CANARA ROBECO VALUE FUND (CRVF)

Value Fund - An open-ended equity scheme following a value investment strategy

(as on September 29, 2023)

| SCHEME OBJECTIVE | The fund aims to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related instrument, with higher focus on value stocks. There is no assurance or guarantee that the investment objective of the scheme will be realized. |

| DATE OF ALLOTMENT | September 03, 2021 |

| BENCHMARK | S&P BSE 500 Index TRI |

| FUND MANAGER | 1) Mr. Vishal Mishra (Fund Manager) 2) Ms. Silky Jain (Assistant Fund Manager) |

| TOTAL EXPERIENCE | 1) 18 Years 2) 11 Years |

| MANAGING THIS FUND | 1) Since 03-September -21 2) Since 01-October -21 |

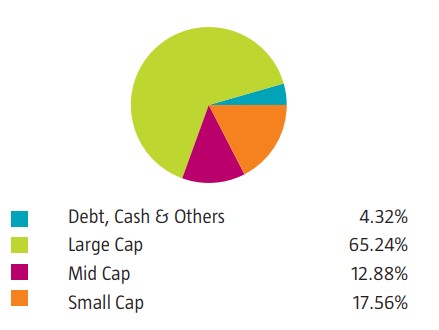

| ASSET ALLOCATION | Equity and Equity – related Instruments 65% to 100% (Risk - Very High) Debt and Money Market Instruments 0% to 35% (Risk Low to Medium) Units issued by REITs and InviTs 0% to 10% (Risk - Very High) Units of MF schemes 0% to 5% ((Risk Medium to High) Equity Exchange Traded Funds 0% to 10% (Risk - Very High) |

| MINIMUM INVESTMENT | Lumpsum Purchase: ₹ 5,000.00 and multiples of ₹ 1.00 thereafter. Subsequent Purchase: ₹ 1000.00 and multiples of ₹ 1.00 thereafter. SIP: For Any date/monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter STP: For Daily/Weekly/Monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter SWP: For monthly frequency – ₹ 1000 and in multiples of ₹ 1 thereafter For quarterly frequency – ₹ 2000 and in multiples of ₹ 1 thereafter |

| PLANS / OPTIONS | Regular Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Regular Plan - Payout of Income Distribution cum Capital Withdrawal Option Regular Plan - Growth Option Direct Plan - Reinvestment of Income Distribution cum Capital Withdrawal Option Direct Plan - Payout of Income Distribution cum Capital Withdrawal Option Direct Plan - Growth Option |

| ENTRY LOAD | Nil |

| EXIT LOAD | 1% - If redeemed/switched out within 365 days from the date of allotment. Nil - if redeemed/switched out after 365 days from the date of allotment |

| EXPENSE RATIO^: |

Regular Plan : 2.21% Direct Plan : 0.66% |

| Monthend AUM# | ₹ 936.78 Crores |

| Monthly AVG AUM | ₹ 939.60 Crores |

| (as on September 29, 2023) | (₹)

|

| Direct Plan - Growth Option | 13.8700 |

| Regular Plan - Growth Option | 13.4000 |

| Regular Plan - IDCW (payout/reinvestment | 13.4000 |

| Direct Plan - IDCW (payout/reinvestment) | 13.8600 |

| Name of the Instruments | % to NAV |

Equities |

95.68 |

Listed |

95.68 |

Banks |

23.25 |

HDFC Bank Ltd |

8.31 |

ICICI Bank Ltd |

6.21 |

Federal Bank Ltd |

2.20 |

Axis Bank Ltd |

2.02 |

State Bank of India |

1.77 |

IndusInd Bank Ltd |

1.46 |

Equitas Small Finance Bank Ltd |

1.28 |

IT - Software |

10.65 |

Infosys Ltd |

6.50 |

HCL Technologies Ltd |

1.75 |

Coforge Ltd |

1.42 |

Tech Mahindra Ltd |

0.98 |

Finance |

6.56 |

Creditaccess Grameen Ltd |

2.75 |

REC Ltd |

2.00 |

Sundaram Finance Ltd |

1.39 |

Jio Financial Services Ltd |

0.42 |

Pharmaceuticals & Biotechnology |

4.78 |

J.B. Chemicals & Pharmaceuticals Ltd |

2.08 |

Sun Pharmaceutical Industries Ltd |

2.07 |

Cipla Ltd |

0.47 |

Mankind Pharma Ltd |

0.16 |

Power |

4.38 |

NTPC Ltd |

4.38 |

Petroleum Products |

4.32 |

Reliance Industries Ltd |

3.58 |

Bharat Petroleum Corporation Ltd |

0.74 |

Automobiles |

3.83 |

Bajaj Auto Ltd |

1.56 |

Tata Motors Ltd |

1.48 |

Maruti Suzuki India Ltd |

0.79 |

Diversified Fmcg |

3.45 |

ITC Ltd |

3.45 |

Industrial Products |

3.44 |

KEI Industries Ltd |

2.46 |

AIA Engineering Ltd |

0.98 |

Aerospace & Defense |

3.20 |

Bharat Electronics Ltd |

3.20 |

Insurance |

3.00 |

SBI Life Insurance Co Ltd |

1.60 |

ICICI Lombard General Insurance Co Ltd |

1.40 |

Telecom - Services |

2.86 |

Bharti Airtel Ltd |

2.80 |

Bharti Airtel Ltd |

0.06 |

Construction |

2.60 |

Larsen & Toubro Ltd |

2.60 |

Transport Services |

2.53 |

Interglobe Aviation Ltd |

0.95 |

Blue Dart Express Ltd |

0.86 |

VRL Logistics Ltd |

0.72 |

Realty |

2.23 |

Brigade Enterprises Ltd |

2.23 |

Beverages |

1.91 |

Varun Beverages Ltd |

1.91 |

Fertilizers & Agrochemicals |

1.78 |

EID Parry India Ltd |

0.95 |

Sumitomo Chemical India Ltd |

0.83 |

Auto Components |

1.72 |

Samvardhana Motherson International Ltd |

1.72 |

Healthcare Services |

1.41 |

Max Healthcare Institute Ltd |

1.12 |

Vijaya Diagnostic Centre Ltd |

0.29 |

Consumer Durables |

1.12 |

Cera Sanitaryware Ltd |

1.12 |

Agricultural Food & Other Products |

1.05 |

CCL Products (India) Ltd |

1.05 |

Agricultural, Commercial & Construction Vehicles |

1.05 |

Ashok Leyland Ltd |

1.05 |

Textiles & Apparels |

1.04 |

K.P.R. Mill Ltd |

1.04 |

Electrical Equipment |

1.03 |

KEC International Ltd |

1.03 |

Personal Products |

0.90 |

Dabur India Ltd |

0.90 |

Chemicals & Petrochemicals |

0.85 |

Deepak Nitrite Ltd |

0.85 |

Household Products |

0.74 |

Jyothy Labs Ltd |

0.74 |

Money Market Instruments |

3.78 |

TREPS |

3.78 |

Net Current Assets |

0.54 |

Grand Total ( Net Asset) |

100.00 |

| This product is suitable for investors who are seeking*: | |

|

|

|

|

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. | |

$ Source ICRA MFI Explorer | #Monthend AUM / Quantitative Information as on 29.09.2023 | ^The expense ratios mentioned for the schemes includes GST on investment management fees. Please click here for disclaimers.