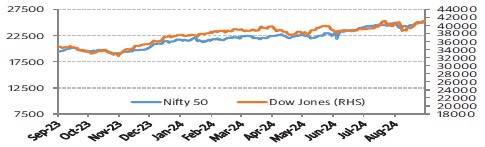

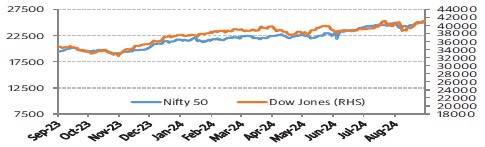

Equity Markets - India & US

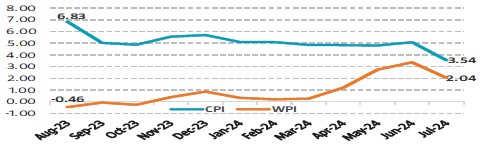

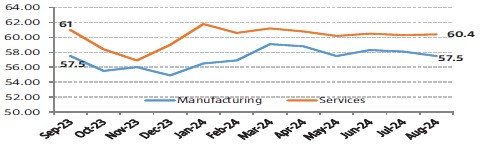

Bellwether indices, Nifty 50 and S&P BSE Sensex increased marginally during the month by 1.14% and 0.76% respectively on m-o-m basis following continuous foreign fund inflows. Indian equity markets extended its gains as positive U.S. labour market data along with GDP data pointed to a soft landing for the world’s largest economy. The key benchmark indices witnessed fresh record highs on expectations of a rate cut by the U.S. Federal Reserve, the prospects of solid domestic economic growth amid a healthy monsoon. Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹7320 crores this month. Domestic retail inflation is within the Reserve Bank of India’s upper tolerance level of 6%. Goods and Services Tax (GST) shows collection of ₹1.75 lakh crore for Aug’24, 10% more than the corresponding period of last year and this points towards the growing trajectory of the Indian economy. Dow Jones increased by 1.76% from previous month.

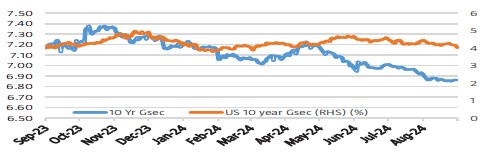

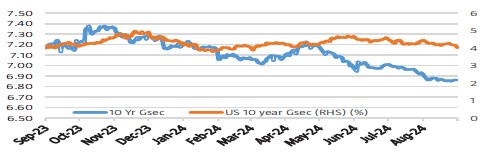

Interest Rate Movement (%) - India & US

Yield on the 10-Year benchmark paper remained range-bound, closing at 6.864% on Aug'24 vs 6.926% on Jul'24. Bond yields decreased following a drop in U.S. Treasury yields after the U.S. Federal Reserve hinted that its rate easing cycle could start in Sep'24. US 10 year G-Sec closed lower at 3.9034% on Aug’24 vs 4.0296% on Jul’24.

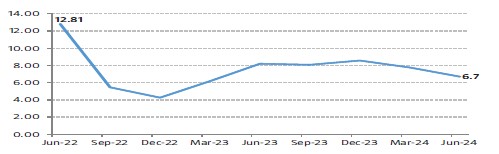

Inflation in India (%)

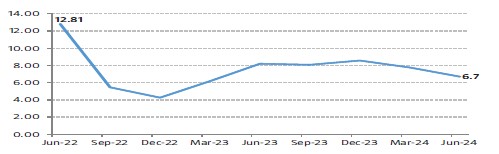

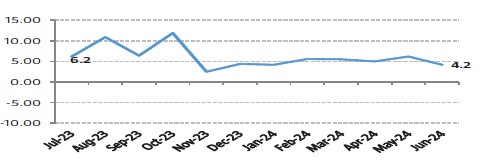

India’s GDP hit a 15-month low of 6.7% for Q1 FY25 vs 7.76% for Q4 FY24, and 8.2% in FY24 and slightly below the market expectations, majorly over soft government spending and low consumer spending. Compared to last quarter, all major sectors have shown improvement except manufacturing and financial, real estate & professional services. On the expenditure front, private final consumption expenditure and investments saw a significant recovery. India still remains the fastest-growing major economy in the world, as China's GDP growth in the April-June quarter came in at 4.7 per cent.