Economic Indicators (as on March 31, 2023)

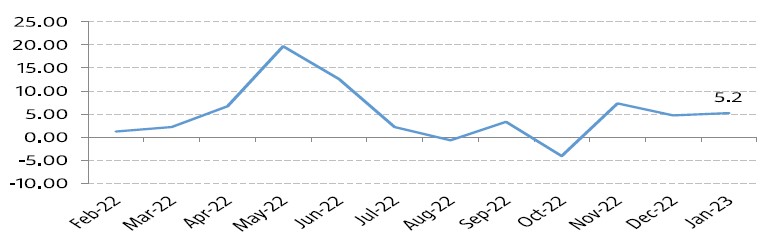

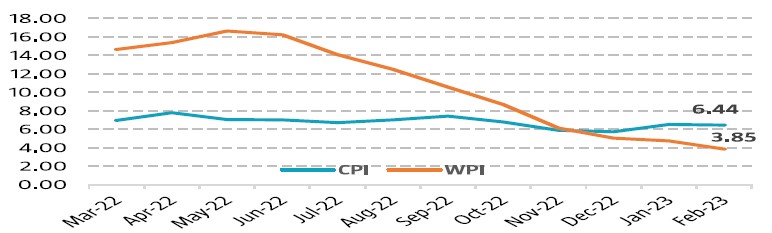

Inflation in India (%)

Consumer Price Index decreased to 6.44% in Feb’23 from 3-month high of 6.52% in Jan’23, mainly due to decrease in prices of vegetables and lowered inflation of other food items. Wholesale Price Index (WPI) cools down to 25 months low, 3.85% in Feb’23 from 4.73% in Jan’23, primarily contributed by fall in the prices of manufactured items and fuel and power. This is the 9th straight month of decline in WPI-based inflation.

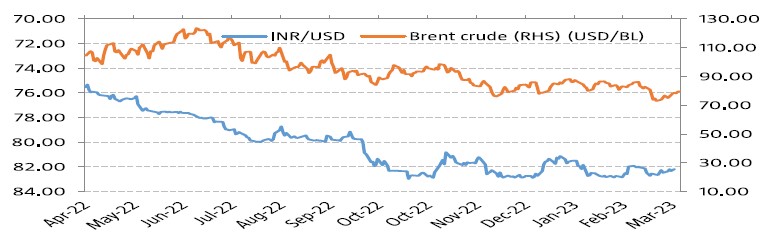

Index of Industrial Production (%)

Index of Industrial Production (IIP) rose to 5.2% in Jan’23 from 4.7% in Dec’22 primarily owing to a double digit growth in electricity output and subdued growth in mining and manufacturing. The electricity and mining sectors rose by 12.7% and 8.8% respectively, whereas the manufacturing sector increased by 3.7% in Jan'23.