Debt Market Review

Mr. Avnish Jain

Head - Fixed Income

Macro Review & Fixed Income Market Outlook

Global Economy Update:

Macro Backdrop: Global growth continues to remain stronger than anticipated despite formidable headwinds.

In its Interim Economic Outlook report, released on March 17, 2023, the Organization for Economic Cooperation and Development (OECD) revised up the global growth forecast for 2023 to 2.6 percent from 2.2 percent in November 2022, and for 2024 to 2.9 percent from 2.7 percent.

Inflationary pressures, tight labour markets, and hawkish central bank guidance have fuelled market expectations of higher interest rates for a longer period.

The initial reaction was a rise in sovereign bond yields, a strengthening of the US dollar, and a retreat in global equity markets in February.

The failure of three banks in the United States has unsettled investor sentiments just as markets were pricing in the possibility of further tightening of financial conditions.

This has led to market expectations turning to US FED pivoting to rate easing earlier than expected.

Recession risks are increasing on US regional banking turmoil.

Indian Economic Growth:

Macro Backdrop: Despite high tides of global uncertainty, the impact on Indian economy has remained limited till now.

The National Statistical Office (NSO) released the second advance estimates (SAE) of national income on February 28, 2023, indicating that the recovery from the pandemic was stronger than previously thought, led by private consumption, and supported by a rebound in government consumption during 2021-22.

According to the NSO's data released at the end of February, India's per capita GDP will grow by 14.7% in nominal terms and 5.9% in real terms in 2022-23.

Over the last decade, these growth rates were 9.5% and 4.5%, respectively, resulting in improved livelihoods.

In US dollar terms, India's per capita GDP has surpassed US$ 2,450, representing a significant step towards becoming a middle-income economy.

Agriculture is in a seasonal uptick, industry is emerging from contraction, and services have maintained momentum.

The increase in export growth, combined with a significant decrease in import growth, reduced the drag from net exports.

Consumer price inflation remains high, and sticky, defying the apparent softening of input costs, probably indicating corporates not passing input cost benefit to consumers

On the supply side, the expansion was broader, led by services and followed by industry.

The GST collections (Centre plus States) grew by 12.4 per cent (y-o-y) in February 2023 to INR 1.49 lakh crore.

Inflation:

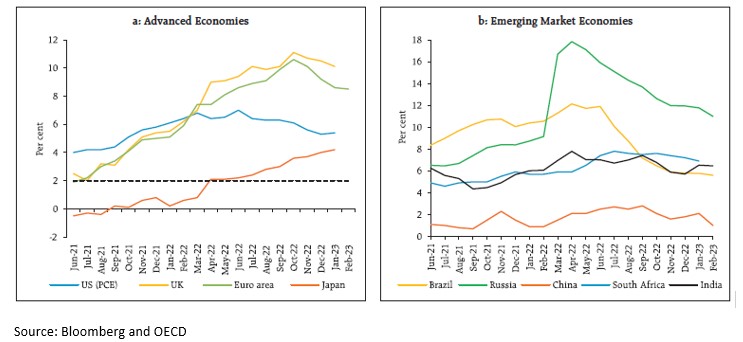

Global: Headline inflation eased across most AEs (Advanced Economies) and EMEs (Emerging Market Economies); nonetheless, it remains elevated and well above targets in most economies.

In the US, headline CPI inflation fell to 6.0 percent in February 2023 from 6.4 percent the previous month, in line with market expectations. In January 2023, inflation based on the personal consumption expenditure (PCE) price index increased slightly to 5.4%.

In the Euro area and in the UK, Inflation fell to 8.5% and 10.1% in February and January 2023, respectively.

In Japan, CPI (all items excluding fresh food) inflation reached 4.2% in January 2023, the highest level in four decades.

In most economies, elevated core inflation remains a major concern as it is well above the targets

In February 2023, inflation in Brazil, Russia, Thailand, and China moderated.

India: CPI inflation moderated to 6.44 per cent in February 2023 from 6.52 per cent in January, though remains above RBI’s comfort band of 6%. The easing of headline inflation by 8 basis points between January and February was driven by a favorable base effect of 24 basis points, which more than offset the positive momentum of 17 basis points.

Trends and Drivers of CPI Inflation:

Bond Yields & Spreads:

US FED hiked rates by 25bps in Mar ‘23 FOMC (Federal Open Market Committee), following a similar hike in Feb ‘23, despite banking sector stress, indicating that inflation remains top priority.

ECB hiked by 50bps with the Bank of England (BoE) hiking by 25bps.

In a surprise move, RBI paused in the first policy of FY2024, keeping rates steady at 6.50%.

US 10Y yield dropped sharply in March, falling to 3.47% as contagion fears from the banking stress engulfed global markets.

India rates drifted lower on global cues despite uptick in inflation, though extent of fall was limited. 10Y GSEC traded in 7.30-7.40% range, awaiting RBI policy outcome in April 2023.

Short-term rates drifted lower as liquidity remained good and absence of any government supply supported markets. Further, global rate softening helped positive market sentiment.

Medium to long term corporate spreads remained on lower side in absence of any material increase in supply.

Outlook:

Global: Global economy is likely to be marked by slow growth, moderating but elevated inflation, peaking policy rates, and continuing geo-political risks.

Recent spate of bank failures in the US and takeover of Credit Suisse by UBS has added to global angst.

Inflation seems to have peaked in major countries, though reasons to cheer may still be far away.

Recent inflation prints point to pace of fall moderating and pushing global central banks to continue hawkish stance.

The sharp rise in rates by the US FED and other central banks points to extraordinary steps needed to tame decades high inflation.

With inflation mandates of 2% in most AEs (Advanced Economies), the current inflation is still very high. AE banks are likely to remain inflation focused though the evolving banking crisis is likely to complicate policy making in 2023.

While rate hikes in major countries may end soon, rates may have to remain higher for longer to bring down inflation to mandated levels.

India: In India, macro situation is better. Growth while remaining resilient is likely to slow down to below 6% in FY2024, though RBI is projecting inflation at 6.4% in FY2024.

Inflation continued to remain high in Feb23, printing 6.4%.

Government borrowing plan for FY2024 threw no surprises with government planning to borrow INR 8.8 trillion (about 59% of full year budgeted target).

RBI MPC surprised markets by pausing of rate hikes, citing global financial stability concerns and the need to assess the impact of cumulative tightening already delivered in last 1 year.

RBI MPC did not change stance as well, keeping room for more action if required.

While Governor Das stressed that the pause in hike cycle was only for the current meeting, we believe that the bar for further rate hike is now high, as the US FED is probably veering to the end of cycle as well, in the wake of banking stress in the US.

We now expect RBI MPC to go for a longish pause and watch the evolving inflation dynamics.

India growth remains resilient, keeping pressure on core inflation as well as on RBI MPC, to maintain tight monetary policy.

With RBI projecting inflation to be 5.2% for FY2024, it remains above their 4% medium term policy target, giving them little room for easing action.

Global rate scenario has turned benign in wake of banking stress and contagion risk. If global inflation continues to moderate, as expected, rate easing may start earlier than expected, possibly by end of 2023.

Markets have rallied post policy, with the curve steepening as short-term rates drop more than longer term rates. With RBI likely to remain in pause and volatile global markets, rate markets may trade in a range with a downward bias. We expect 10Y G-SEC to trade in range of 7.10-7.30% in the near term.

Source: RBI, MOSPI, CMIE, FIMMDA, NSDL, Bloomberg.