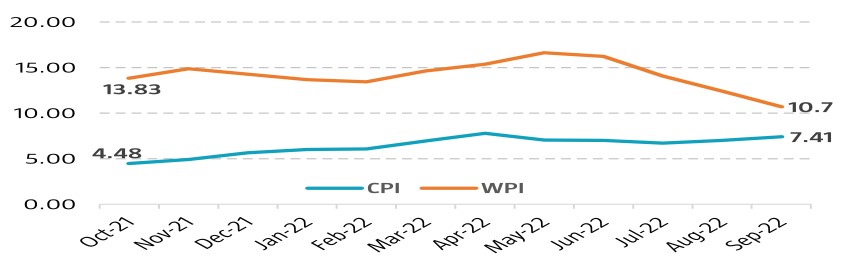

Inflation in India (%)

Consumer Price Index further increased this month to 7.41% in Sep’22, from 7% in Aug’22 due to spike in food prices. The current level of inflation continues to remain above the 6% mark for the ninth consecutive month. Wholesale Price Index (WPI) decreased to 10.70% in Sep'22 from 12.41% in Aug'22 despite a rise in prices of crude and manufactured products. The current level of inflation continues to rise above RBI’s limit of 4%-6% in response to rise in prices of mineral oil, natural gas, basic metals, chemicals and chemical products, food articles etc.

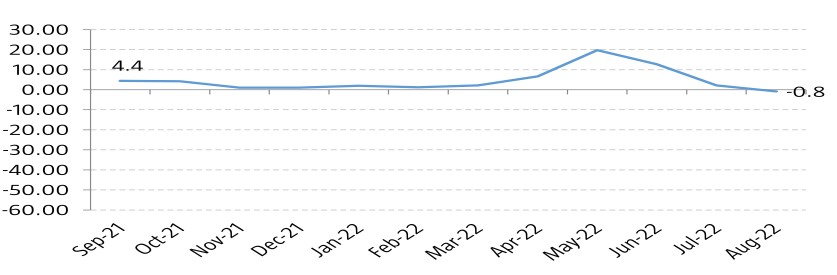

Index of Industrial Production (%)

Index of Industrial Production (IIP) fell to -0.8% in Aug’22 from 2.2% in Jul’22 showing decrease in industrial activity for first time since Feb’21. The electricity sector rose by 1.4%, whereas the manufacturing and mining sectors shrank by 0.7% and 3.9% respectively in Aug'22.