Economic Indicators (as on October 31, 2024)

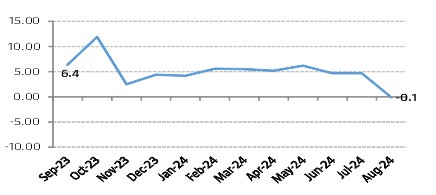

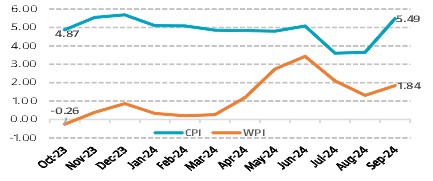

Inflation in India (%)

Consumer Price Index hits nine-month high to 5.49% in Sept’24 from 3.65% in Aug’24 largely on account of an uptick in food inflation, high base effect and adverse weather conditions. While prices of cereals, meat and fish, eggs, and pulses fell in September, prices of milk and milk products, fruits, and vegetables rose during the month. Though, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) increased to 1.84% in Sept’24 from 1.31% in Aug’24 driven mainly by higher prices in food articles and other manufacturing segment though Fuel and power sector deflated. It stepped out of the deflationary zone for the eleventh time in row.

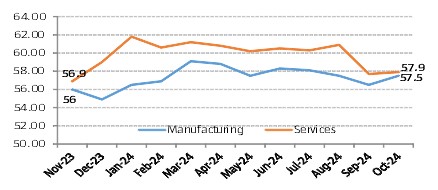

Index of Industrial Production (%)

Index of Industrial Production (IIP) decelerated to -0.1% in Aug’24 from 4.8% in Jul’24. The slowdown was primarily due to an unfavourable base and a contraction in the mining and electricity sectors due to excess rains. The three major components of IIP, including mining, manufacturing and electricity, witnessed a contraction of 4.2 per cent, growth of 1 per cent and contraction of 3.7 per cent, respectively. A decline in output was observed in 11 out of the 23 manufacturing subcategories.