Economic Indicators (as on July 31, 2023)

Inflation in India (%)

Consumer Price Index rises for the first time in 5 months of 4.81% in Jun’23 from 4.31% in May’23, largely due to rise in food inflation. Nevertheless, retail inflation is below the Reserve Bank of India’s upper tolerance level of 6%. Wholesale Price Index (WPI) cools down to nearly 8-year low to -4.12% in Jun’23 from -3.48% in May’23, primarily contributed by fall in the prices of mineral oils, basic metals, crude petroleum and natural gas, and fuel and power. This is the 13th straight month of decline in WPI-based inflation.

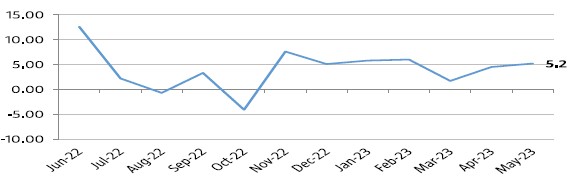

Index of Industrial Production (%)

Index of Industrial Production (IIP) jumps to 3 months high of 5.2% in May’23 from 4.5% in Apr’23 primarily owing to above average performance of the mining and manufacturing sectors. Power sector saw a marginal growth of 0.9% whereas manufacturing sector and mining sector grew by 5.7% and 6.4% respectively.