Economic Indicators (as on October 31, 2023)

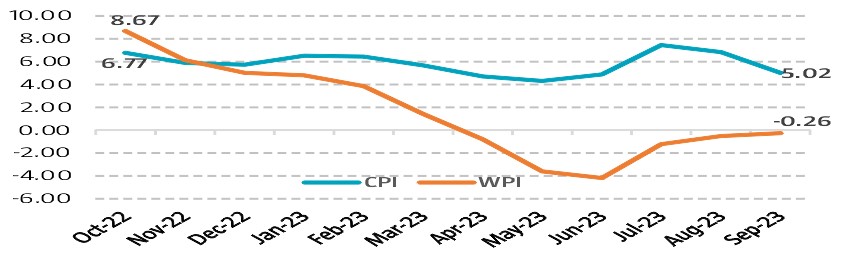

Inflation in India (%)

Consumer Price Index eased to 5.02% in Sep’23, lowest in 3 months, from 6.83% in Aug’23, largely due to correction in food items especially vegetable prices was one of the reason for the recent decrease in inflation. Retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) is -0.26% in Sep’23 from -0.52% in Aug’23, it remained negative for the 6th consecutive month but the contraction was narrower compared with the previous months due to a mild uptick in crude oil, natural gas, fuel and power prices.

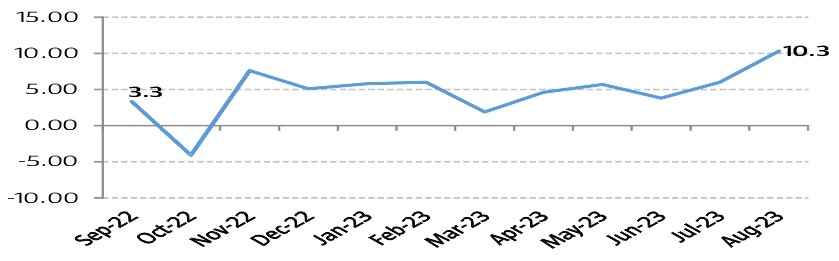

Index of Industrial Production (%)

Index of Industrial Production (IIP) surges to 14 months high of 10.3% in Aug’23 from 5.7% in Jul’23 with manufacturing sector which witnessed a growth of 9.3%, power sector saw some improvement with a growth of 15.3% whereas mining sector grew by 12.3%.