CANARA ROBECO ELSS TAX SAVER (CRETS)

ELSS - An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit

(as on February 29, 2024)

| SCHEME OBJECTIVE | ELSS seeking to provide long term capital appreciation by predominantly investing in equities to facilitate the subscribers to seek tax benefits as provided under Section 80 C of the Income Tax Act, 1961. However, there can be no assurance that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | March 31, 1993 |

| BENCHMARK | S&P BSE 500 Index TRI |

| FUND MANAGER | 1) Mr. Vishal Mishra 2) Mr. Shridatta Bhandwaldar |

| TOTAL EXPERIENCE | 1) 18 Years 2) 15 Years |

| MANAGING THIS FUND | 1) Since 26-June-21 2) Since 01-Oct-19 |

| ASSET ALLOCATION | Equity and equity related instruments - 80% to 100% (Risk - Very High) Money Market instruments- 0% to 20% (Risk- Low) |

| MINIMUM INVESTMENT | ₹ 500 and in multiples of ₹ 1 thereafter Subsequent purchases: Minimum amount of ₹ 500 and multiples of ₹ 1 thereafter SIP: For Any date/monthly frequency – ₹ 500 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 500 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 500 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | Nil |

| EXPENSE RATIO^: |

Regular Plan : 1.72% Direct Plan : 0.58% |

| Monthend AUM# | ₹ 7,332.91 Crores |

| Monthly AVG AUM | ₹ 7,278.11 Crores |

| (as on February 29, 2024) | (₹) |

| Direct Plan - Growth Option | 163.8400 |

| Regular Plan - Growth Option | 148.9500 |

| Regular Plan - IDCW (Payout) | 44.1000 |

| Direct Plan - IDCW (Payout) | 70.3100 |

| Standard Deviation | 12.21 |

| Portfolio Beta | 0.89 |

| Portfolio Turnover Ratio | 0.32 times |

| R-Squared | 0.93 |

| Sharpe Ratio | 0.91 |

Name of the Instruments |

% to NAV |

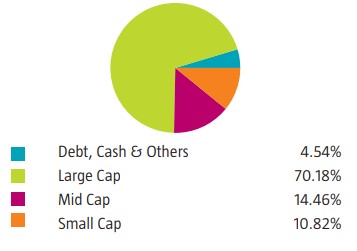

Equities |

95.46 |

Listed |

95.46 |

Banks |

17.65 |

HDFC Bank Ltd |

6.39 |

ICICI Bank Ltd |

5.78 |

State Bank of India |

2.26 |

Axis Bank Ltd |

1.95 |

IndusInd Bank Ltd |

1.27 |

IT - Software |

10.86 |

Infosys Ltd |

5.05 |

Tata Consultancy Services Ltd |

2.74 |

HCL Technologies Ltd |

1.30 |

Coforge Ltd |

1.12 |

Tech Mahindra Ltd |

0.65 |

Finance |

6.64 |

REC Ltd |

2.16 |

Bajaj Finance Ltd |

2.11 |

Creditaccess Grameen Ltd |

1.05 |

Cholamandalam Investment and Finance Co Ltd |

0.85 |

Jio Financial Services Ltd |

0.47 |

Petroleum Products |

5.42 |

Reliance Industries Ltd |

4.51 |

Bharat Petroleum Corporation Ltd |

0.91 |

Automobiles |

5.05 |

Tata Motors Ltd |

1.92 |

Bajaj Auto Ltd |

1.36 |

TVS Motor Co Ltd |

1.08 |

Maruti Suzuki India Ltd |

0.69 |

Pharmaceuticals & Biotechnology |

4.29 |

Sun Pharmaceutical Industries Ltd |

2.24 |

Mankind Pharma Ltd |

1.15 |

J.B. Chemicals & Pharmaceuticals Ltd |

0.90 |

Auto Components |

4.08 |

Samvardhana Motherson International Ltd |

1.72 |

Uno Minda Ltd |

0.82 |

Sona Blw Precision Forgings Ltd |

0.79 |

Schaeffler India Ltd |

0.75 |

Electrical Equipment |

4.01 |

KEC International Ltd |

1.07 |

CG Power and Industrial Solutions Ltd |

0.95 |

ABB India Ltd |

0.79 |

Siemens Ltd |

0.78 |

GE T&D India Ltd |

0.42 |

Insurance |

3.17 |

ICICI Lombard General Insurance Co Ltd |

1.40 |

Medi Assist Healthcare Services Ltd |

1.20 |

SBI Life Insurance Co Ltd |

0.57 |

Cement & Cement Products |

2.93 |

Ultratech Cement Ltd |

1.82 |

J.K. Cement Ltd |

1.11 |

Power |

2.83 |

NTPC Ltd |

2.83 |

Construction |

2.77 |

Larsen & Toubro Ltd |

2.77 |

Retailing |

2.42 |

Trent Ltd |

1.46 |

Vedant Fashions Ltd |

0.96 |

Telecom - Services |

2.36 |

Bharti Airtel Ltd |

2.36 |

Aerospace & Defense |

2.21 |

Bharat Dynamics Ltd |

1.17 |

Bharat Electronics Ltd |

1.04 |

Chemicals & Petrochemicals |

1.93 |

Deepak Nitrite Ltd |

0.80 |

Navin Fluorine International Ltd |

0.64 |

Vinati Organics Ltd |

0.49 |

Diversified Fmcg |

1.83 |

ITC Ltd |

1.83 |

Personal Products |

1.82 |

Godrej Consumer Products Ltd |

0.99 |

Dabur India Ltd |

0.83 |

Capital Markets |

1.56 |

BSE Ltd |

0.79 |

Central Depository Services (India) Ltd |

0.77 |

Consumable Fuels |

1.22 |

Coal India Ltd |

1.22 |

Fertilizers & Agrochemicals |

1.08 |

PI Industries Ltd |

1.08 |

Industrial Products |

1.05 |

KEI Industries Ltd |

1.05 |

Realty |

1.00 |

Oberoi Realty Ltd |

1.00 |

Household Products |

0.98 |

Jyothy Labs Ltd |

0.98 |

Consumer Durables |

0.95 |

Titan Co Ltd |

0.95 |

Industrial Manufacturing |

0.94 |

Titagarh Rail Systems Ltd |

0.94 |

Healthcare Services |

0.94 |

Max Healthcare Institute Ltd |

0.94 |

Transport Services |

0.88 |

Interglobe Aviation Ltd |

0.88 |

Beverages |

0.82 |

United Spirits Ltd |

0.82 |

Agricultural Food & Other Products |

0.81 |

CCL Products (India) Ltd |

0.81 |

Entertainment |

0.64 |

PVR Inox Ltd |

0.64 |

IT - Services |

0.32 |

Tata Technologies Ltd |

0.32 |

Money Market Instruments |

4.57 |

TREPS |

4.57 |

Net Current Assets |

-0.03 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.2.2024 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.