Economic Indicators (as on February 29, 2024)

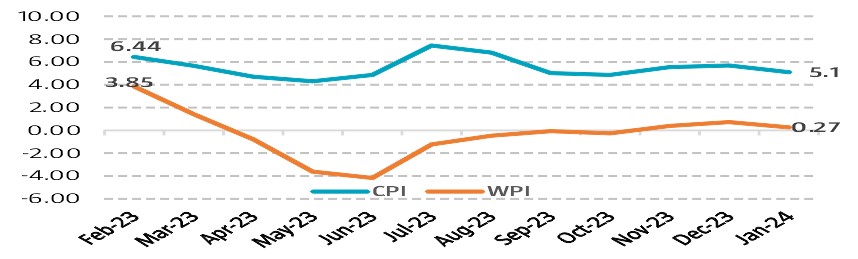

Inflation in India (%)

Consumer Price Index decelerated to a 3-month low of 5.1% in Jan’23 from 5.69% in Dec’23 due to easing food prices. Though, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) eases to 0.27% in Jan’24 from 0.73% in Dec’23, at a 3-month low. Positive rate of inflation in Jan'24 is primarily due to increase in prices of food articles, machinery & equipment, other manufacturing, minerals, other transport equipment etc. It stepped out of the deflationary zone for the third time in row.

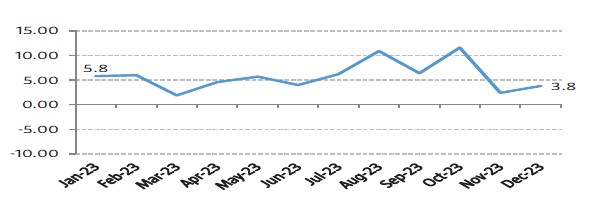

Index of Industrial Production (%)

Index of Industrial Production (IIP) slumps to 8-month low of 3.8% in Dec’23 from 2.4% in Nov’23, with key sectors namely manufacturing sector growing by 3.9%, mining sector growing by 5.1% and electricity growing by 1.2%.