CANARA ROBECO LIQUID FUND (CRL)

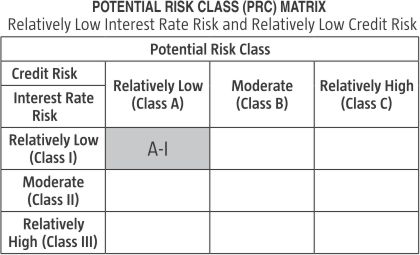

Liquid Fund - An open ended liquid scheme. A relatively low interest rate risk and relatively low credit risk.

(as on October 31, 2023)

| SCHEME OBJECTIVE | The scheme has been formulated with the objective of enhancement of income, while maintaining a level of high liquidity, through investment in a mix of Money Market Instruments & Debt Securities. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| DATE OF ALLOTMENT | January 15, 2002 |

| BENCHMARK | CRISIL Liquid Debt A-I Index |

| FUND MANAGER | 1) Mr. Kunal Jain 2) Mr. Avnish Jain |

| TOTAL EXPERIENCE | 1) 14 Years 2) 27 Years |

| MANAGING THIS FUND | 1) Since 18-July-22 2) Since 01-April-22 |

| ASSET ALLOCATION | Money Market Instruments / call money - 65% to 100% (Risk- Low) Debt (including securitized debt) - 0% to 35% (Risk- Medium) |

| MINIMUM INVESTMENT | ₹5000 and in multiple of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 1000 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency - ₹ 1000 and in multiples of ₹ 1 thereafter. For quarterly frequency - ₹ 2000 and in multiples of ₹ 1 thereafter. STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Daily Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Weekly Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Weekly Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Monthly Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Monthly Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Daily Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Weekly Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Weekly Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Monthly Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Monthly Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option Direct Plan - Unclaimed Redemption & Dividend Plan -Direct Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | If redeemed on Day 1 - Exit Load is 0.0070% If redeemed on Day 2 -Exit Load is 0.0065% If redeemed on Day 3 -Exit Load is 0.0060% If redeemed on Day 4 -Exit Load is 0.0055% If redeemed on Day 5 -Exit Load is 0.0050% If redeemed on Day 6 -Exit Load is 0.0045% If redeemed on or after Day 7 - Exit Load is Nil |

| EXPENSE RATIO^: |

Regular Plan : 0.19% Direct Plan : 0.12% |

| Monthend AUM# | ₹ 3,813.48 Crores |

| Monthly AVG AUM | ₹ 3,416.53 Crores |

| (as on October 31, 2023) | (₹) |

| Direct Plan - Daily IDCW (reinvestment) | 1,005.5000 |

| Direct Plan - Growth Option | 2,807.1615 |

| Direct Plan - Unclaimed Redemption & Dividend Plan -Direct Growth Option | 1,529.9131 |

| Direct Plan - IDCW (payout/reinvestment) | 2,009.0961 |

| Direct Plan - Monthly IDCW (payout/reinvestment) | 1,001.1343 |

| Regular Plan - Daily IDCW (reinvestment) | 1,005.5000 |

| Regular Plan - Growth Option | 2,794.9834 |

| Regular Plan - Monthly IDCW (payout/reinvestment) | 1,001.1228 |

| Regular Plan - Weekly IDCW (payout/reinvestment) | 1,001.1227 |

| Direct Plan - Weekly IDCW (payout/reinvestment) | 1,001.1343 |

| Annualised Portfolio YTM | 7.09% |

| Modified Duration | 0.08 Years |

| Residual Maturity | 0.09 Years |

| Macaulay Duration | 0.09 Years |

Name of the Instruments |

Rating |

% to NAV |

Alternative Investment Fund |

|

0.17 |

Corporate Debt Market Development Fund Class A2 |

|

0.17 |

Money Market Instruments |

|

99.68 |

ICICI Bank Ltd |

A1+(ICRA) |

5.24 |

Reliance Retail Ventures Ltd |

A1+(CRISIL) |

5.11 |

Small Industries Development Bank Of India |

A1+(CARE) |

3.91 |

Reliance Retail Ventures Ltd |

A1+(CRISIL) |

3.91 |

Tata Capital Financial Services Ltd |

A1+(ICRA) |

3.90 |

HDFC Bank Ltd |

A1+(CARE) |

3.88 |

Kotak Securities Ltd |

A1+(CRISIL) |

2.62 |

Indian Bank |

A1+(CRISIL) |

2.61 |

Bajaj Housing Finance Ltd |

A1+(CRISIL) |

2.61 |

Bajaj Finance Ltd |

A1+(CRISIL) |

2.61 |

ICICI Home Finance Co Ltd |

A1+(ICRA) |

2.61 |

HDFC Bank Ltd |

A1+(CARE) |

2.60 |

Bank of Baroda |

A1+(IND) |

2.60 |

Kotak Mahindra Bank Ltd |

A1+(CRISIL) |

2.60 |

National Bank For Agriculture & Rural Development |

A1+(ICRA) |

2.60 |

Bank of Baroda |

A1+(IND) |

2.58 |

Small Industries Development Bank Of India |

A1+(CARE) |

1.96 |

Small Industries Development Bank Of India |

A1+(CARE) |

1.95 |

HDFC Securities Ltd |

A1+(ICRA) |

1.95 |

Union Bank of India |

A1+(IND) |

1.94 |

ICICI Bank Ltd |

A1+(ICRA) |

1.94 |

HDFC Securities Ltd |

A1+(CARE) |

1.31 |

Kotak Mahindra Bank Ltd |

A1+(CRISIL) |

1.30 |

ICICI Securities Ltd |

A1+(CRISIL) |

0.65 |

Treasury Bills |

|

20.49 |

TREPS |

|

14.20 |

Other Current Assets |

|

0.15 |

Grand Total ( Net Asset) |

|

100.00 |

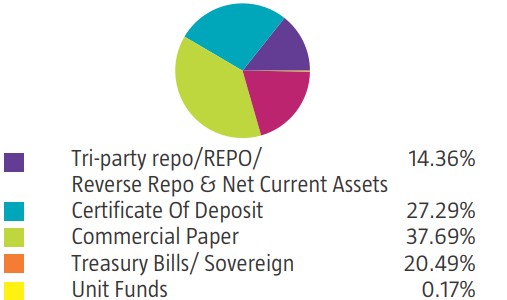

% Allocation |

|

Net Current Assets |

0.16% |

| 0 to 3 Months | 99.67% |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 31.10.2023 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.