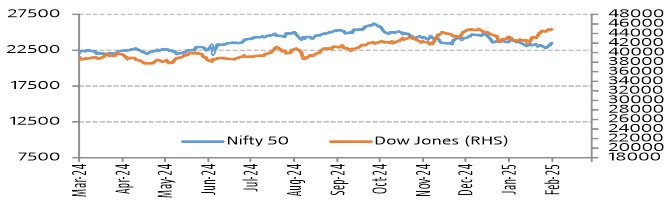

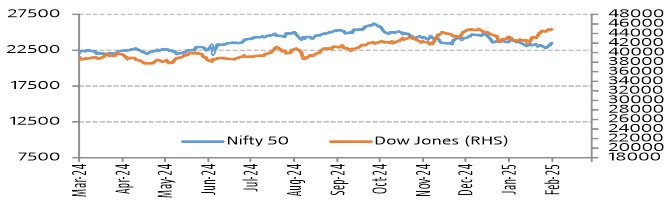

Equity Markets - India & US

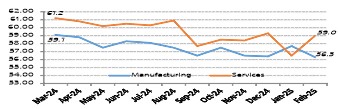

Bellwether indices, Nifty 50 and S&P BSE Sensex moved during the month by -5.89% and -5.55% respectively amid rupee's record fall against the U.S. dollar, broad-based sell-off across the sectors on concerns over weak corporate earnings in Q3 FY’25 and continued foreign fund outflows. There were concerns surrounding potential U.S. tariffs which could potentially drive-up consumer prices, potentially delaying the reduction of interest rates even further affected the market sentiments. Foreign Institutional Investors (FIIs) were net sellers in Indian equities to the tune of ₹ -35694.26 crore. Gross Goods and Services Tax (GST) collections in Feb’25 stood at Rs. 1.84 trillion, representing an 9.1% rise on a yearly basis and this points towards the growing trajectory of the Indian economy. Dow Jones decreased sharply by -1.58% from previous month.

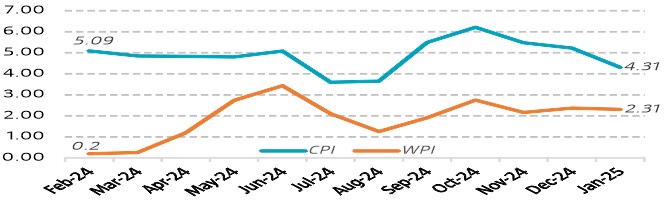

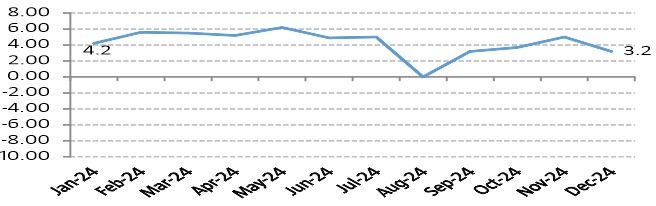

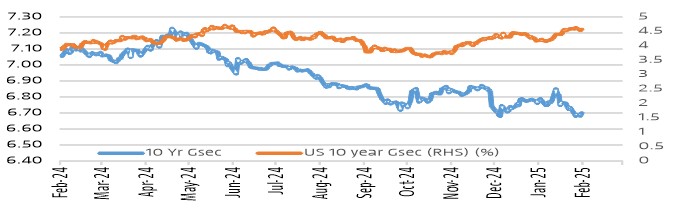

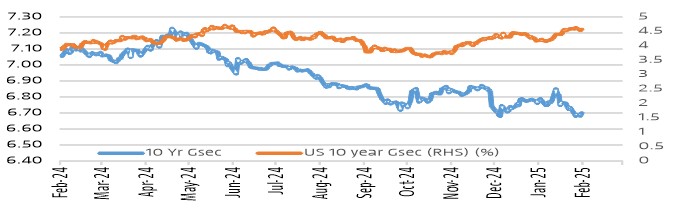

Interest Rate Movement (%) - India & US

Yield on the 10-Year benchmark paper remained range-bound, closing at 6.729% on Feb'25 vs 6.7% on Jan'25 aided by heavy debt supply from states, coupled with a plunge in the local currency. Weaker-than-expected demand for the central government's last debt sale for the financial year soured sentiment. US 10 year G-Sec closed lower at 4.2082 on Feb’25 vs 4.5387% on Jan’25.

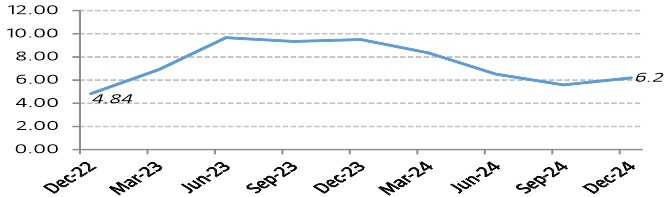

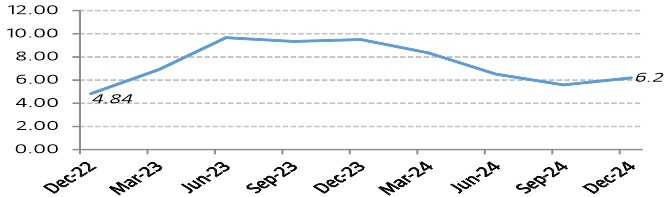

India GDP Growth Rate

India’s GDP grows 6.2% for Q3 FY25 vs 5.4% for Q2 FY25. On the sectoral front, the growth of Manufacturing sector decreased to 3.5% in Q3 of FY25 from 14.0% in same quarter of previous fiscal year. However, growth of Agriculture, Livestock, Forestry & Fishing increased to 5.6% in Q3 of FY25 compared to 1.5% growth in Q3 of FY24. Real GDP growth for FY25 looks achievable at 6.5% on back of remarkable growth in agri sector and supported by sharper growth in Q4 given sustained pickup in Govt spending, capex, especially invits along with improved outlook for rabi sowing as well as buoyancy in consumption demand. There has been reasonable traction in consumption demand amidst spending during Maha-Kumbh and ongoing wedding season. Recovery in urban consumption bodes well for growth outlook. Anticipation of more rate cuts by RBI is positive for growth.