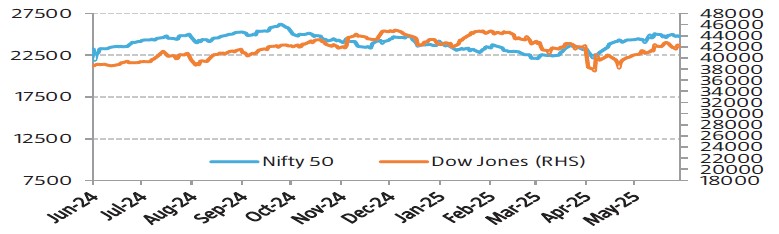

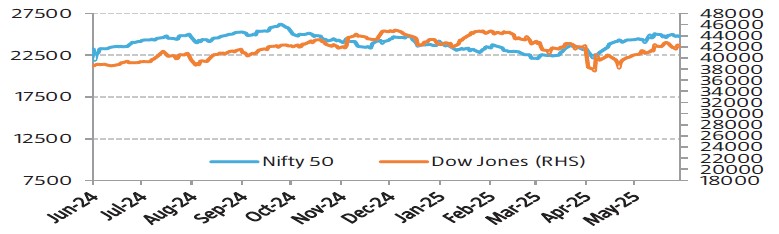

Equity Markets - India & US

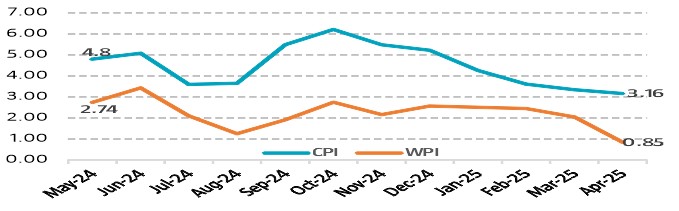

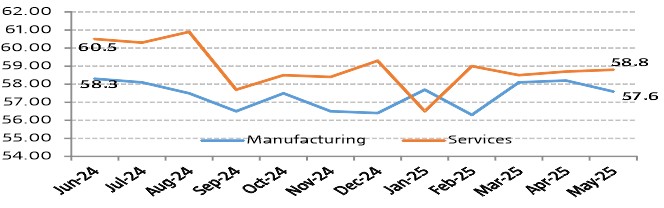

Bellwether indices, Nifty 50 and BSE Sensex moved up during the month by 1.71% and 1.51% respectively as as the softening of domestic retail inflation in Apr’25 boosted investor optimism about the possibility of further rate cuts by the RBI in the coming months. Sentiment improved following an agreement between India and Pakistan to cease all military actions on land, air, and sea. Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹ 19,860.19 crore. Gross Goods and Services Tax (GST) collections in May’25 stood at Rs. 2.01 trillion, representing a 16.4% rise on a yearly basis and this points towards the growing trajectory of the Indian economy. Dow Jones increased sharply by 3.94% from previous month.

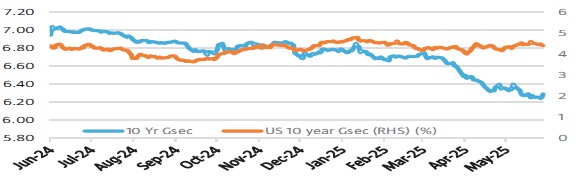

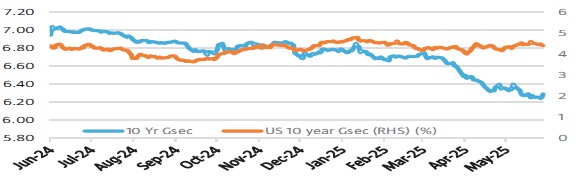

Interest Rate Movement (%) - India & US

Yield on the 10-Year benchmark paper decreased, closing at 6.288% on May'25 vs 6.356% on Apr'25 as there is favourable outlook for further monetary easing by the RBI along with a favourable domestic inflation data . US 10 year G-Sec closed lower at 4.4004 on May’25 vs 4.1619 on Apr’25.

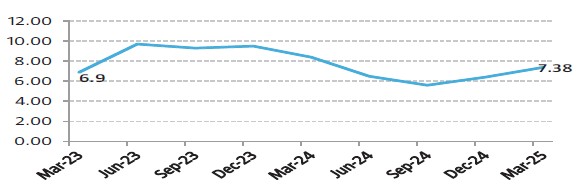

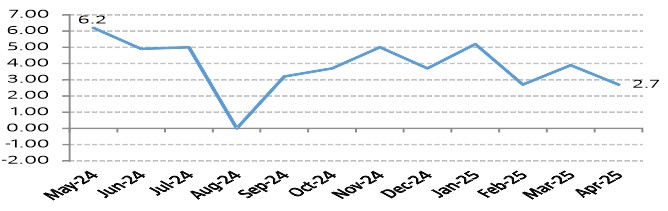

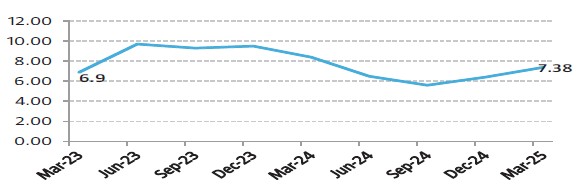

India GDP Growth Rate

India’s GDP grows 7.38% for Q4 FY25 vs 6.2% for Q3 FY25, full year for FY25 growth at 6.5%; Indian economy retains 'fastest growing' tag. On the sectoral front. The growth of Manufacturing sector decreased to 4.8% in Q4 of FY25. However, growth of Agriculture, Livestock, Forestry & Fishing increased to 5.4% in Q4 of FY25. This impressive performance comes despite heightened geopolitical tensions and global trade uncertainties. Asia's third-largest economy benefitted from strong farm activity, steady public spending and improved rural demand in the last financial year, even as manufacturing and new investments by private companies remained weak.