Economic Indicators (as on December 31, 2024)

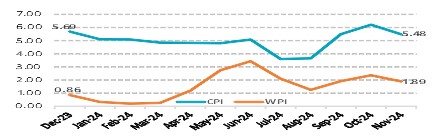

Inflation in India (%)

Consumer Price Index hits 14-month high to 5.48% in Nov’24 from 6.21% in Oct’24 primarily due to a decline in food and beverage inflation. Wholesale Price Index (WPI) eases to 3-month to 1.89% in Nov’24 from 2.36% in Oct’24 driven mainly by comparatively lower prices in food articles and other manufacturing segment.

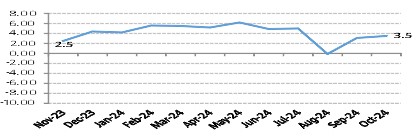

Index of Industrial Production (%)

Index of Industrial Production (IIP) marginally increased to 3.5% in Oct’24 from 3.1% in Sep’24. The recovery was primarily supported by an improvement in the manufacturing sector output, which grew by 4.1% compared to 3.9% in Sep'24. Additionally, mining and electricity output grew by 0.9% and 2% respectively, further supporting the IIP rebound. Year-on-year increase was seen in 18 out of 23 subcategories.