Economic Indicators (as on June 28, 2024)

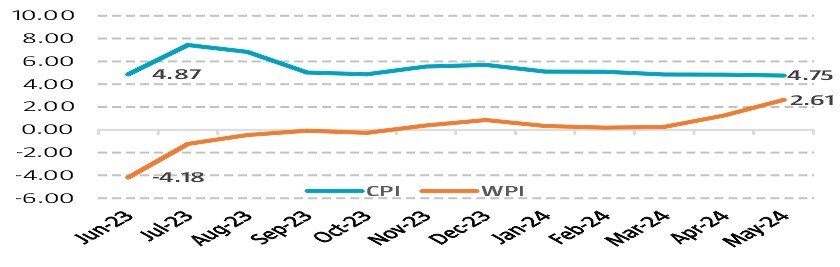

Inflation in India (%)

Consumer Price Index decelerated marginally to 12-month low from 4.83% in Apr’24 to 4.75% in May’24 due to sustained deflation in fuel prices. Though, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) rises to 15-month high to 2.61% in May’24 from 1.26% in April’24 due to increase in prices of food articles, crude petroleum & natural gas, electricity, machinery & equipment and motor vehicles. It stepped out of the deflationary zone for the seventh time in row.

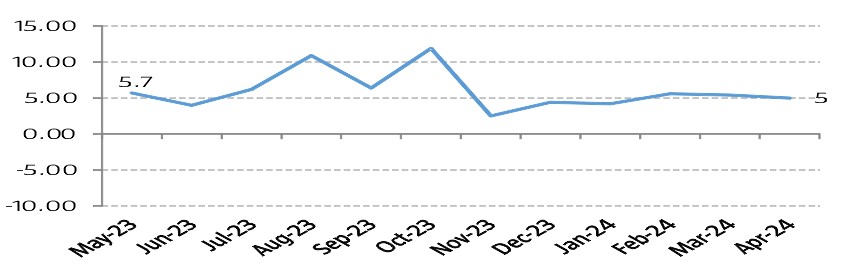

Index of Industrial Production (%)

Index of Industrial Production (IIP) fell to 5% in Apr’24 from 5.4% in Mar’24, indicating a growth in the manufacturing sector of the Indian economy. Manufacturing output, which accounts for a considerable majority of industrial production, expanded by 5.2%. Mining sector growing by 1.2% and electricity growing by 8.6%.