Equity Market Review

Mr. Shridatta Bhandwaldar

Head - Equities

Equity Market Update

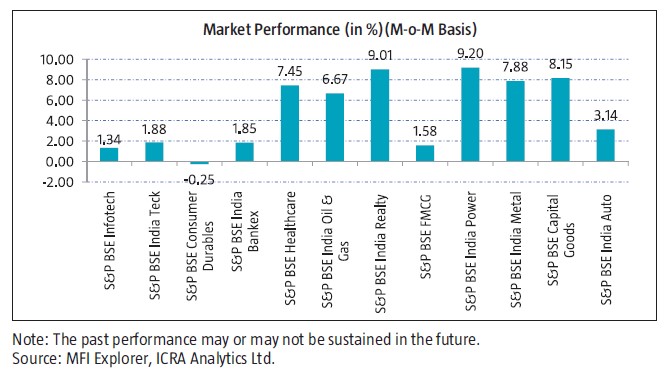

- In the month of Jul’23, equity markets surged significantly with Nifty 50 rising by 2.94% on m-o-m basis attributed by favourable domestic macroeconomic data and strong buying by foreign institutional investors for the month ended Jul’23. The International Monetary Fund (IMF) raised India’s growth forecast to 6.1% for FY24 from 5.9% estimated in Apr’23, citing strong domestic investment.

- Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹ 46,617.83 crores

- Goods and Services Tax (GST) shows highest ever collection of ₹ 1.65 lakh crore for Jul’23, which is 11% more than the corresponding period of last year and this points towards the growing trajectory of the Indian economy. It crossed the ₹ 1.6 lakh crore mark for the fifth time since it was implemented.

- The combined index of eight core industries grew at 5 months high to 8.2% on a yearly basis in Jun’23. Though during the month, gains were neutralized after U.S Federal Reserve hiked interest rates by 25 bps and added that future rate actions will be dependent on incoming data. Profit booking and stretched valuations of domestic equities in some sectors also restricted the market upside.

- Though at the end of the month, markets were resilient with the help from cooling off global inflationary pressures and buoyancy in domestic macro indicators. Climate expert also suggest the 2023 monsoon may be normal.

- Globally, US equity markets went north by 3.35% following upbeat earning numbers for the quarter ended Jun’23 and slowing of annual rate of growth in consumer prices. European and Asian equity markets also closed on a higher side after some prominent companies reported encouraging earning numbers for the quarter ended Jun’23 and China pledged further support to its ailing property sector with an economic stimulus.

Equity Market Outlook

Global macro environment remains complex with persistent inflation at higher level than expected, reducing risks of recession in US, persistent supply chain challenges and geopolitical re-alignment and its long-term implications for supply chains. Within this complexity, the underlying Inflation (except UK) seems to be moderating fast and energy prices/commodity prices have finally started reacting to global compression in money supply, higher interest rates and moderation in growth everywhere (except India). Expect further reduction of inflation and energy/commodity prices in the next 3-4 quarters. While the CPI inflation has been moderating, US growth data points are far more positive than earlier expected; indicating that the rate increases are here to stay for some more time. Expect one more interest rate increase of 25bps, which will take terminal US interest rates to 5.5%-5.75%. Combination of slowing growth, yet sticky inflation is an outcome of healthy US household/Private balance sheets, challenged supply chains, which are taking time to correct itself. Geopolitical tensions are taking time to abate and are only getting complex. Given these tensions, supply chains and global trade has become vulnerable to new dimension in 2023, missing till 2022. The banking crisis is being tackled by central bankers through regulatory channels without compromising on inflation fight through interest rate increases. This will mean that the developed world will see growth moderation through FY24. Commercial real estate in the developed market seem like a risk area to us due to increase in interest rates over last one year. EU is already in recession and China has failed to show any growth uptick post opening up of economy. India remains one of the differentiated markets in terms of growth and earnings; a FII flow positive during FY24.

In our worldview, 1) the Liquidity, 2) Growth and 3) Inflation surfaced post monetary and fiscal expansion in CY20-21 in that order and they will reverse in the same order during CY22-23. We have already witnessed liquidity reversal in the last few quarters (although was forced to reverse due to the banking crisis); growth has started receding lately (Europe is already in recession, US is slowing and China is weak) and inflation will be the last one to moderate. We have seen an initial downtick in inflation, which will accelerate in our view. Inflation is taking more time than usual to recede given healthy household savings in US, elevated energy prices, tight labor markets and challenged supply chains in China.

Indian macro remains resilient. CAD has improved significantly and is expected to be within <1% for FY24. Most domestic macro and micro indicators remain steady. Given these aspects, the domestic equity market remains focused on earnings. Both key factors, earnings growth (~15% earnings CAGR FY23-25E) and cost of capital (interest rate outlook globally – likely to decline) are turning positive for markets gradually. The cost of capital has peaked and has started witnessing correction –- likely to aid valuation multiples, as they moderate. While the earnings are not getting upgraded yet; they are resilient and seems to be bottoming. Financials, auto, industrials, Cement, Telecom, Hospital and Hotels are witnessing a healthy earnings cycle whereas Energy/commodities and IT continues to moderate. Indian equity market trades at 21xFY24 and 18.5FY25 earnings – with earnings CAGR of ~15% over FY23-25E – in a fair valuation zone from medium term perspective – given longevity of earnings cycle in India. The market has moved up ~15% during last quarter -capturing near term earnings valuation positives for FY24 and thus roll over returns of FY25 is fair return expectations to have in market over next 12-15months.

Having said this on near term earnings /market context, we believe that Indian economy is in a structural upcycle which will come to fore as global macroeconomic challenges recede over next few quarters. Our belief on domestic economic up-cycle stems from the fact that the enabling factor are in place viz. 1) Corporate and bank balance sheets are in best possible shape to drive capex and credit respectively, 2) Consumer spending remains resilient through cycle given our demographics, 3) Govt is focused on growth through direct investments in budget as well as through reforms like GST(increasing tax to GDP), lower corporate tax and ease of doing business (attracting private capex), PLIs( private capital through incentives for import substitution or export ecosystem creation) and 4) Accentuated benefits to India due to global supply chain re-alignments due to geopolitics. This makes us very constructive on India equities with 3-5years view. We believe that India is in a business cycle / credit growth cycle through FY23-26E – indicating starting of healthy earnings cycle from medium term perspective.

Source: ICRA MFI Explorer