Economic Indicators (as on January 31, 2024)

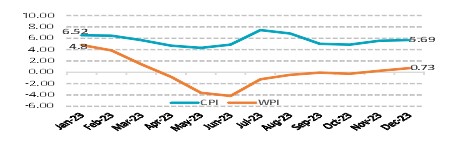

Inflation in India (%)

Consumer Price Index increased to 4-month high of 5.69% in Dec’23 from 5.55% in Nov’23 due to increase in prices of some food items. Though, Retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) is 0.73% in Dec’23 from 0.26% in Nov’23, at a 9-month high, mainly due to faster rises in prices of food and primary articles and highly unfavourable base effect. It stepped out of the deflationary zone for the second time in row.

Index of Industrial Production (%)

Index of Industrial Production (IIP) slumps to 8-month low of 2.4% in Nov’23 from 11.6% in Oct’23, due to a significant deceleration in key sectors namely manufacturing sector growing by 1.2%, mining sector growing by 6.8% and electricity growing by 5.8%.