Economic Indicators (as on July 31, 2024)

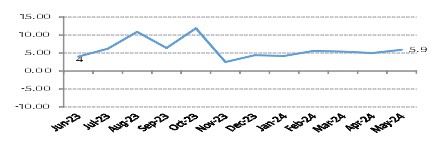

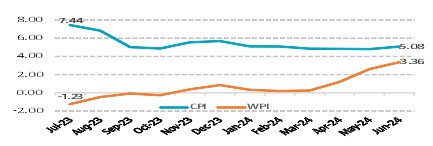

Inflation in India (%)

Consumer Price Index accelerated marginally to 12-month low of 5.08% in Jun’24 from 4.75% in May’24 to reflect the fastest pace of price growth since Feb'24 due to increase food prices. Though, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) rises to 16-month high to 3.36% in Jun’24 from 2.61% in May’24 due to a faster rise in manufacturing, primary articles, and food prices. It stepped out of the deflationary zone for the eigth time in row.

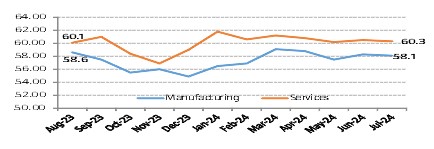

Index of Industrial Production (%)

Index of Industrial Production (IIP) rose to 5.9% in May’24 from 5% in Apr’24, indicating a growth in the manufacturing sector of the Indian economy. The growth rates of the three sectors Mining, Manufacturing and Electricity in in May'24 stood at 6.6 percent, 4.6 percent and 13.7 per cent year-on-year respectively.